Table of Contents

In addition to the oncoming slowdown in economic growth, volatile financial markets and a dangerous trade war between the United States and China, corporate banks competing in Asia are having to navigate another major challenge: keeping corporate clients happy despite an increasingly onerous documentation/compliance process that results from toughening regulatory requirements across different jurisdictions in Asia and abroad. The challenge for bankers to fulfill compliance-related obligations and to manage client expectations on Know-Your-Customer (KYC) requirements continues to grow.

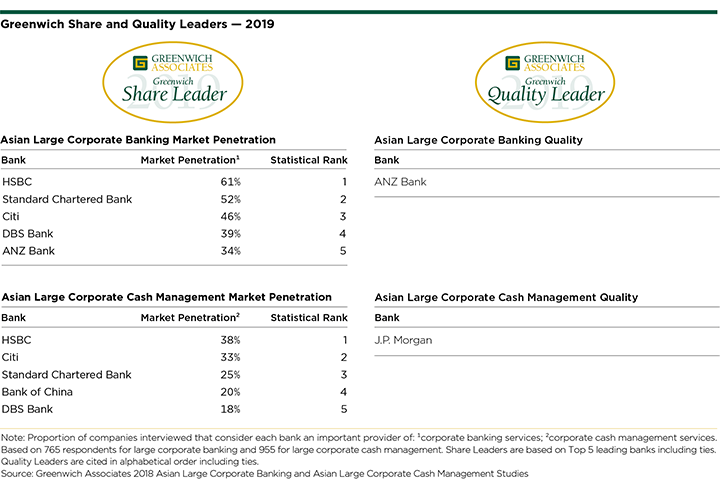

The roster of 2019 Greenwich Share Leaders℠ in Asian Large Corporate Banking is a remarkably stable list, featuring No. 1-ranked HSBC, perennial powerhouses Standard Chartered Bank and Citi, and Asian leaders DBS Bank and ANZ Bank. HSBC also tops the list of Greenwich Share Leaders in Asian Large Corporate Cash Management, followed by Citi, Standard Chartered, Bank of China, and DBS Bank.

“These banks and other large competitors in the corporate banking and cash management business are working hard to minimize a compliance burden that is starting to have a significant impact on the way CFOs, treasurers and other corporate executives view their banks,” says Gaurav Arora, Head of Asia Pacific at Greenwich Associates.

“Ease of Doing Business” is a Key Factor in Bank Selection

Regulatory compliance has been a tough issue for multinational companies operating in Asia, since each country in the region has its own unique set of laws, practices and regulators. This means a separate compliance process for each country, complete with multiple requests from banks for information that, in many cases, the company has already provided during a previous months-long documentation process in another country. Compliance demands have actually intensified in the past decade, as Asian regulators introduce new measures, and global banks have imported post-crisis rules from the United States and Europe into universal platforms.

All these rules have created new “pain points” in an already difficult process. “What makes this all the more frustrating is the fact that Asian corporate executives—like the rest of us—have gotten used to seamless services from retail businesses like Amazon, WeChat, Alibaba, and Uber, as consumers,” says Greenwich Associates Global Head of Corporate Banking, Don Raftery. “Then they try to open a new account with their bank, which puts them through long and tedious procedures.”

As a result, companies across Asia are now elevating “Ease of Doing Business” on the list of criteria employed when assessing their banks and selecting new ones. “Of course pricing and specific capabilities will always be critical, but companies are becoming more open to switching their business to banks that are willing to hold their hands and walk them through the demanding process of KYC/compliance,” says Greenwich Associates Head of International Business Dr. Tobias Miarka.

Seeking Solutions to Declining Client Perceptions

These issues are starting to have a real impact on companies’ satisfaction with their banks. The Greenwich Quality Index (GQI) is a composite score based on evaluations of banks by their corporate clients. In 2018, GQI scores for some of the top banks competing in Asia dropped due to lower “Ease of Doing Business” ratings connected to compliance, documentation and KYC issues. “This can be a big problem for very large banks,” says Greenwich Associates consultant Winston Jin. “To do business across multiple Asian countries requires some standardization of platforms and processes, which can make the banks seem rigid and inflexible to clients.”

For banks, falling scores are a signal that business could be at risk. To avoid client attrition, banks are training and deploying relationship managers, onboarding specialists and client service staff to guide companies through documentation and compliance, and to ensure that the entire process is as transparent as possible. “CFOs and corporate treasurers understand that the banks aren’t trying to make their lives difficult, and that the same standards are being applied to everyone by regulators,” says Gaurav Arora. “However, banks can go a long way in deepening the relationship by enhancing transparency through the process, i.e., why the process is what it is, how it will play out, where the company stands at that moment, and exactly how long it will take to complete.”

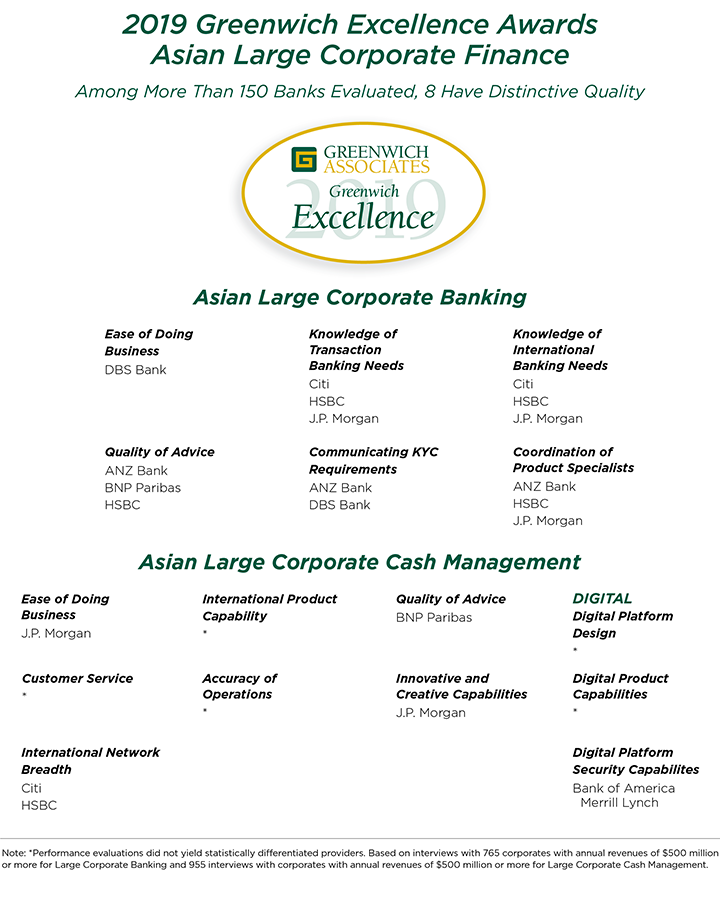

An even better approach is to eliminate some of the headaches altogether with digital solutions. The traditional Asian corporate banking leaders, HSBC, Citi and Standard Chartered, are all investing heavily in digital platforms. Similarly, Asian leaders like DBS, which has positioned itself as the most digitally advanced alternative for large corporates, have made significant progress in this area. In fact, of all the corporate banks competing in the Asian region in 2018, only DBS Bank and ANZ Bank receive Greenwich Excellence Awards in “Communicating KYC Requirements,” and DBS alone takes home a Greenwich Excellence Award in the critical category of “Ease of Doing Business.”

Keeping Up with Innovation

Asian CFOs, treasurers and treasury professionals are eager to hear the latest news about innovations, whether bank-owned or third-party led, which they can potentially implement to make their corporate finance, trade and cash management operations more efficient.

The pace of change in business continues to accelerate, particularly in banking, where fintech companies are popping up seemingly every day, offering new approaches in payments and a host of other functions. While most of the actual impact of these innovations at this point has been in the retail business, there are digital solutions in the wholesale space with the potential to help companies in working capital management, liquidity, receivables, payments, and other critical areas.

Corporate clients are not just looking to banks for information about their own digital products and platforms. On the contrary, many of them are interested to understand what new and innovative digital platforms from external providers are available to supplement their existing operations. For example, how can they integrate their treasury systems with the likes of Alipay and WeChat Pay in China and Paytm in India for easier reconciliation.

“As opposed to fintech startups, banks still hold the trust of treasury professionals. Large corporates need advice from banks in harnessing new technologies that can optimize operations and improve liquidity management,” says Winston Jin.

2019 Greenwich Leaders

Following is a complete list of the 2019 Greenwich Share and Quality Leaders in Asian Large Corporate Banking and Cash Management, at the market level.

Consultants Gaurav Arora, Dr. Tobias Miarka and Winston Jin specialize in Asian corporate banking and treasury services. Managing Director Don Raftery is the global head of corporate banking and treasury services.

MethodologyFrom September to November of 2018, Greenwich Associates conducted 765 interviews in large corporate banking and 955 interviews in large corporate cash management at companies in China, Hong Kong, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. Subjects covered included product demand, quality of coverage, and capabilities in specific product areas.

The Greenwich Exchange

In this fast-changing environment, it’s more important than ever for corporate treasurers to understand the strategies and expectations of their banks, and other banks competing in the region. (Treasurers and other corporate finance executives can obtain valuable insights in this critical area by participating in a Greenwich Associates research study and becoming part of the Greenwich Exchange.)