Table of Contents

The competitive dynamics of Asia’s corporate banking landscape are changing rapidly.

Banks around the world continue to view Asia as an important source of earnings and/or growth. However, because these banks are domiciled in countries with their own economic conditions and regulatory climates, they are approaching the region with a shifting array of objectives and strategies.

Competition among this group of global players—and increasingly with Asian franchises stepping into the fray—is changing the makeup of the market. It is also working to the benefit of Asian corporate treasurers, who find themselves solicited by a broad list of banks with offerings that run the gamut in terms of capabilities and price.

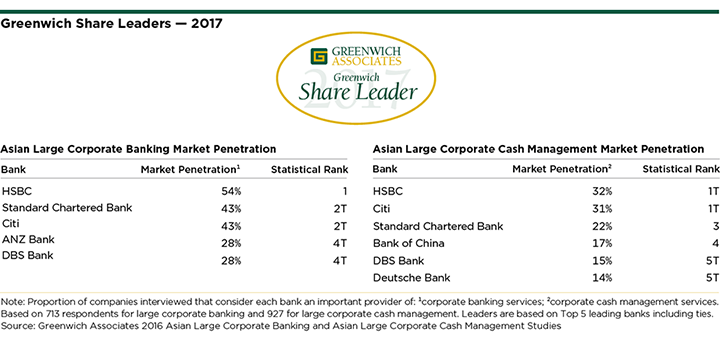

The list of Greenwich Associates 2017 Share Leaders in Asian Large Corporate Banking is topped by familiar names. HSBC leads with 54% market penetration, followed by Standard Chartered and Citi, which are tied for second at 43%. ANZ Bank and DBS Bank tie for fourth at 28%.

The situation is much the same in Large Corporate Cash Management, where HSBC and Citi are statistically tied for first place with market penetration scores of 31%–32%, followed by Standard Chartered at 22%, Bank of China at 17%, and DBS and Deutsche Bank sharing the No. 5 spot with scores of 14%–15%.

But these regional leaders represent only the tip of the iceberg when it comes to companies’ options for banking services. Asia is a highly heterogeneous group of markets, many of which support “national champions,” whose businesses are growing in step with their domestic markets and are becoming increasingly competitive on a domestic level.

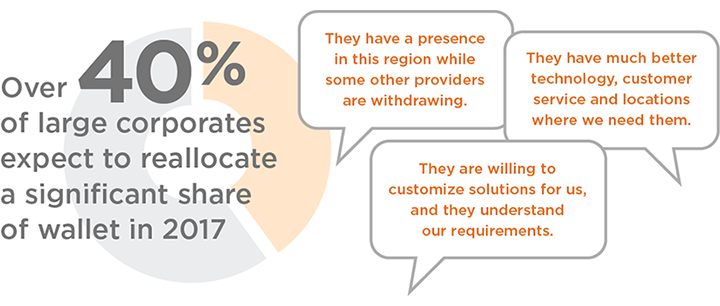

Asian companies seem more than ready to take advantage of this wealth of alternatives. Approximately 40% of large Asian companies say they plan to shift a significant share of wallet from an incumbent core bank in 2017.

“Global franchises continue to dominate the pan-Asia stage, but are less dominant than before,” says Greenwich Associates Managing Director Paul Tan. “We are seeing all of the market leaders make prudent “participation choices,” prioritizing return over sheer market share.”

From the buy-side perspective, corporates are increasingly willing to “mix and match,” with bank lists including “glocal,” global, regional, and leading local banks. Even as some corporates desire to streamline their bank lists, many are leaning toward finding the right provider for their needs—whether that be access to competitively priced credit, multi-market network connectivity, or deep in-market banking services.

Global Banks Shift Gears

At the top of corporate bank lists in Asia are global banks from Europe and the United States. To varying degrees, these banks are all still adjusting to the aftermath from the global financial crisis and the resulting regulation. Capital constraints have caused the globals to reassess their strategies in every market around the world.

In Asia, global banks are facing a tough combination of higher costs of capital, compliance and the relatively higher costs of servicing clients. Compounding the challenges are continued margin compression and increasingly sophisticated regional and local competitors, all fighting for the same higher-margin products.

Due to these factors, global banks have sharpened their selectivity in the Asian corporate banking landscape. They are targeting specific markets, channels or products that play to their strengths and offer the best potential for profitability.

At the same time, they are scaling back and in some cases shedding corporate relationships that fall short of internal profitability hurdles. The result has been a multi-year de-concentration in the pan-Asia competitive landscape.

Amid this rationalization, Asian corporates indicate that they increasingly value “commitment to market and the long-term relationship with us,” even as they demand competitive pricing. Global (and regional) franchises that are well regarded for these attributes will see favorable response to the balance sheet they choose to deploy in Asia.

“American banks like Citi, J.P. Morgan and Bank of America Merrill Lynch are reviving animal spirits in Asia because, for a variety of reasons, they bit the bullet earlier in terms of making the tough adjustments required by new capital rules and other regulations,” says Greenwich Associates consultant Gaurav Arora.

Local Banks Raise Their Game

The shift of many global banks to a more targeted strategy means at least some Asian companies are experiencing a reduction in coverage. This shift is creating new opportunities for a group of ambitious and fast-improving local providers that are emerging as a credible option for Asian corporate treasurers in search of replacement, supplemental or simply lower-cost banking service.

As recently as 2010, Asian banks held less than half of all available Asian corporate-banking relationships¹. Increasing steadily since then, that share now stands at 58%. Leading this charge are banks with regional ambitions, like ANZ and DBS, and the biggest banks from the regions’ largest country markets, including Bank of China, State Bank of India and HDFC.

“These gains reflect the perfect alignment of growing sophistication and opportunity,” says Gaurav Arora. “The best Asian banks have made rapid improvements in terms of the quality of their offerings, the talent of their teams and the overall sophistication of their enterprises.”

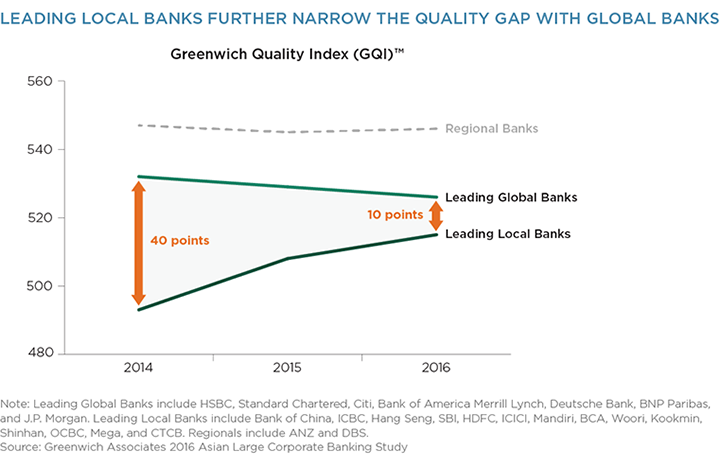

The following graphic shows just how dramatically the quality gap between leading global banks and leading local banks has narrowed. Over the 12-month period covered in the most recent Greenwich Associates Asian corporate finance study, some local Asian banks saw improvements of 30–40 points on the Greenwich Quality Index—a composite measure of client perceptions of bank product and service quality. A 20-point change in any given year is considered significant.

Reflecting these improvements, the list of 2017 Greenwich Quality Leaders in Asian Large Corporate Banking includes one Asia-based franchise —DBS Bank—in addition to Bank of America Merrill Lynch and Citi. On the whole, however, local Asian banks have not yet matched the quality and sophistication of the globals. But large banks like Bank of China and HDFC have enhanced their platforms to the point of being competitive with globals within their domestic markets, and DBS has become competitive in key regional markets.

A Heterogeneous Market Poses Strategic Challenges

Both global and Asian banks aspiring to a regional profile are discovering how difficult it can be to achieve economies of scale in a market as heterogeneous as Asian corporate banking. The 15 jurisdictions that make up the Asian region differ widely in terms of regulatory regime, market structure, economic conditions, cultural tendencies, local competitors, and a wide variety of other factors. Companies from those markets need and value different things from their banks.

For example, companies in China and India say they are seeking banks that, above all else, understand the basics about their markets, their businesses and their needs. Clients in Hong Kong and Singapore, however, are looking for banks

that go beyond the fundamentals and provide high-value ideas and advice about how to advance their businesses. These clients also place greater emphasis on turnaround times and efficiency.

Even as the regional franchises strive to achieve scale economics across a diverse set of markets, local banks in individual domestic markets are rapidly improving the quality of their service offerings. In some countries, the biggest national banks are narrowing the gap with rival global banks on that score.

“The flux in Asian corporate banking today is largely a function of banks in the region adjusting new and different strategies for taking on this complex market,” says Greenwich Associates Managing Director Paul Tan. “Global banks’ growing selectivity about which roles and areas to focus on is actually an alternative route to achieving scale economics—within these better-defined spaces as opposed to sheer scale from the broadest of blanket coverage.”

Greenwich Leaders by Country

The following tables present the complete listing by country of Greenwich Associates 2017 Share and Quality Leaders in Asian Large Corporate Banking and Cash Management.

¹Share of relationships cited to Greenwich Associates. On average, corporates cite their Top 9-10 banking relationships to Greenwich Associates each year.

Consultants Paul Tan and Gaurav Arora specialize in Asian corporate banking and treasury services.

MethodologyFrom August to November of 2016, Greenwich Associates conducted 713 interviews in large corporate banking and 927 interviews in large corporate cash management at companies in China, Hong Kong, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. Subjects covered included product demand, quality of coverage, and capabilities in specific product areas.