Table of Contents

Although the names at the top of Asia’s corporate banking market are unchanged from 2017 to 2018, the industry as a whole is actually in the midst of an accelerated evolution, as large companies and a growing list of global, regional and domestic banks work to sort out who is—and who wants to be—relevant to whom.

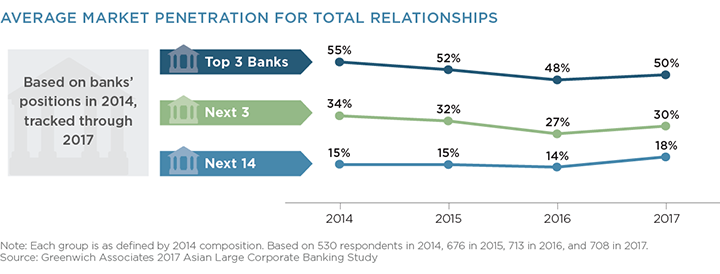

HSBC, Standard Chartered Bank and Citi have been the top three banks in Asia since Greenwich Associates started tracking the large corporate banking market over 15 years ago. In recent years, ANZ Bank and DBS Bank have consistently rounded out the top five, while a few European global franchises have stepped back to varying degrees in the landscape.

Amid the stability at the top of the market, a longer term evolution has progressed among the majority of leading banks in Asia.

An Increasing Focus on “Target Market”

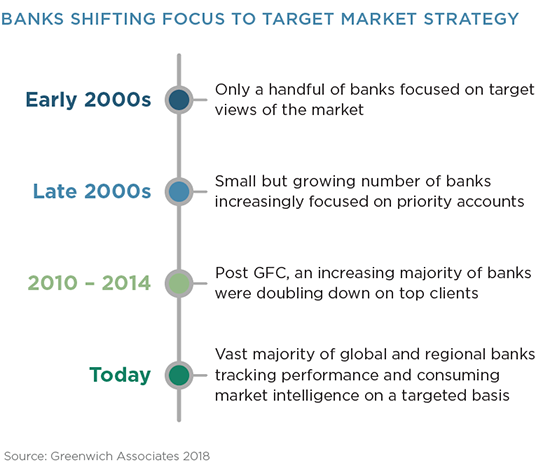

When Greenwich Associates started covering Asia’s corporate banking landscape in the early 2000s, almost all of our bank clients asked to see their results based on our “total sample” research universe—meaning the full sample of interviews conducted with hundreds of large companies from across the entire region. (This year, Greenwich Associates interviewed 708 companies across 11 markets, representing a known universe of some 2,200 companies with annual sales of more than U.S.$500 million.) This approach reflected their broad strategies, with ambitions to serve much of the Asian large corporate banking market.

“The entire Asian corporate market felt relevant to most banks then and vice versa. Only a handful of banks defined a narrower ‘target market’ in the early and mid-2000s.” says Greenwich Associates Managing Director for Asia, Paul Tan.

In the late 2000s—primarily prompted by the global financial crisis (GFC)—a handful of banks shifted gears and started tracking more targeted subsets of the market, focusing on prioritized client (and prospective client) accounts. This reflected a growing emphasis on deepening client relationships, product (and geographic) cross-sell and “share of wallet” capture. In turn, these highlighted the rising capital requirements—and weakened balance sheets—of several American and European banks.

“As the large global banks have implemented Basel III, most have taken an even more “selective” approach to their target markets. They look early and often at the total return, as well as potential return, versus the cost of the coverage model. In some cases, it means exiting clients, having tough discussions about needing better economics, or changing the client to a less expensive coverage model.” says Greenwich Associates Global Head of Corporate Banking, Don Raftery.

From 2010 through 2014, these global banks increasingly doubled down on priority accounts. Coupled with the post-crisis economic recovery in Asia, more of the large corporate banking landscape opened up as opportunities for regional leaders, emerging regional franchises and some of the leading local banks. In parallel, many of these banks benefited from a slower rollout of regulatory requirements in Asia and their home markets.

“While some of the global banks grew more focused on their top priority accounts, some of the regional leaders and the emerging regional aspirants saw opportunities to grow visibility and market penetration. Our work with several banks became heavily focused on ‘how to deepen with target accounts,’ while we supported other banks with tracking their leadership or rise in the Asia corporate banking landscape,” says Paul Tan.

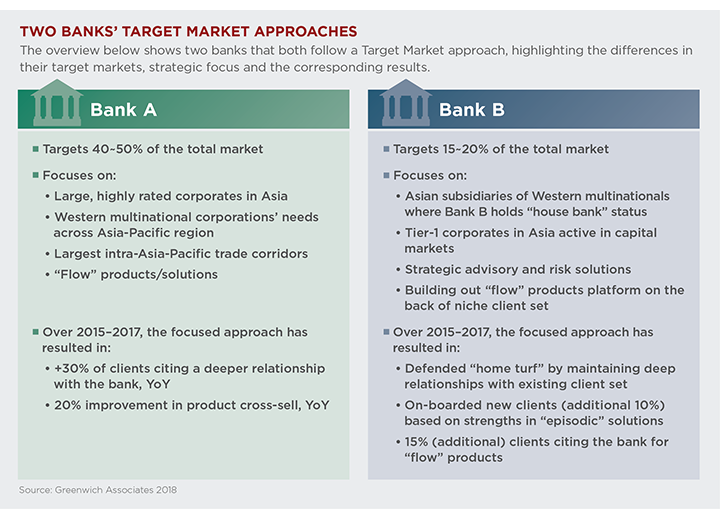

Fast-forward to today, and Greenwich Associates now sees a vast majority of global and regional leading banks tracking performance against a tailored target market. Within this trend, however, there is wide variation in size, strategy and composition of how these banks define their target markets. Some banks define a scope representing as much as 50%–60% of the market, while others focus more on the region’s “top-tier” companies, representing as little as 15%–20%. Meanwhile, a sizable remainder among the Top 20 banks and beyond continues to pursue opportunities among the total sample of large corporates across Asia (or within their home markets).

Defining Target Markets

Although every bank defines its target market and corresponding research sample differently, most share some common criteria:

- Company size and/or credit rating

- Degree of international operations, including regional and global

- Mix and breadth of bank products and services used or needed

Individual banks diverge more when it comes to applying factors like:

- Industry sector (defining which sectors to cover/not to cover)

- Priority markets (defined in terms of both origins and destinations)

- Crowding (how competitive is the fight for wallet?)

How Corporates are Responding: “Mix and Match” or Greater Consolidation?

This shift in perspective has—and will have—significant implications for large corporates in Asia. CFOs and the C-suite need to understand how their banks view their role and ambitions in the region, underpinned by required levels of overall return and other non-financial parameters defining their focal areas. The quid pro quo of distributing “ancillary business” to lenders has not gone away, but it has grown more complex, as some banks define which product spaces, geographic corridors and types of companies they seek to serve.

On the flip side, many large companies in Asia are having frank conversations with their banks about what each bank can or cannot do. “These companies are finding places where their needs intersect with the largest banks’ new strategies and making sure they are positioned securely within the banks’ target market segment,” says Greenwich Associates consultant Gaurav Arora.

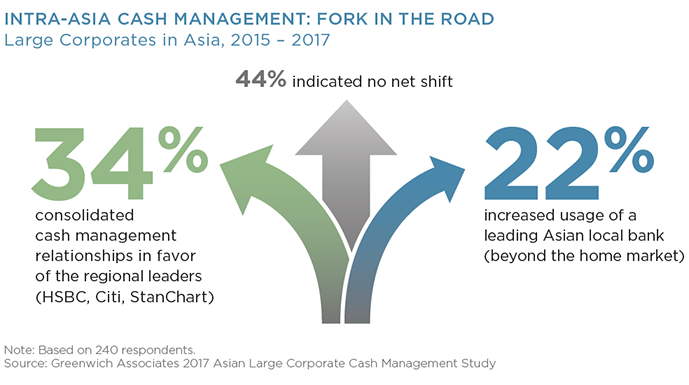

This has led to a growing number of corporates that are increasingly willing to “mix and match” the best providers for each geography/service need, while others remain keen to consolidate the variety of banking relationships (and KYC requirements) they have to manage.

The following graphic illustrates how multinationals (both Asian and Western) look to multi-market, intra-Asia cash management. A segment of the market is trending toward the regional franchises (HSBC, Citi and Standard Chartered), while others are increasingly looking to the “national champions” in each (or key) markets—e.g., HDFC in India.

Opportunities for Local Banks

The growing selectivity on the part of many global and leading regional banks has created new opportunities for local banks in Asia to expand their own footprints by capturing new relationships with companies that fall outside the target markets of the global and regional competitors.

“Some of the most advanced banks in Asia have been successfully capitalizing on this opportunity. This is, in part, because they spent the past several years building and improving their capabilities, so they are now credible alternatives to foreign banks in certain domestic “on the ground” banking,” says Paul Tan. “This has translated into a flatter competitive landscape: most prominently in the trade finance space, and also in the overall corporate or wholesale banking market. The market leaders were more selective through 2016, although our latest research (4Q 2017) shows the pendulum has swung back slightly.”

A sizable number of large companies in Asia have decided not to concentrate their business with increasingly selective global and regional players. Rather, they are applying “mix and match” strategies to take advantage of these improved product and service offerings that use these local providers for domestic banking needs and employ global or regional players for international coverage.

That shift has been a boon to banks like Bank of China and ICBC, which are ranked No. 1 and 2, respectively, on the list of 2018 Greenwich Share Leaders in China, in both Large Corporate Banking and Cash Management, and HDFC and State Bank of India, which top the list of Greenwich Share Leaders in both categories in India.

Greenwich Excellence Awards

Greenwich Share and Quality Leaders

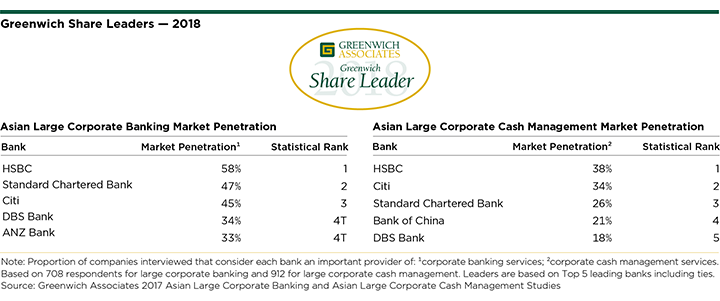

The results of the Greenwich Associates 2017 Asian Large Corporate Banking Study reveal stability at the top. Fifty-eight percent of large companies in Asia (including Western multinationals) use regional leader HSBC for corporate banking. With a market penetration of 47%, Standard Chartered Bank is next, followed by Citi at 45%. ANZ Bank and DBS Bank tie for 4th (with scores of 33%–34%), to round out the top five. These banks are the 2018 Greenwich Share Leaders in Asian Large Corporate Banking.

With a market penetration of 38%, HSBC also leads in cash management, followed by Citi at 34%, Standard Chartered at 26%, Bank of China at 21% and DBS Bank at 18%. These banks are the 2018 Greenwich Share Leaders in Asian Large Corporate Cash Management.

The 2018 Greenwich Quality Leaders in Asian Large Corporate Banking are ANZ Bank, Citi and DBS Bank, while in Cash Management, BNP Paribas and Citi earn the title.

The accompanying tables present the complete list of 2018 Greenwich Share and Quality Leaders in Asian Large Corporate Banking and Large Corporate Cash Management, at the market level.

Managing Director Paul Tan and consultant Gaurav Arora specialize in Asian corporate banking and treasury services. Managing Director Don Raftery is the global head of corporate banking and treasury services.

MethodologyFrom September to November of 2017, Greenwich Associates conducted 708 interviews in large corporate banking and 912 interviews in large corporate cash management at companies in China, Hong Kong, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. Subjects covered included product demand, quality of coverage, and capabilities in specific product areas.

The Greenwich Exchange

In this fast-changing environment, it’s more important than ever for corporate treasurers to understand the strategies and expectations of their banks, and other banks competing in the region. (Treasurers and other corporate finance executives can obtain valuable insights in this critical area by participating in a Greenwich Associates research study and becoming part of the Greenwich Exchange.)