Companies around the world are in the process of introducing environmental, social and governance (ESG) and sustainability goals into corporate finance and treasury functions. As they do, corporate banks have a valuable opportunity to deepen client relationships and win new business by helping companies understand the role ESG can play in these functions and advising them on how to implement ESG standards.

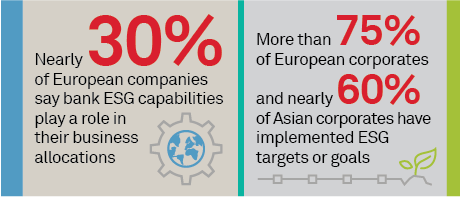

Banks that move quickly on this issue could build a long-term competitive advantage, as companies begin considering ESG policies and practices in the allocation of their corporate banking wallets.

In this paper, we examine the evolution of ESG and sustainability in corporate finance and treasury functions among large corporates in Europe, North America and Asia. Based on the multiple data-driven insights on ESG gathered from over 2,000 corporates globally as part of the Coalition Greenwich Large Corporate Finance Studies, we recommend a series of actions banks can take to advise and assist their clients in implementing ESG and sustainability into their corporate finance and treasury functions, and across their organizations.