Table of Contents

The banking groups used by large European companies are shrinking. After briefly spiking during the chaos of the global financial crisis, the average number of banks servicing big European companies has returned to the downward trajectory that started a decade ago.

In 2005, the typical large European company with at least E500 million in turnover used approximately 12 banks, with two to three of those banks considered lead relationships. In 2014, the overall average declined to fewer than 10 banks, with approximately two lead relationships on average.

The contraction of corporate banking groups has accelerated in the post-crisis era. The establishment of Basel III capital rules and other new regulations has caused many European and global banks to abandon past strategies aimed at capturing market share and revenues in favor of maximizing profitability. As part of that shift, they have become much more deliberate in segmenting their clients, pushing resources toward those offering the greatest profit potential while cutting back resource allocations or even severing relationships with smaller and less lucrative accounts.

These break-ups are not always initiated by banks. From companies’ perspective, bank relationships are often (but not always) driven by one thing: credit. As one corporate research participant said: “Our core banks lend to us. No lending, no call. Simple.” Although European companies have made aggressive use of capital markets amid an extended run of highly favorable conditions, Greenwich Associates research shows clearly that many companies regard the security of bank credit lines as an absolute imperative.

Therefore, as balance sheet pressures, capital rules and other regulations force banks to become more conservative in their lending policies, companies unhappy about the availability or terms of bank credit lines feel forced to act. In some cases, companies find it advantageous to reduce the number of providers overall in order to concentrate their business—and increase their importance as clients—with their remaining banks.

These trends have contributed to the overall reduction in the number of banks servicing large European companies. They have also led to the movement of large corporate banking relationships from Top 10 banks, which are aggressively adjusting their strategies and client portfolios, to banks ranked 11−20.

However, as past relationships end, large European companies are not necessarily replacing top-tier European and global banks with replacements from that same pool, or even from the relatively large group of regional European banks and national champions. In fact, the number of banking relationships held by mid-tier European banks is actually on the decline. One reason: In a growing number of cases large European companies are turning to a new resource—foreign banks specializing in specific international markets.

International Banking Needs

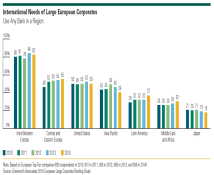

Large European companies are among the world’s most active when it comes to expanding business beyond their own country borders. The chart below shows the share of big European companies that use banking services in foreign markets. Most European companies that employ banks outside their home markets do so to support business in other Western European countries. For companies in nearly all European countries, the No. 2 foreign market is the United States. The one exception is Germany, where approximately 60% of large companies use banking services in Central and Eastern Europe. Asia is generally next in terms of exposure, and the data reveals a 2014 spike in demand for banking services in Latin America.

When companies make their initial forays into international business, they often call on the services of one or more of the largest global banks. Often these banks are existing relationships and have the types of broad international capabilities and networks required to meet companies’ requirements. A key factor in the decision-making process becomes who can best advise them of the pitfalls and opportunities associated with entering a particular country. However, as companies’ businesses expand and deepen in foreign markets, they often have developed the necessary skill sets and processes to manage these tasks. What they now need is local infrastructure support, local credit lines and experience with local regulatory subtleties. At this point, companies often begin to consider employing local banks.

Greenwich Associates data suggest this process is now playing out among many large European companies. Regional banks from Asia and Latin America are winning a share of relationships formerly held by European banks. Obviously most of these banks are not providing credit or service in Europe; instead, growing numbers of companies are crossing the threshold at which they require specialized, local coverage in specific foreign markets.

“Large regional banks from Brazil and other markets are winning relationships with the very biggest European companies, that have the most extensive overseas operations and therefore the most extensive banking needs,” says Greenwich Associates consultant Dr. Tobias Miarka. “But these banks are already setting their sights on the next tier of large European corporates with fast-growing businesses in the banks’ home regions.”

One additional factor could be at play: regulatory impact. Non-European banks from developing countries with less stringent regulatory frameworks could be enjoying an advantage over competitors domiciled in developed and more highly regulated markets.

Of course, foreign banks are not the only competitors benefitting from the increasing internationalization of European businesses. The largest European-based global banks are also getting a lift from increased demand not only for their international networks, but also for their advisory capabilities. “The expansion of cross-border operations adds new levels of complexity to cash management, FX, trade finance and other areas,” says Greenwich Associates Robert Statius-Muller. “As a result, companies are calling in banks with global capabilities for strategic discussions. These can be incredible opportunities to expand the bank’s share of wallet—if banks field the right people to make these discussions valuable to the client.”

Greenwich Leaders

Within this continuously evolving marketplace, BNP Paribas has established itself as the clear leader in European corporate banking and cash management.

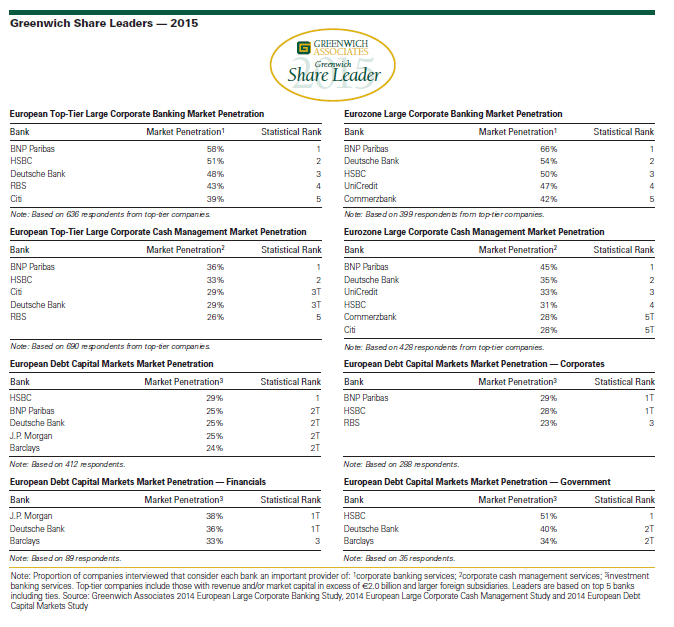

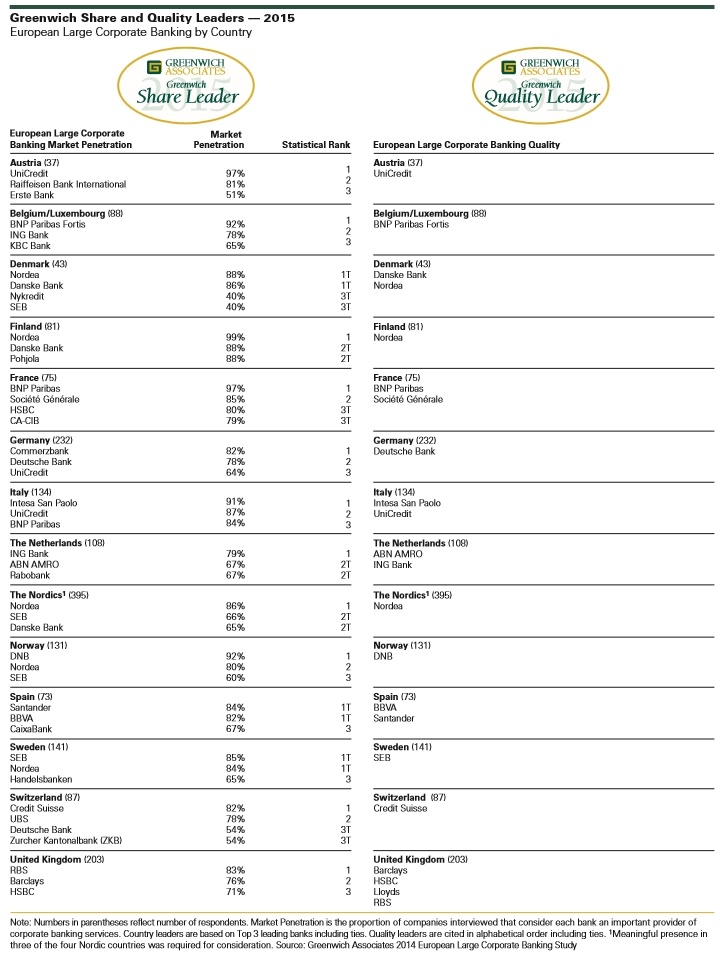

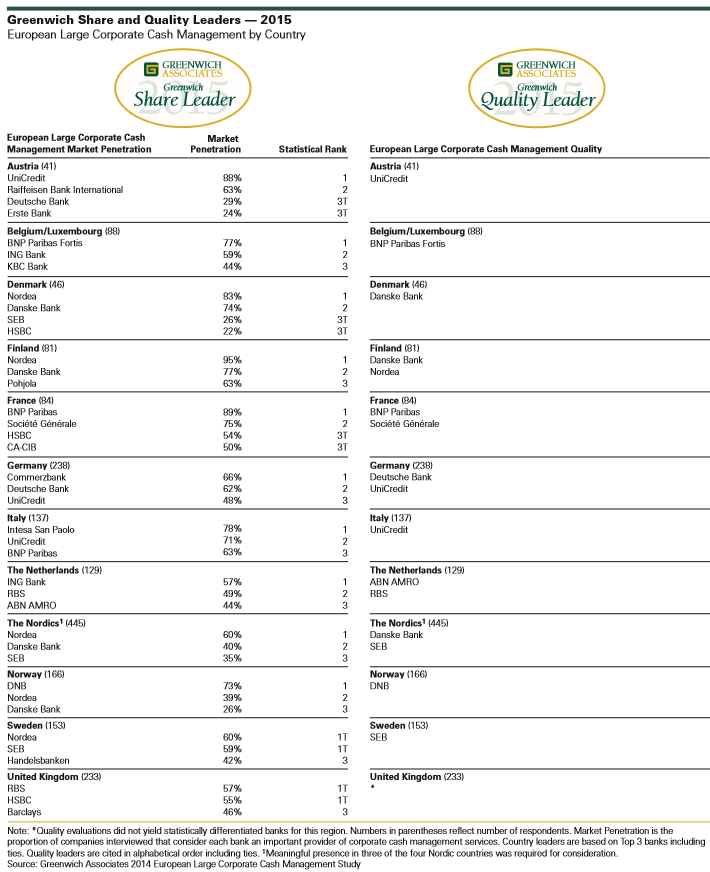

As part of its 2014 research study, Greenwich Associates asked large European companies to name the banks they used for corporate banking, cash management and debt capital markets, and to rate the quality of these banks in a series of product and service categories. Banks that receive ratings topping those of competitors by a statistically significant margin are named Greenwich Quality Leaders.

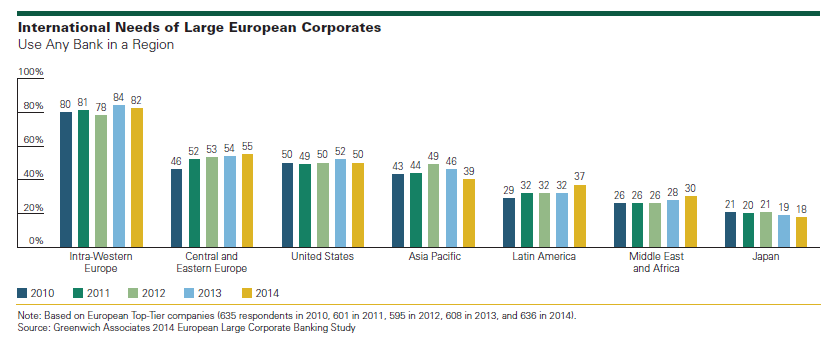

Across Europe, 58% of large companies use BNP Paribas for corporate banking services, followed by HSBC at 51%, Deutsche Bank at 48%, RBS at 43%, and the only non-European player in the group, Citi, at 39%.

These banks are the 2015 Greenwich Share Leaders in European Top-Tier Large Corporate Banking. The 2015 Greenwich Quality Leaders for Europe are BNP Paribas, Commerzbank, Deutsche Bank, and UniCredit.

Within the Eurozone, two-thirds of large companies use BNP Paribas for corporate banking, followed by Deutsche Bank at 54%, HSBC at 50%, UniCredit at 47% and Commerzbank at 42%. These are the 2014 Greenwich Share Leaders in Eurozone Large Corporate Banking. The Greenwich Quality Leaders within the Eurozone are BNP Paribas and Deutsche Bank.

In cash management, BNP Paribas leads with a market penetration score of 36% across Europe and 45% within the Eurozone. On a pan-European basis, HSBC ranks second in cash management, followed by a tie between Citi and Deutsche Bank and, RBS rounds out the Top 5. In the Eurozone, Deutsche Bank places second in market penetration, followed by UniCredit, then HSBC, while Commerzbank and Citi tie for fifth place. These banks are the 2015 Greenwich Share Leaders in European Top- Tier and Eurozone Large Corporate Cash Management respectively. The 2015 Greenwich Quality Leaders in Cash Management are Deutsche Bank and UniCredit within the Eurozone and BNP Paribas, Deutsche Bank and UniCredit across all of Europe.

The list of Greenwich Share Leaders in European Debt Capital Markets is led by HSBC with a market penetration score of 29%, followed by BNP Paribas, Deutsche Bank, J.P. Morgan and Barclays, all which are tied with market penetration scores of 24–25%. The 2015 Greenwich Quality Leaders in European Debt Capital Markets are Deutsche Bank and J.P. Morgan.

The accompanying tables present the complete list of 2015 Greenwich Share and Quality Leaders in European Large Corporate Banking, Cash Management and Debt Capital Markets, including Greenwich Leaders in individual country markets and specific client segments.

Consultants John Colon, Robert Statius-Muller and Dr. Tobias Miarka specialize in corporate and investment banking in Europe.

MethodologyGreenwich Associates conducted 3,055 interviews with financial officers (e.g., CFOs, finance directors and treasurers) at corporations and financial institutions with sales in excess of €500 million, including 1,238 with sales of at least €2 billion. Interviews were conducted throughout Austria, Belgium, Denmark, Finland, France, Germany, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom. Interviews took place from August through November 2014. Subjects covered included bank credit capabilities, domestic and cross-border advisory capabilities and equity underwriting capabilities. Cash management and debt capital markets capabilities were examined in separate interviews with corporate treasurers.

The findings reported in this document reflect solely the views reported to Greenwich Associates by the research participants. They do not represent opinions or endorsements by Greenwich Associates or its staff. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results.

© 2015 Greenwich Associates, LLC. All rights reserved. Javelin Strategy & Research is a subsidiary of Greenwich Associates. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, Greenwich ACCESS™, and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promotional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.