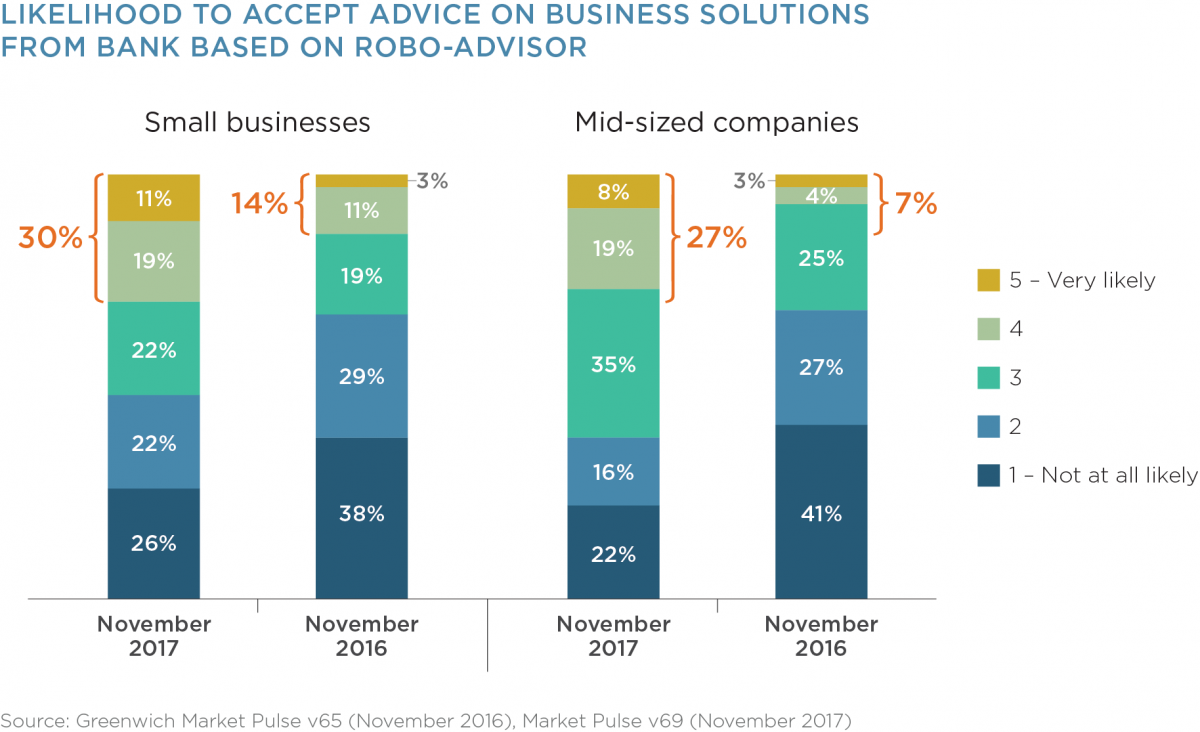

Artificial Intelligence (AI) has transformed how businesses function and interact with each other to the point where more tech-savvy business executives are willing to accept advice from automated "robo-advisor" platforms.

Our recent Greenwich Market Pulse confirmed that many U.S. small businesses and mid-sized companies would, in fact, rather work with banks that provide digital self-service options and have access to a relationship manager for an additional fee.

That's great news for banks looking to lower costs, but it comes at a price.

These changing attitudes about technology also mean that banks are expected to reduce their service turnaround to 24 hours for credit decisions and more.

Considering that business owners and executives now have the option of choosing among a wide range of alternative sources (consumer retail, retail finance and fintech firms) that offer virtually instantaneous responses, there is a lot of pressure for banks to make it happen.

Contact me to learn more about how your bank can deliver on what has now become the new norm of service expectations.