Table of Contents

Macroeconomic volatility in Asia could actually be working to the advantage of the world’s biggest corporate banks. In times of market dislocation and stress—say, during a period in which trade wars are forcing companies to move supply chains and a global pandemic is shuttering production—corporate executives are eager to rely on the expertise, capabilities and deep balance sheets of banks with networks that span not only the region, but the world.

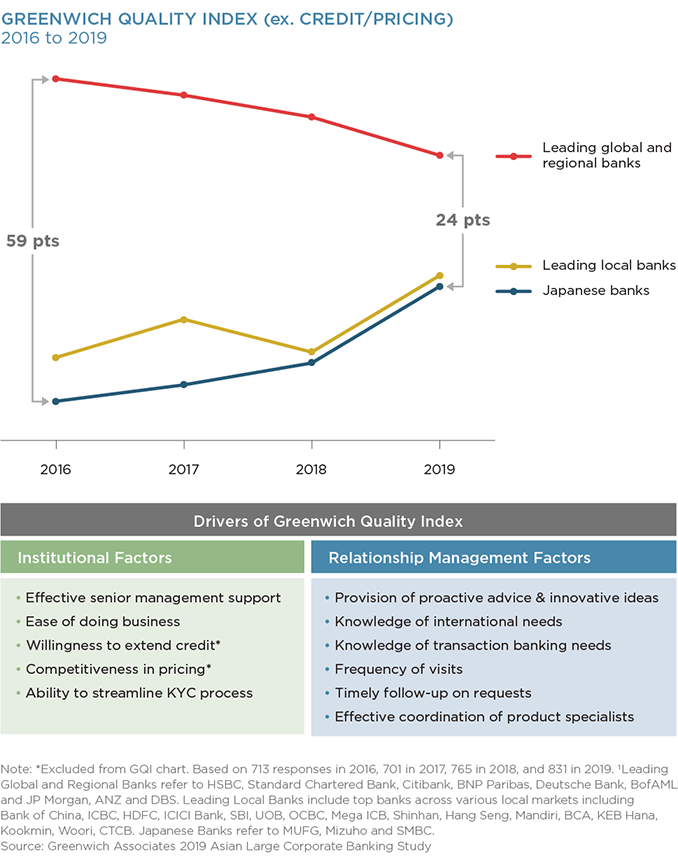

However, global banks like those that top the list of the Greenwich 2020 Share and Quality Leaders in Asian Large Corporate Banking and Cash Management should not let today’s stress-induced demand for their services make them overconfident. Over a longer-term horizon, the gap between global banks and other competitors is narrowing in the eyes of Asian corporate executives. Every year, Greenwich Associates tracks Asian companies’ perceptions of their banks in the Greenwich Quality Index. The GQI is derived from ratings that corporate executives participating in our annual study assign to their current banks. It’s a broad measure, encompassing factors ranging from ease of doing business and willingness to lend to provision of ideas and advice and demonstrating knowledge of clients’ international and transaction banking needs.

While large global banks typically score better than their rivals on quality perceptions, the gap across both institutional and relationship manager qualities has been closing since at least 2016, and in places, scores are now approaching convergence. In particular, Japanese banks, which have been aggressively using their balance sheets to court the business of large corporates in Asia for the better part of the last decade, are increasingly seen as competitive in terms of quality—and not just price. This improvement can be attributed in part to acquisition-based expansion that has given some Japanese banks a large local presence in Southeast Asian markets like Indonesia, Thailand and Philippines, as well as other Asian markets.

More generally, Japanese banks, regional Asian competitors and leading local banks are upgrading both their platforms and their people. In terms of the latter, talent has been filtering to the smaller banks, as regional and local players hire professionals from foreign firms. These hires helped to significantly narrow the gap in the corporate ratings of relationship manager quality across the two groups from 2018 to 2019.

“Asian companies see increasing commoditization of products and services across all types of providers, which is eroding the traditional quality halo enjoyed by the global banks and will eventually make this market much more competitive,” says Greenwich Associates Head of Asia Pacific & Middle East Gaurav Arora.

These shifts are starting to show up in corporate banking market share as well as in quality ratings. Specifically, regional and even leading local banks are starting to pick up more relationships in domestic cash management and banking. These banks are good enough in terms of product, people and digital capabilities to earn the confidence of Asian corporates.

“To some extent, this is business that has been ceded by global banks that narrowed their strategic focus in Asia,” says Greenwich Associates consultant Winston Jin. “But the fact that companies are now more than willing to trust this business to local players shows just how far corporate perceptions of non-global banks have shifted.”

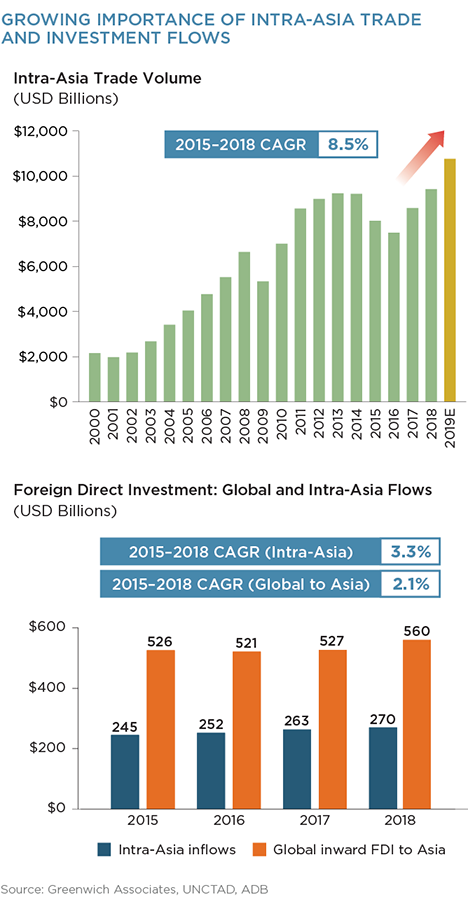

The Global Advantage

Although competition in Asian corporate banking appears to be heating up, global banks still have some important advantages over regional and local players. First, as noted earlier in this report, macroeconomic volatility has made the expertise, network and funding capabilities of global banks all the more valuable to Asian corporates. Large Asian companies have always relied on global banks for their expertise and reach into western markets. But as the U.S.-China trade war and other developments cause disruptions like the acceleration of supply chains out of China, more companies are looking for advice and assistance within and across the broader Asian region itself, as observed from the fast-growing intra-Asia trade and investment flows (see charts below). In that capacity, the “global locals” of Citi, HSBC and Standard Chartered often are best positioned to deliver, due to their sizable presence in most major Asian country markets. But even the other global banks are benefiting from their ability to provide advice and support across a variety of Asian countries—including funding support.

Over the past 12 months, securing reliable financing has replaced cost optimization as the top priority for corporates in Asia. Here’s what three Asian corporate treasury professionals had to say on the topic:

“In the face of macro changes and shifting supply chains, it just makes sense for large Asian companies to turn to banks that span multiple Asian countries and with deep expertise in transaction banking and other key areas,” says Gaurav Arora.

Ease of Doing Business

Apart from issues related to market volatility, global banks are also differentiating themselves from rivals by demonstrating the technological wherewithal to streamline know-your-customer (KYC)/anti-money-laundering (AML)/onboarding requirements and minimize the documentation burden on their clients. Headaches caused by stricter compliance-related rules have strained relationships between banks and corporate clients and elevated “ease of doing business” to a top criterion for companies. In fact, when it comes to cash management, Asian companies name ease of doing business as their top consideration when choosing a provider, aside from pricing.

That’s a significant accomplishment, especially given that while local banks must accommodate documentation and compliance rules within one or maybe two countries, global banks must navigate clients through the regulatory mazes of countries across Asia. To do so, they are relying on technology—although for the most part it’s technology that clients don’t see. While investments in middle- and back-office platforms might be invisible to clients on the front end, companies will notice significant efficiency increases, as banks with enhanced digital platforms/capabilities eliminate the need to submit duplicate documents, present clients with pre-populated forms and otherwise eliminate documentation pain points. “In this capacity, global banks, with complex structures and answering to multiple regulators, are significantly ahead of the competition, considering the scale of investments in this space,” says Winston Jin.

J.P. Morgan, which has made massive investments in digitalizing/digitizing middle- and back-office processes that help clients streamline KYC/AML/onboarding procedures and, as a result, now gets one of the region’s highest ratings for ease of doing business.

Greenwich Leaders

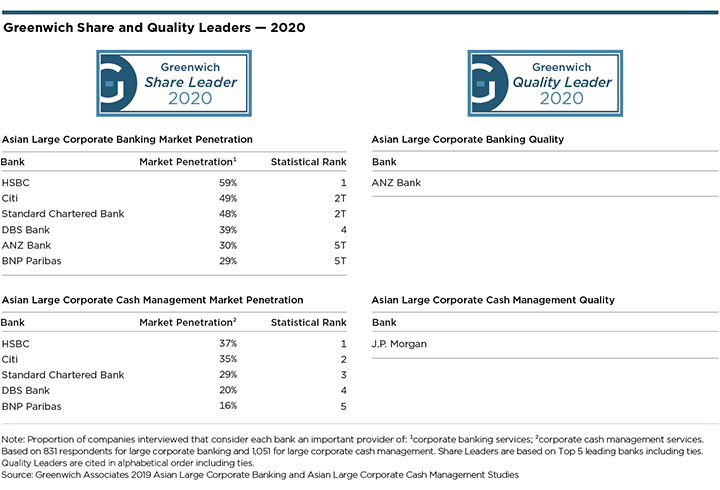

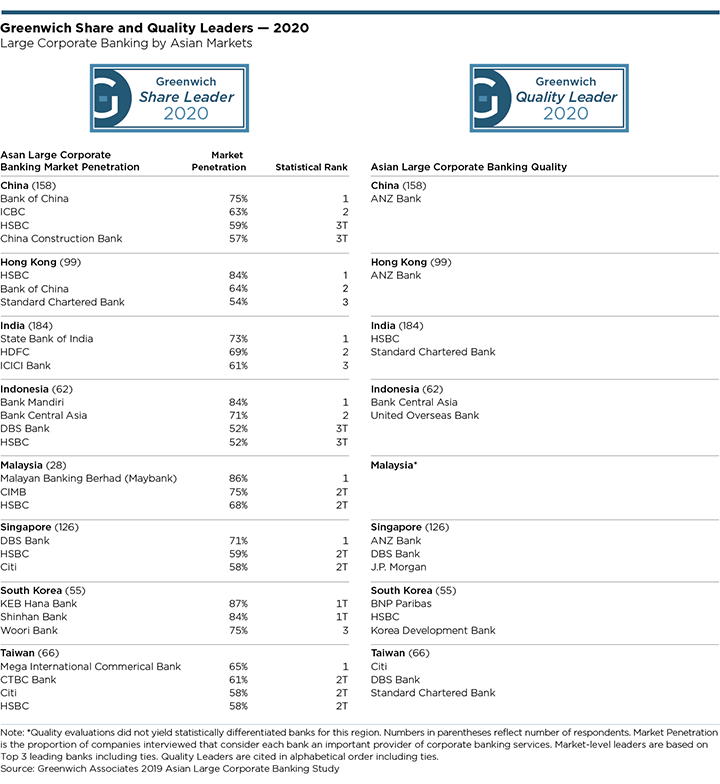

Despite any shifts in the competitive landscape, the list of 2020 Greenwich Share Leaders℠ in Asian Large Corporate Banking is still topped by the “global locals” that have traditionally dominated this market. HSBC, which scores first in terms of market penetration, appears to be pivoting to an even greater strategic focus on Asia that is already paying off. We expect that momentum to spread as the bank looks to diversify its franchise in the region by reducing its business concentration in Hong Kong and generating more revenues elsewhere in Asia. Citi, which is tied for second with Standard Chartered, remains perhaps the region’s top bank when it comes to digital innovation, design and product capabilities in the critical world of cash management—a fact that helped it cement its leading position in that business in 2020. ANZ Bank continued its progress as a key “Asia network” bank for Western multinationals and Asian corporates, retaining the crown of Greenwich Quality Leader℠. And while BNP Paribas is well-recognized for the strength of its trade and structured finance franchise, the bank has also stepped into the Top-5 space as a credible large corporate banking and cash management provider in Asia.

One bank to watch in the year to come is DBS, which ranks fourth in market penetration but has generated significant momentum of its own, largely due to its big investments in technology. DBS is building a strong suite of digital capabilities and is being recognized more and more often by Asian corporates and multinationals for innovation and creativity in the digital space.

The following tables provide the complete list of 2020 Greenwich Share and Quality Leaders in Asian Large Corporate Banking and Cash Management.

Head of Asia & Middle East Gaurav Arora, Head of International Dr. Tobias Miarka and consultant Winston Jin specialize in Asian corporate banking and treasury services. Managing Director Don Raftery is the global head of corporate banking and treasury services.

MethodologyFrom September to November of 2019, Greenwich Associates conducted 831 interviews in large corporate banking and 1,051 interviews in large corporate cash management at companies in China, Hong Kong, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. Subjects covered included product demand, quality of coverage, and capabilities in specific product areas.

The Greenwich Exchange

In this fast-changing environment, it’s more important than ever for corporate treasurers to understand the strategies and expectations of their banks, and other banks competing in the region. (Treasurers and other corporate finance executives can obtain valuable insights in this critical area by participating in a Greenwich Associates research study and becoming part of the Greenwich Exchange.)