Table of Contents

Trade is back. Since the collapse of global trading activity in Q1 2020, trade volumes have recovered rapidly. Throughout 2021, trade volumes in Europe, Asia and the United States climbed steadily as pandemic-related supply chain disruptions subsided. Although the pace of that growth has slowed in the face of new challenges, such as soaring inflation and the war in Ukraine, large European companies in 2022 are enjoying robust trade flows around the world—and they are in need of trade finance services to support that business.

Over the past 12 months, the number of large European companies citing cross-border trade finance needs into and out of other Western European countries increased by three percentage points, and by three to four percentage points for trade into North America, Asia-Pacific and the Middle East and Africa.

The increasing number of companies looking for their banks’ help to facilitate their growing demand for international trade finance services has been driven by both the overall recovery in global trade and the continuing need to revamp supply chains. Three-quarters of large European companies say they are currently experiencing supply chain disruptions. By far, the most common negative impacts have been price increases, especially for energy. Companies have also battled freight and logistics snags, and shortages in products, components and raw materials. European companies continue adjusting supply chains to address these ongoing issues. They are also working more broadly to make supply chains more resilient against future events, and they are relying on their trade finance providers to help them achieve that goal.

The large companies participating in the Coalition Greenwich 2022 European Large Corporate Trade Finance Study are using five main strategies to strengthen supply chain resilience and are looking to draw on a range of banking products, services and solutions beyond traditional trade finance to support these strategies:

- Forecasting: Adopting increasingly sophisticated techniques and technologies to predict future economic and business conditions with an emphasis on building more nimble supply chains

- Planning: Using new and better data to prepare for shifts in supply, demand and availability of products and materials, as well as FX exposure

- Alternative Products and Suppliers: Diversifying supply chains to reduce reliance on individual partners

- Mergers & Acquisitions: Acquiring companies within their supply chains to increase control

- Renegotiations: Renegotiating trade finance relationships, credit lines and factoring agreements to accommodate pricing increases

Searching for the Right Providers

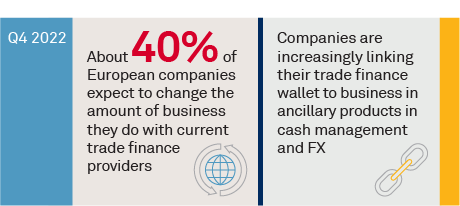

As large European corporates work through supply chain issues and manage expanding international trade volumes, many are shifting trade finance business among providers. About 40% of European companies say they expect to increase or decrease the amount of business they do with current trade finance providers in the year ahead. Companies in the United Kingdom and Ireland are among the most likely to shift business, a finding that makes sense given the highly competitive trade finance market in those countries and the large number of domestic and international banks competing for their business.

Companies in France, Germany and Benelux are all showing an increased propensity to shift trade finance business this year. Conversely, more large companies in Italy seem to be staying put with their current providers. Rather than any profound sense of satisfaction with the status quo, that finding likely reflects the dwindling number of options for corporates, as international banks lose their appetite for the Italian market.

There is one important factor influencing the way large European corporates allocate their trade finance business this year: price. During the pandemic, concerns about pricing on trade finance often took a back seat to the more pressing imperative of securing the financing and other essential services needed to keep businesses operating. Today, with the business environment largely normalized and inflation surging, companies are closely scrutinizing prices charged by their trade finance providers.

As shown in the accompanying chart, pricing has returned to its traditional position as the top criterion in companies’ selection of a trade finance bank. Three other shifts in corporate priorities stand out. First, companies are placing a strong emphasis on bank turnaround times. In a period of historic inflation, it’s critical for companies to lock in pricing quickly to avoid increases in costs for products, materials and shipping. Second, companies are increasingly linking their trade finance wallet to business in ancillary products in cash management and FX, thereby integrating trade finance more deeply into larger and broader treasury and corporate finance relationships. Third, our data reveals that banks’ digital capabilities are increasingly table stakes and, as such, less seen as a strong differentiating factor.

Digital Capabilities: Not a Differentiator, for Now

When it comes to companies’ selections of trade finance providers, digital capabilities are playing a surprisingly small role. During the pandemic, digital capabilities almost instantly took on a critical and even paramount role for both companies and banks. With nearly all staff working from home, a quick switch to digital documents, e-signatures and other digital tools was the only way to keep trade flowing. The speed with which companies and banks transitioned to digital applications was actually quite impressive. A trade finance industry that had, to that point, proven resistant to modernization showed itself capable of being quite agile when pressed.

Now, with the worst of the COVID-19 disruptions hopefully in the past, most companies have fully integrated basic digital tools into their trade process. That allows them to digitize at least large portions of their bilateral interactions with trade counterparties and trade finance providers. However, because the pandemic made these capabilities ubiquitous, companies don’t see these digital features as something that would distinguish one bank from another, as it had at the start of the pandemic.

While these “bilateral digitization” capabilities have quickly become table stakes for companies and their banks, more sophisticated and impactful digital transformation remains out of reach for the majority of European companies. The next wave of trade digitization will require the digitization of full supply chains, requiring multiple parties to adopt standardized or at least interoperable platforms and technologies. This type of “multilateral digitization” will be extremely difficult to achieve. If it does arrive, it could be many years down the road.

Related to this, the use of third-party platforms to facilitate trade finance seems to also be slowly growing. In fact, only about 1 in 5 large European companies are telling us that they are using a third-party digital solution for trade finance. Of those not using a third party platform at the moment, three-quarters say they simply see no reason to sign on to a multi-bank platform or to other digital offerings targeting procurement, invoicing, financing, bills of lading, or other aspects of the trade finance process.

Trade finance won’t enter its next stage of digitization until more large companies begin to at least experiment with common digital solutions. The fact that one or at least a small handful of dominant third-party platforms has not yet emerged adds to the “wait and see” approach, which prevents a number of buy-side players from committing to any one platform at the moment.

So the industry is currently stuck between these two phases of bilateral digitization, which has quickly arrived to a high level of maturity, and multilateral digitization, which hasn’t really started on a broad basis. As a result, digital capabilities don’t seem to be an important differentiator for companies now looking to select a new trade finance provider.

A Pause in Sustainability, an Opportunity for Banks

Roughly half (52%) of large European corporates have established goals to enhance the sustainability of their overall trade finance activities. Most of those goals are focused on environmental issues, with an emphasis on carbon emissions and global warming, and governance topics, including achieving compliance with new regulations on the environment and other issues.

Despite this progress on ESG, the share of large European corporates citing “expertise in sustainable financing” as an important factor in their selection of a trade finance provider—which was already fewer than 1 in 5—declined from 2021 to 2022. That year-to-year dip suggests that although sustainable supply chains are the future for European companies, that future will have to wait for now. After two years of COVID disruptions, mounting inflationary pressures and a war in Ukraine, many large European corporates appear to be putting efforts to make supply chains more sustainable on hold while they deal with more immediate and pressing issues.

Banks should recognize that pause as an opportunity to do both good and well. In the former category, there is vast potential to achieve emissions reductions and other environmental gains by enhancing the sustainability of corporate supply chains. In the latter category, because so many companies have made so little progress on this issue, banks’ expertise and green financing capabilities can be of great value to corporate executives. By positioning themselves as key advisors on sustainable supply chains and trade finance, banks have a unique chance to strengthen their relationships with important European clients.

Here are the five banks (in alphabetical order) cited by large European corporates as being most helpful in achieving ESG/sustainability goals:

- BNP Paribas

- HSBC

- ING Bank

- Rabobank

- UniCredit

Conclusion

Digital and ESG are taking a breather, but we expect that this will change once companies have worked their way through the most immediate new macro shocks. As they do, banks (and in the case of digital, also fintechs) are further improving on educating corporates about the benefits, as well as enhancing their offerings to be more ROI oriented (as regulators do their share). At the same time, banks have substantial opportunities to deepen their client relationships to support corporates in building the resilience of their supply chains and in bringing integrated transaction banking solutions.

Dr. Tobias Miarka, Melanie Casalis, Yoann Pasquer, and Ana Voicila specialize in corporate banking, cash management and trade finance services in Europe.

MethodologyBetween April and August 2022, Coalition Greenwich conducted the 2022 European Large Corporate Trade Finance Study that included 480 interviews with corporates with annual revenues of €500 million or more across Austria, Belgium, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Nordic countries, Portugal, Spain, and the United Kingdom. This research includes topics on trade services (traditional documentary trade finance), structured finance & commodities, working capital, supply chain financing.