Table of Contents

The European trade finance market continues to feel the effects of the RBS retrenchment. RBS’ 2014 pullback put clients and money into motion, as companies moved to find new trade finance providers. That volatility has not completely settled and in 2016, the European trade finance business continued to see unusually high levels of turnover. Looking forward into 2017, the market is unlikely to reach an equilibrium, as some European banks are facing new headwinds, thus putting counterparty risk back on the map.

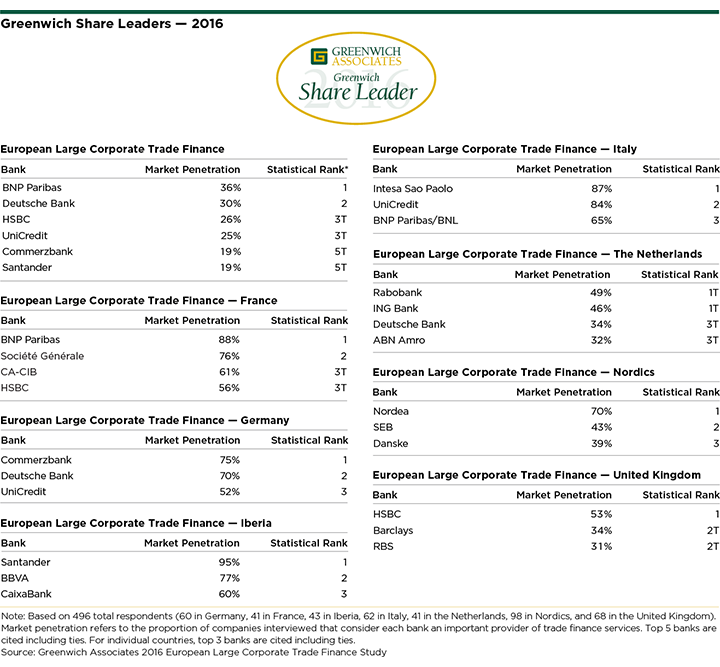

Initially, the primary beneficiary of the strong turnover that started in 2014 was BNP Paribas, which picked up new clients aggressively in 2015. In 2016, the impact has been more diffuse, with trade finance business and relationships flowing to a diverse group of competitors. Nevertheless, BNP Paribas leads the market with 36% penetration. Deutsche Bank is next, named as a trade finance provider by 30% of large European companies, despite its more recent challenges, followed by HSBC and UniCredit, statistically tied for third place at 25–26%. Commerzbank and Santander are rounding out the top five with penetration scores of 19%. These banks are the 2016 Greenwich Share Leaders℠ in European Large Corporate Trade Finance.

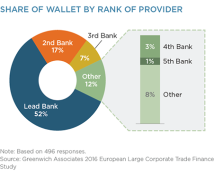

The current battle for lead relationships is a critical one for these competitors. European corporates are using fewer trade finance providers, and they are allocating a growing share of their business to their top banks. The average number of banks used by large European companies for trade finance declined to 4.7 in 2016 from 5.0 in 2015. (Companies used an average 2.6 banks for domestic activities and about 4.0 for international trade finance.) Declines were sharpest in Italy and the Netherlands. Across Western Europe, providers holding the coveted “lead bank” position captured an average 52% of companies’ trade finance business.

Greenwich Quality Leader

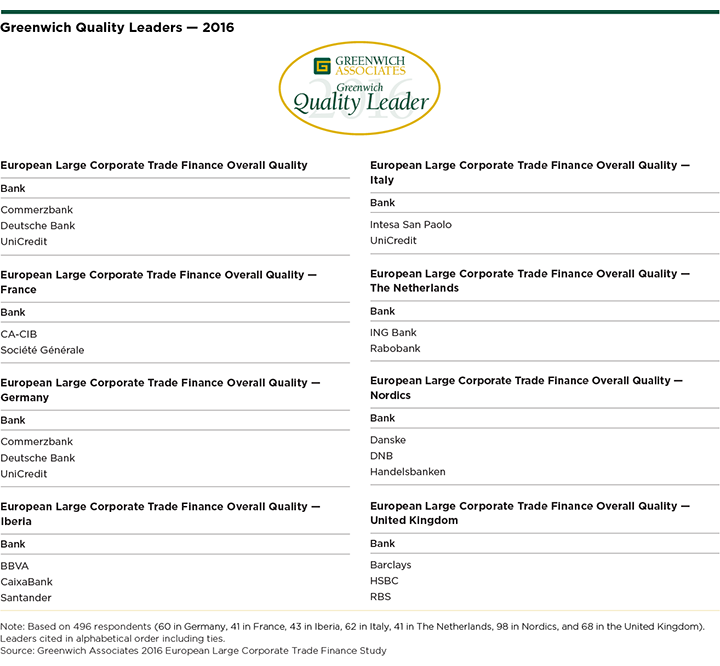

The 2016 Greenwich Quality Leaders℠ in European Large Corporate Trade Finance are Commerzbank, Deutsche Bank and UniCredit.

Among the industry’s leaders, only one bank notched significant improvements in client ratings of product and service quality last year: Deutsche Bank. As Deutsche Bank responds to the pressures on its overall business and balance sheet, the bank has shifted its focus in trade finance, successfully forgoing attempts to maximize market share in favor of a more narrow targeting of large, top-end clients.

Among this target segment, companies give Deutsche Bank ratings that are meaningfully above the industry average and improving. “Of course, counterparty risk is an important calculation in companies’ choice of a trade finance partner. In coming months, Deutsche Bank’s biggest challenges will not be on the operational side, but on the financial front—to maintain the positive momentum they have shown with large trade finance clients this year,” says Greenwich Associates Managing Director Dr. Tobias Miarka.

Digitization Drive

Companies that move too slowly to make their treasury operations compatible with digital trade finance systems might end up paying extra fees. That’s one of the main conclusions of Greenwich Associates 2016 European Large Corporate Trade Finance Study, for which the firm interviewed treasury and financial officials from 496 large European companies.

Large parts of the trade finance business have become commoditized, and bank providers have seen profit margins shrink. With few opportunities to differentiate themselves on the basis of product functionality or quality, banks are looking to reduce costs of servicing clients by automating trade finance processes. Digital platforms also enable trade finance products and services to better link with other products such as cash management and FX, allowing corporates to benefit from a more solution-oriented working capital management offering.

For the most part, only a small number of the largest European corporates have taken the steps required to move to this more automated process. However, this number is growing with the largest corporates in particular increasing their technologyspend, thus benefiting first from digital innovation. While these sophisticated companies see digital trade finance as a way to create efficiency and relieve some of the pressure on over-taxed treasury staff, the majority of European companies continue to handle trade finance through established, much more manual and paper based procedures. In fact, some regional banks and providers in certain countries like Italy have yet to begin

implementing digital capabilities because their midsized and smaller corporate clients aren’t yet ready to start using them.

Greenwich Associates strongly advises European companies to talk to their banks about what it would take to transition to more automated digital systems. Given increasing pricing pressure and a negative interest-rate environment, banks can’t afford to continue servicing trade finance customers in a manual fashion. As a result, paper-based transactions will eventually be viewed and priced as an extra service.

Dr. Tobias Miarka concludes, “So the message to companies is this: You will spend on digitizing and upgrading, or you’ll spend it on fees. Long term, it makes much more sense to invest in innovation now.”

Mainstreaming Asia

Trade with Asia has become so important to European corporates that large companies are demanding robust capabilities in important Asian markets from their trade finance providers in their home markets.

When selecting a trade finance provider, the strength of banks’ international networks ranks second only to pricing on companies’ criteria list. Fifty-seven percent of large European companies say they require trade finance products and services for trade into Asia—topping the 41% of companies needing trade for business in North America.

In the past, many European corporates would turn to regional specialists like HSBC for trade finance coverage in Asia. While HSBC still maintains a formidable franchise in this business, its footprint has declined recently. Meanwhile, banks like BNP Paribas, Deutsche Bank, UniCredit, and Citi have seen their Asian trade finance client bases grow.

“Asia is now so important that it is no longer being left to the specialist players,” says Greenwich Associates Managing Director Robert Statius-Muller. “If you are a European company, it’s increasingly likely that your European house bank is also your provider for at least some Asian trade finance. If you are a European corporate bank, the ability to provide trade finance in Asia has become almost as important as your Western European coverage.”

This dynamic differs from the trend playing out in Latin America and in other emerging markets. In these areas, European companies are less active and, in some cases, European banks have pulled back dramatically. As such, companies have come to accept the fact that coverage in these areas by big European banks’ might actually come from correspondent providers, and regional specialists remain in relatively strong demand. For example, in Italy, where companies have been expanding their trade into Latin America, Santander, which previously had not been very visible in the market, has picked up clients in a meaningful way.

“As big European banks retrenched around the world, most maintained their coverage of Asian hubs in Hong Kong, Taiwan, South Korea, Singapore, and at times, mainland China—even if they reduced their on-the-ground presence in smaller Asian markets,” says Greenwich Associates consultant Melanie Casalis. “They did so in part because their corporate clients in Europe are demanding coverage to support their Asian business.”

Consultants Dr. Tobias Miarka, Robert Statius-Muller and Melanie Casalis specialize in corporate and investment banking in Europe.

MethodologyGreenwich Associates conducted interviews with 496 financial officers (e.g., CFOs, finance directors and treasurers) at large corporations and financial institutions throughout Belgium, France, Germany, Italy, the Netherlands, Nordic countries, Portugal, Spain, Switzerland, and the United Kingdom. Interviews took place from April through June 2016.