Table of Contents

Corporate treasury departments aren’t getting the productivity boost they anticipated from their investments in artificial intelligence (AI). This experience, and treasurers’ struggles to leverage this new technology, might have broader lessons for companies around the world wondering why the return on investment (ROI) on AI is falling short of expectations, at least for now.

Almost every company and corporate department are betting heavily on AI. But corporate treasurers have an extra reason to hope these investments pay off. Over the past few years, the roles of corporate treasurer and treasury departments have undergone a significant transformation.

Traditionally, the treasury function has often been viewed (incorrectly) as largely operational, with primary responsibilities centered on the transactional business of managing the company’s daily cash and liquidity. The digitization of business and the deployment of powerful data analytics have changed that picture completely. Today, the treasury department serves as the central processing unit of the company—both the operational center of the organization and a key repository of information on the financial state of the business. CFOs and other senior executives are increasingly looking to the data and analytic power housed in the treasury department for insight into high-level strategic decisions, amid a complex and evolving business environment.

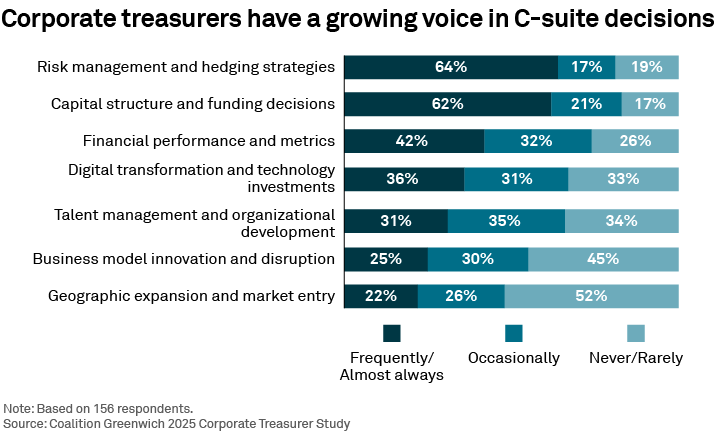

As shown in the graphic above, these changes have earned corporate treasurers an important seat at the C-suite table, as they help senior leaders improve their confidence in making strategic decisions. Nearly two-thirds of corporate treasurers taking part in Crisil Coalition Greenwich research in 2025 said they are almost always included in C-suite conversations about risk management and hedging strategies, and nearly the same share almost always participates in C-suite decisions about capital structure and funding decisions. As the chart illustrates, treasurers now have a voice in senior leadership discussions on a host of other critical topics as well. Meanwhile, CFOs and other senior leaders are increasingly asking corporate treasurers to draw on their data, analytics and execution capabilities to head up large, strategic projects.

However, as the C-suite leans on treasurers for more information, analysis and projections, the treasury department still has its day job. With additional strategic responsibilities taking up more time, corporate treasurers have a pressing need to create efficiencies across their department. Enter AI.

Limited progress

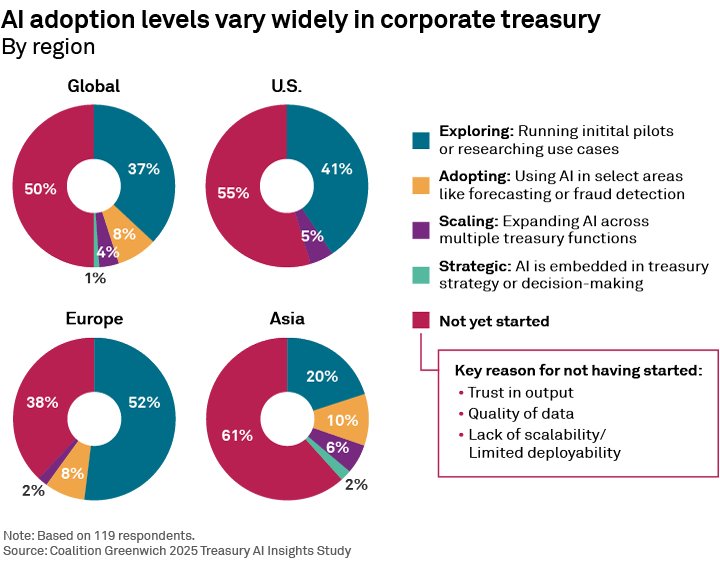

Around the world, about half of large corporates have committed resources to deploy AI in their treasury departments, and both senior leadership and corporate treasurers are anxious to see results. However, as shown in the following graphic, companies have made varying and, for the most part, limited progress actually implementing AI into workflows in a way that can meaningfully impact performance.

Most companies that have started using AI in treasury are still in the exploration phase, researching potential use cases and running initial pilots. Fewer than 1 in 10 have implemented AI into daily workflows in areas like forecasting and fraud detection, and only a relative handful claim to be in the process of deploying AI at scale across multiple treasury functions. In both the United States and Europe, not a single company purports to have reached the stage of strategic deployment, wherein AI is embedded in treasury strategy and decision-making.

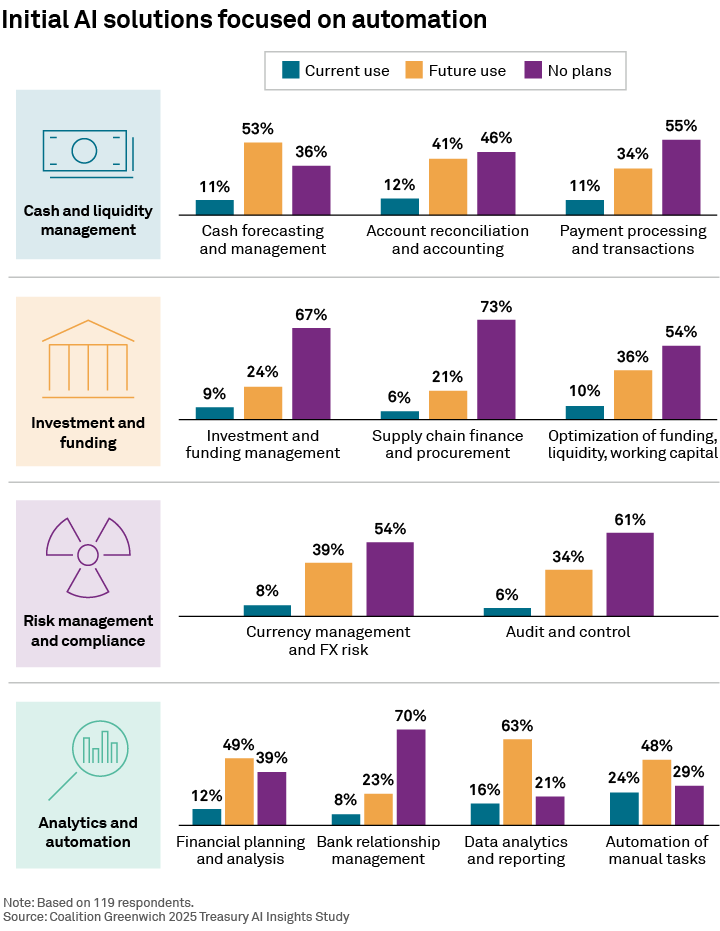

As shown in the preceding chart, treasury departments that have implemented AI are using it most often for automation. In terms of AI integration, automating manual tasks represents low-hanging fruit. Automation solutions are relatively easy to create and deploy, and the fast gains they can produce are invaluable to treasurers desperate for efficiency enhancement.

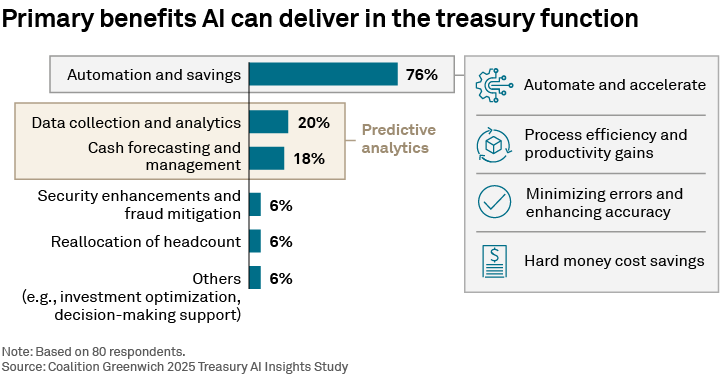

Three-quarters of corporate treasurers surveyed cite automation and savings as the primary benefit they are receiving or expect to receive from AI investments in their departments. Study participants emphasize the potential for efficiency gains, cost savings and error reduction through the automation of bank account reconciliation, cash positioning, trade processing, and other functions.

Pinpointing obstacles to AI adoption

To summarize the data on AI adoption: Half of large companies around the world haven’t yet deployed AI at all in their treasury departments, and those that have started implementing have made only limited progress, often in the form of process automation.

These findings raise an obvious question: Why has progress been so slow when it comes to both adoption and implementation?

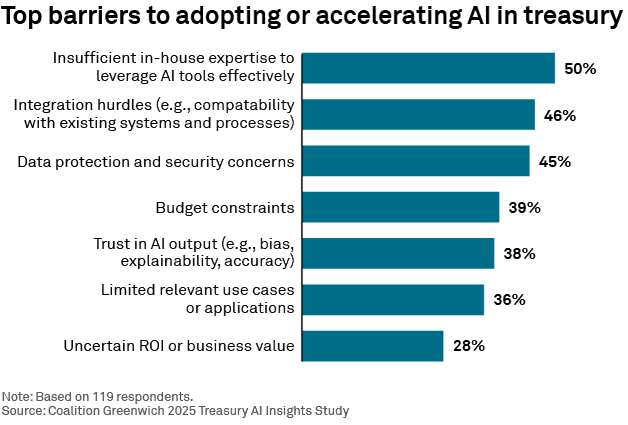

The graphic above shows what treasurers see as the primary barriers to AI adoption in their departments and functions. Two obstacles stand out: a lack of in-house expertise and integration hurdles.

The first issue—a lack of in-house expertise—is problematic, but relatively straightforward to address. Companies need to hire more AI experts and data scientists and train professionals throughout the organization on the use of the new technology. In treasury and elsewhere, companies should focus on developing AI “champions,” who encourage experimentation and use of AI, both at the strategic level and in daily workflows.

The second issue—integration hurdles—is more vexing and more central to the struggles companies have had achieving ROI expectations from AI investments in treasury and across businesses. Put simply: AI applications run on data, ideally clean data in fact, and most companies aren’t capable of delivering it, or at least not in the quantity and at the quality required.

The central mistake: Neglecting data

The central mistake companies are making with their AI investments in treasury and management systems and other departments is allocating resources to AI solutions without first building the data infrastructure needed to effectively operate those solutions. Companies are skipping the foundational work and jumping ahead to the sexier job of building and buying AI tools. This, we believe, is the fundamental reason companies are failing to achieve expected results.

This mistake is understandable. With AI hype intensifying, CEOs are under pressure to capitalize on the revolutionary technology. As a result, they are green-lighting investments in AI. As they do so, they know that boards and investors are clamoring for deals with major AI providers and headlines about the arrival of cutting-edge AI solutions. These audiences are unlikely to be impressed with an announcement that the company is directing a large part of those AI investments toward rebuilding internal data management architecture.

But that is exactly what’s required.

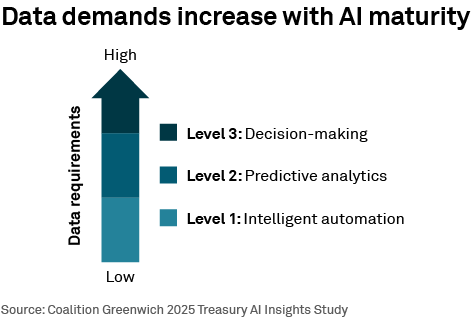

There is a near-perfect correlation between data governance and the ability to scale AI. Without the ability to produce seamless, timely and accurate data, companies will never be able to integrate AI at scale in treasury or anywhere else.

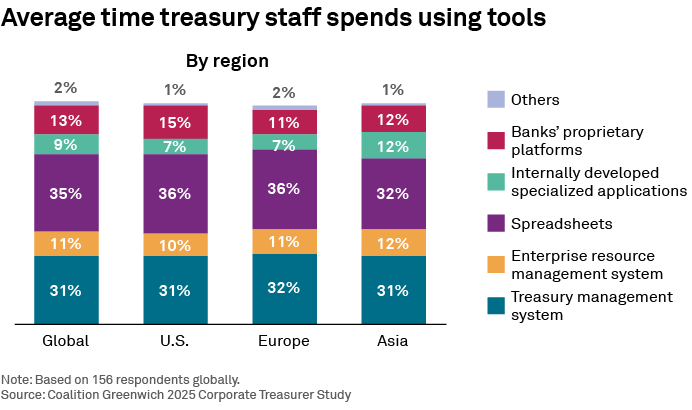

The unfortunate reality is that many large companies run on outdated legacy technology platforms composed of siloed systems that don’t interact well and store data in multiple locations, often in varying and incompatible formats. As illustrated above, this data fragmentation presents an inherent barrier to AI adoption, often limiting companies to isolated applications, such as intelligent process automation in a specific workflow. Data fragmentation is one of the primary reasons treasury department staff still spend nearly a third of their time working in spreadsheets (see following graphic).

Building an AI-ready foundation of data governance

To realize the hoped-for benefits of AI, companies will first have to conduct the less-glamorous groundwork of establishing sound data governance and management. At a strategic level, senior leadership, chief data officers and corporate treasurers, and other functional and business heads should focus on five priorities:

- Establish data quality standards and assurance processes. Data rationalization enables the adoption and scalability of AI solutions by providing the necessary foundation and infrastructure, leading to quicker implementation and better utilization of AI capabilities.

- Document data lineage. To have confidence in AI results, companies must know where ingested data came from, how and when it has changed, and what it’s been used for. Tracking data lineage is critical to establishing trust in AI output and auditability. As AI models accelerate and evolve using various data versions, maintaining a clear lineage of the data that trains each model becomes essential.

- Acquire high-quality training data in abundance. Companies must create pipelines that rationalize and integrate structured and unstructured data, and build ingestion engines that help reduce data latency and enhance data security and compliance. Delivering transparency must be a top priority. Transparency in training data allows business users to understand how the AI model operates, enhances trust in results and allows subject-matter experts to request adjustments.

- Evolve a shared responsibility model. Developing a robust data governance model for successful AI implementation will require a cross-functional team. Guided by an expert governing body, this team will set risk standards, audit AI systems, and guide business and development teams in complying with regulatory and organizational standards.

- Invest in data literacy across the organization. Professionals at every level must understand the critical importance of sound data, the requirements of good data governance and the potential benefits the company and its employees can derive from the combination of effective data management and innovative AI. Education and upskilling can help leaders overcome the shortage and costs of talent and expertise, and third-party governance providers can deliver quick access to tried-and-tested solutions.

Conclusion

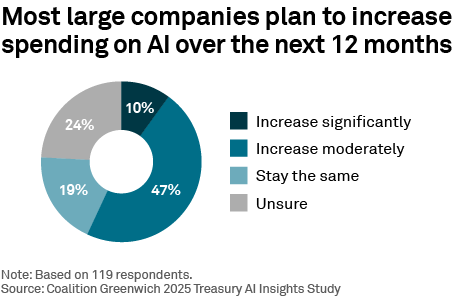

About 60% of large global corporates around the world expect to increase their investments in AI. For companies that take this step without addressing foundational issues of data management and governance, it could be a case of throwing good money after bad. It is impossible to implement sophisticated AI solutions like predictive analytics and decision-making without a comprehensive source of reliable and timely data.

Over the past several years, too many corporate treasury departments have learned that lesson the hard way. At a time when treasurers and treasury staff need efficiency enhancements more than ever, an inability to produce seamless and clean data has been one of the biggest factors slowing the adoption of increasingly powerful and capable AI solutions.

The good news for companies and corporate treasurers alike is that an answer is at hand. Companies can unlock anticipated ROI on AI in treasury departments and across organizations, if they are willing to roll up their sleeves and tackle the hard work of revamping legacy systems and establishing processes for sound data governance. Data integration by sound data governance was an aspiration way before the AI wave we are now witnessing. However, it was often deemed as difficult, costly and, ultimately, something to be tackled at a later stage. Given the leverage AI has to offer, the rewards attainable by finally tackling this foundational data challenge have never been greater.

About the author

Dr. Tobias Miarka leads corporate banking research globally at Crisil Coalition Greenwich.

Acknowledgements

The author gratefully acknowledges the contributions of Mohit Modi, Head of Strategy and Corporate Development at Crisil, as well as our core operational research team, in particular Siddarth Mehta.

In June 2025, Crisil Coalition Greenwich conducted a study exploring AI adoption for corporate treasury professionals, including current state, future directions and key considerations. Over 100 treasurers participated from large corporations with a turnover of more than $500 million across Asia, Europe and the United States. Questions also examined the top hurdles to AI adoption in treasury functions and where treasury executives turn for advice and/or implementation support.