Table of Contents

Even as countries around the world are planning to emerge from lockdown conditions, there is no doubt that the coronavirus has already changed the way we operate and live. Digital adoption is now a new necessity, as corporates seek to thrive in a post-COVID world.

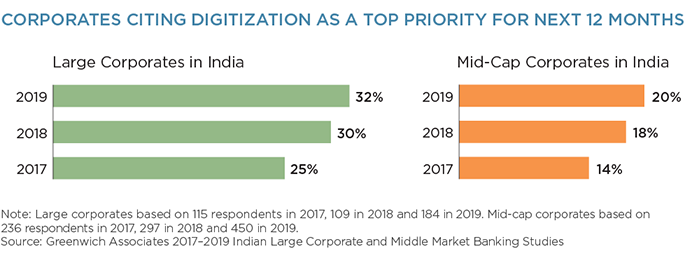

In India, the trend for digitization has been developing quickly over the past few years. A third of large corporate treasurers now view digitization as a top priority, compared to just 25% two years ago. The trend is similar among the mid-cap Indian corporates, as companies recognize the importance of investing in technology to drive operational efficiencies internally and to increase their competitiveness in the market.

With the impact of the global pandemic, usage of corporate banking digital platforms is rising exponentially, as more business transactions are done online and the option of using traditional channels is limited. However, this also draws greater attention to banks’ ability to deal with cybersecurity and fraud.

Cybersecurity in the Spotlight

India is one of the most targeted countries for cyberattacks due to the large volume of online activities and a growing internet population. According to the Indian Computer Emergency Response Team (CERT-In), there was a threefold increase in cybersecurity incidents, which rose from 53,801 in 2017 to 208,456 in 2018. High-profile cyberattacks on banks in recent years, such as the Cosmos Bank hack that caused 944 million rupees to be siphoned off, have also raised alerts for companies. To corporate treasurers dealing with millions of rupees in each transaction, the inherent risks of fraud are apparent.

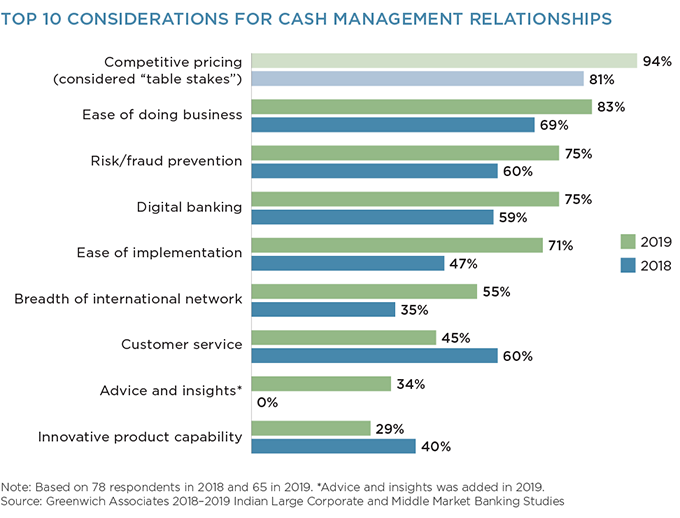

Insights from our Indian Large Corporate Cash Management Study show that 75% of corporates view risk and fraud prevention as a key criterion when selecting a cash management provider. In relative importance, it ranks second when we exclude pricing as a consideration. This largely highlights the awareness among Indian corporates of the risks in conducting transactions digitally and their reliance on banking providers to be their first line of defense. As digital transactions are projected to rise, it is even more critical for banks to demonstrate the robustness of their digital security capabilities to clients.

Key Cybersecurity Concerns of Indian Corporates

We took a deeper look at the feedback from corporates in India and found that their cybersecurity concerns are broadly focused on three key areas:

- Prevention of fraudulent transactions

- Identity and access controls

- Protection of data and sensitive information

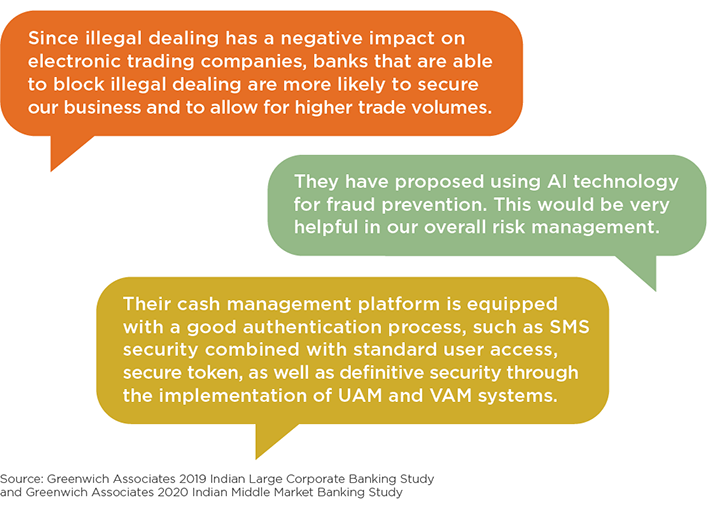

Corporates may vary greatly in their digital development, but most count on banks to provide the technology and framework to identify potential fraud within their treasury operations. Companies in India are cognizant of the application of advanced technologies such as artificial intelligence and machine learning in financial fraud prevention, and they cite this as an area where banks can do more to help them realize benefits of early warning or automated alert systems.

As more day-to-day transactions need to be performed over banks’ digital platforms, corporates are also more mindful of the security of these online interfaces. Corporate users need to be assured that ease of using the banks’ platforms are well balanced with a high level of access control. Corporate executives want to see sufficient safeguards in place to authenticate users and prevent unauthorized transactions before they are willing to expand their overall usage. While banks are required to adhere to strict standards set by the Reserve Bank of India to ensure that banking systems and payment gateways are highly secured, there is room to further communicate these developments to clients more frequently and clearly.

Finally, in a time of increased scrutiny on personal data protection, both banks and corporates are under pressure to safeguard the massive amount of data that flows through their systems. Corporates are progressively more sensitive to how their banking counterparts are tracking and storing their transactional and company data. Any lapse in the management of corporate data can deal a deadly blow to the banking relationship.

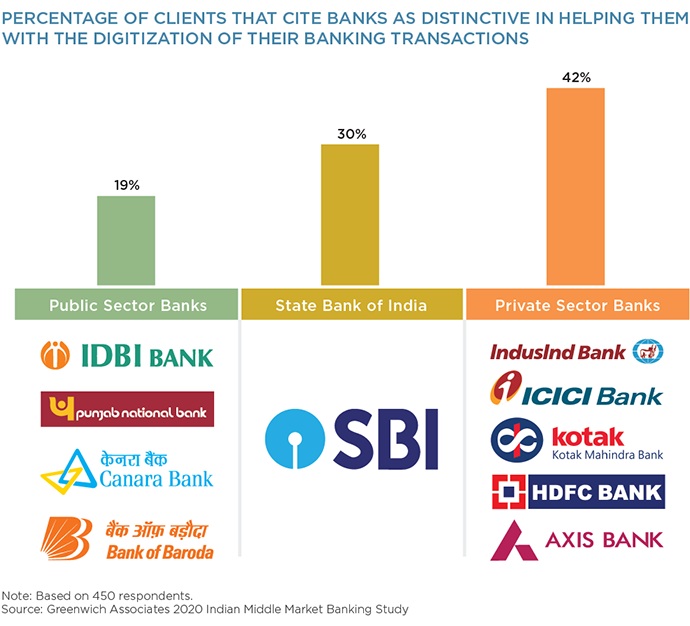

Private Sector Banks Lead Peers in Helping Clients Digitize

Private sector banks in India are currently well positioned to take advantage of the corporate shift to digitization. Continued investments in corporate banking systems by leading banks such as HDFC are starting to differentiate them with key competitors. According to our 2020 Indian Corporate Banking Study, private sector banks now have a significant lead over key competitors in terms of client recognition of digital capabilities. Over 42% of corporate clients cite private sector banks as being the most distinctive in helping them with the digitization of their banking transactions, compared with 30% for SBI and 19% for the other public banks. (Look out for the release of the 2020 Greenwich Leaders: Indian Corporate Banking.)

As the public sector banks go through a wave of consolidation to strengthen their balance sheet, it is also paramount to recognize the importance of investing in technology and the digitization of banking services. A key result of the current pandemic might be greater digital adoption from corporates in India, and banks need to be ready for the post-COVID transition.

Head of Asia Pacific & Middle East Gaurav Arora and Vice President Winston Jin specialize in Asian corporate banking and treasury services.

MethodologyGreenwich Associates interviewed a total of 634 India-based companies and foreign subsidiaries between Q4 2019 and Q1 2020. Of these, 184 are large corporates with annual turnover of at least INR 3,000 crores, and 450 are middle market businesses with turnover between INR 300 crores and 3,000 crores. Respondents were asked to name the banks they use for a variety of services, including corporate lending, cash management, trade services and finance, foreign exchange, structured finance, interest-rate derivatives, and investment banking.