Table of Contents

The consequences of the COVID-19 crisis continue to play out across the European trade finance industry, as companies seek out support and advice amid lingering disruptions in business operations, supply chains and trade flows.

The global pandemic cut global trade by about 5% in 2020, according to the World Trade Organization. In the midst of that reduction, however, demand for trade finance services was actually growing among large European corporates. That increase, which spanned services for trade both within Western Europe and around the world, reflects companies’ need for expertise and assistance amid the COVID-19 crisis and geopolitical challenges.

In this volatile environment, companies are not hesitating to reallocate business among trade finance providers to get the help they need. More than 40% of the large European corporates participating in the Coalition Greenwich 2021 European Large Corporate Trade Finance Study say they intend to shift business to or from individual trade finance providers in the coming year.

Companies aren’t making these moves on the basis of price. In fact, since 2019, the share of large European corporates citing pricing as one of their top considerations when selecting a trade finance provider dropped from approximately three-quarters to about one half. Instead of price, companies are focusing on products and services that can help them keep their businesses on track.

For example, also since 2019, the share of companies citing digital capabilities as a primary consideration when choosing a trade finance provider more than tripled, with most of that increase occurring during the pandemic lockdown of 2020. Companies are also placing much more weight on broad banking relationships that provide value across multiple international markets as well as products and functions.

BNP Paribas at the Top, Santander on the Rise

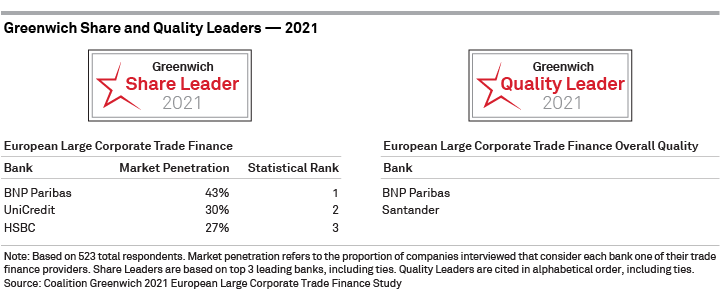

In this tumultuous environment, BNP Paribas drew on its robust international network and high-quality service to widen its lead over other providers in terms of market share among large European corporates. BNP Paribas tops the list of 2021 Greenwich Share Leaders in European Large Corporate Trade Finance, which also includes UniCredit and HSBC. BNP Paribas also joins Santander as 2021 Greenwich Quality Leaders.

The strong performance of Santander, which has invested heavily in its trade finance business over the past two years, illustrates the somewhat surprising resilience of regional providers against larger competitors, and of European banks generally against their U.S. rivals.

In businesses like corporate banking and cash management, large U.S. banks have been expanding their footprints in Europe, leveraging balance sheet strength and robust digital capabilities to capture share. In trade finance, only one U.S. bank, Citi, cracks the top 10 in terms of market penetration. As a result, the high levels of turnover in European trade finance relationships are resulting mainly in the movement of business from one European bank to another.

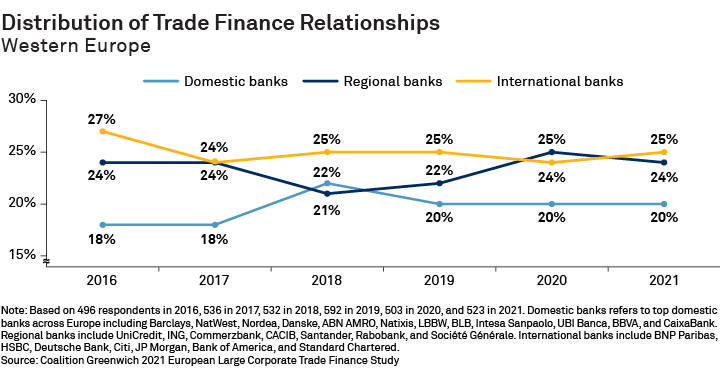

Europe’s regional banks claim about a quarter of those relationships—essentially matching the share held by international banks. This performance has created a diversified landscape of relevant providers that stands in stark contrast to the trade finance markets in Asia and the United States, which are dominated by large, international banks. Regional banks capitalize on both their status as longtime lenders to European corporates, and from the deep base of knowledge about the local market environment and company needs that comes from longstanding relationships. Regional banks have supplemented those strengths by building out cross-border trade finance capabilities robust enough to satisfy the needs of their corporate client bases.

Europe’s regional banks also benefit from the fact that, until very recently, trade finance has proven resistant to digitization. While some regional banks like Santander are mustering the resources to invest heavily in digital capabilities, many others simply lack the wherewithal to keep pace in a digital arms race. That shortcoming hasn’t presented too large a problem for regional banks to this point because most companies continue to employ manual and paper-based processes for trade. It remains to be seen how much that changes in the wake of a global pandemic that forced companies to adopt digital solutions during the abrupt shift to work-from-home.

Digital Gains Ground

Although trade finance lags far behind most financial service businesses when it comes to digitization, there are signs that a transformation is underway, and that the COVID-19 crisis provided a catalyst for change. As referenced at the start of this report, the share of large European corporates citing “quality of digital platforms and solutions” as a key criterion in picking trade finance providers jumped to 37% in 2021 from just 11% in 2019.

Most banks report a sizable pickup in the share of corporate clients using their proprietary digital platforms to initiate and manage trade services and finance. Among the biggest banks in the industry, usage ranges from about a quarter of large corporate clients to more than 35%, with individual banks like Santander topping 40%. Companies are also increasing their use of third-party digital platforms. Although these platforms are generally used only as a supplement to bank proprietary system, the rising tide of digital adoption during the COVID-19 crisis increased corporate usage last year.

Companies Work to Define ESG in Trade Finance

Large companies in Europe and around the world are embracing environmental, social and governance standards for their businesses. When it comes to trade finance, companies’ initial focus is centered on sustainable finance. Beyond that starting point, many companies seem unsure of the role ESG will play in their trade finance function, and are looking to banks for advice on supply chain and other critical issues.

The share of large European corporates naming “expertise in sustainable financing” as a key factor in their selection of trade finance provides jumped to 16% in 2021 from just 3% in 2019. In Norway, nearly a third of companies now consider sustainable finance expertise when picking a trade finance provider, as do 1 in 5 Germany companies.

Outside of sustainable financing, many large European corporates say they don’t know or it’s too soon to tell what their banking providers can do to help them achieve their ESG objectives. Although many companies are still working on defining or refining their ESG targets, all do agree on one point, however: Providers should be proactively engaging with advice and ideas on the topic of ESG in trade finance.

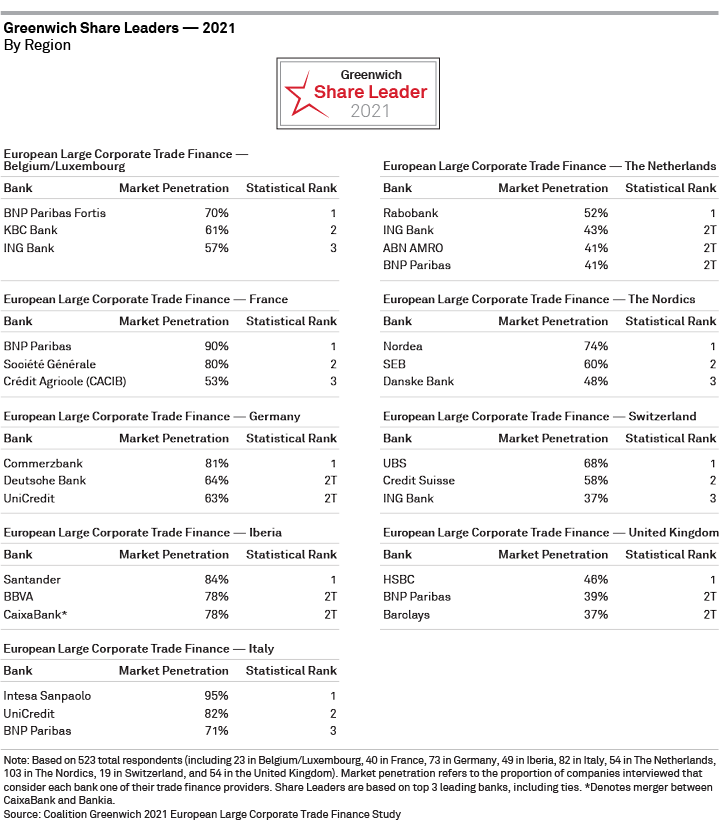

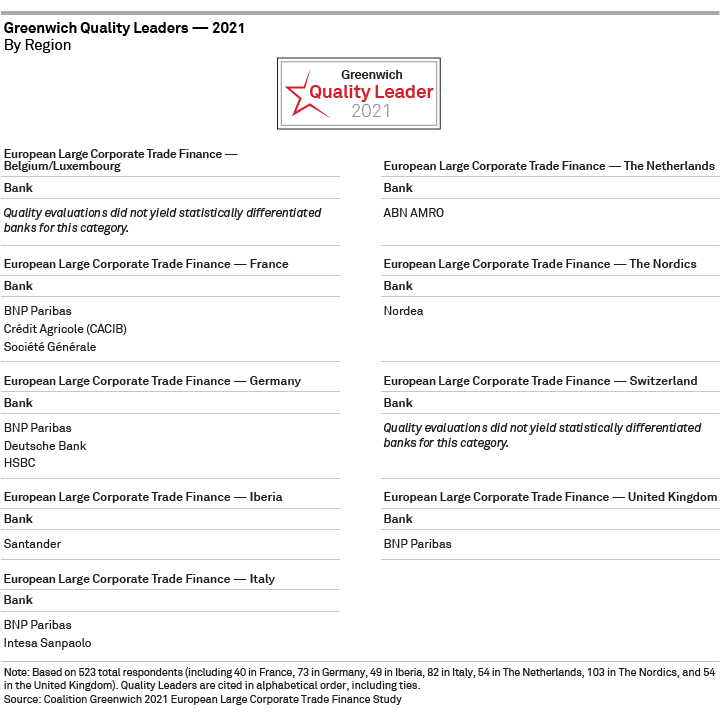

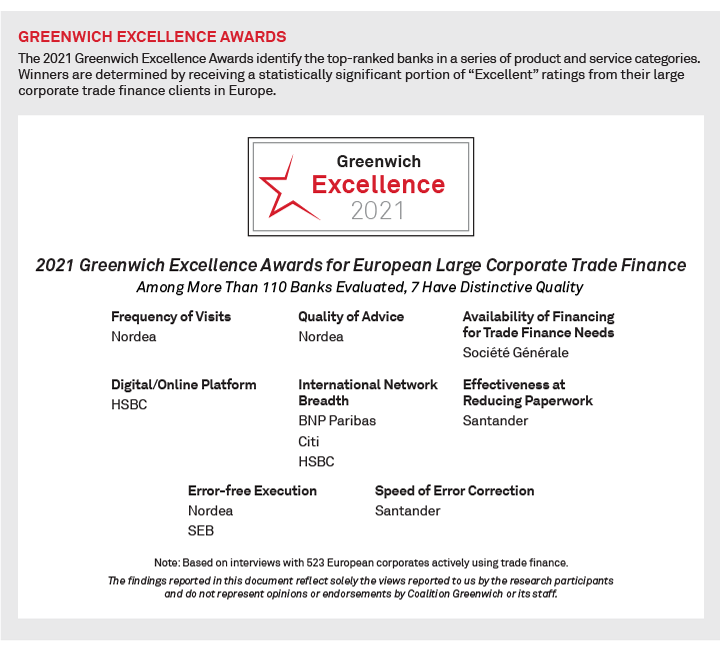

Greenwich Share and Quality Leaders, Excellence Awards

The following tables present the complete list of 2021 Greenwich Share and Quality Leaders in individual European countries and the winners of the 2021 Excellence Awards in several important categories.

Coalition Greenwich consultants Dr. Tobias Miarka, Melanie Casalis, Yoann Pasquer, and Aaron Finnegan specialize in corporate banking, cash management and trade finance services in Europe.

MethodologyBetween April and July 2021, Coalition Greenwich conducted 523 interviews with corporates with annual revenues of €500 million or more across Austria, Belgium, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Nordic countries, Portugal, Spain, and the United Kingdom. Interview topics included product demand, quality of coverage and capabilities specific to trade finance.