Banks today, in many ways, feel like analog players in an increasingly digital world. Yet change is coming fast: Within the next decade, they will feel and operate more like tech companies with banking licenses.

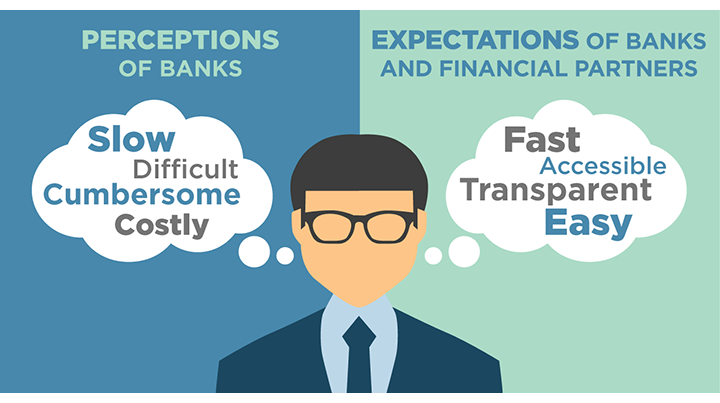

Over the last year, buyers of wholesale banking services have started bringing their personal experiences as online consumers to their expectations for commercial banking services. One-click ordering from Amazon, tracking fulfilment requests from Uber, auto-populating information from Google Chrome, and other innovations have changed perceptions about what is possible and what is expected in electronic commerce. With tech and retail sites setting new standards, customers increasingly expect interactions with their banks to be easy, fast, transparent, and done on their own terms. Expectations have changed dramatically in the last six to 12 months, with frustration evident when desired digital simplicity is not found.

These demands and other competitive factors are pushing banks inexorably toward a new model: By 2025, leading banks will be operating as digital financial superstores that blur the line between technology companies and banks.

Getting to that point will not be a smooth ride. Even in the best scenario, banks as currently constructed will struggle to keep pace with retail and tech providers when it comes to innovations in online functionality and service. New regulations and compliance demands have made onboarding, loan applications and other standard bank functions more difficult, time-consuming and frustrating for customers.

Although banks are trying to use technology to overcome these new challenges and deliver a more seamless customer experience, their efforts to date have largely failed to alleviate the problems and keep up with rapidly rising expectations. These developments have left banks in a tough spot. At exactly the time when their customers are learning how fast, easy and transparent online service can be, banks are struggling simply to maintain the quality of service, as much of their technology spend is dedicated to addressing risk, security and compliance needs and keeping disparate legacy systems running.

These developments have left banks in a tough spot. At exactly the time when their customers are learning how fast, easy and transparent online service can be, banks are struggling simply to maintain the quality of service, as much of their technology spend is dedicated to addressing risk, security and compliance needs and keeping disparate legacy systems running.

Enter the nonbanks. Banks’ troubles in this area have created an opening for nonbank lenders and fintech providers that leverage cutting-edge technology and their largely unregulated status to deliver the type of service and experience consumers have come to expect from the best Internet and mobile sites.

For the next five years, the industry will continue to experience this “digital divide,” in which technology-fueled disruptors drive rapid and dramatic change in the financial landscape. However, this fierce competition will set the stage for a new era. To overcome their regulatory disadvantages and keep pace with high-tech rivals, traditional providers will be forced to make sizable investments and implement sweeping alterations to their culture. Some providers will make it, many will be left behind.

These changes will transform many of these traditional providers into “digital financial superstores” that represent the future of banking.

MethodologyData noted in this report is collected from the Greenwich Associates Commercial Banking Program and Greenwich Market Pulse studies, which is ongoing research that addresses the most important and timely issues facing small ($1mm–$10mm) and mid-sized ($10mm–$500mm) company executive decision-makers about their banking relationships.