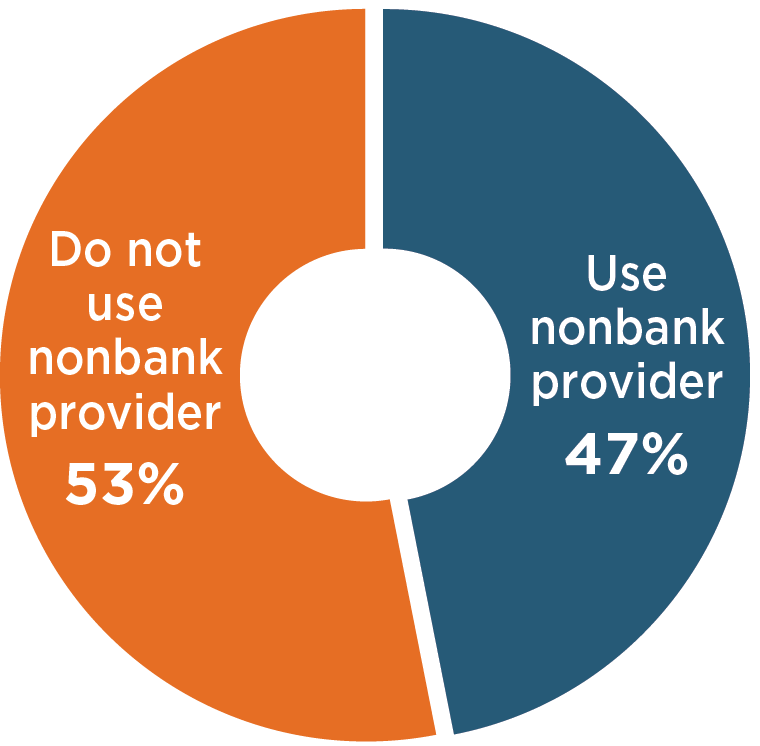

According to recent research, the number of companies using nonbank providers is almost equal to those who do not. This is likely driven by the rise of nonbank players on the U.S. corporate banking field who are competing for companies' share of wallet.

Large U.S. Corporates Using a Nonbank Provider

Traditional insurance companies, for example are offering lending services while new cloud-based service providers offer alternatives for managing treasury functions.

In Corporate Banking, Thomson Reuters FXall is the top trading platform for foreign exchange. They currently work with more than 1,500 clients on execution, end-to-end workflow management and straight-through processing. For insurance companies that handle private placement and lending, notable mentions were Prudential, MetLife, New York Life, Voya and TIAA-CREF.

Read about the top nonbank providers in Large Corporate Cash Management and Large Corporate Trade Finance.