Table of Contents

India’s capital markets have exhibited exceptional growth over the past two years, defying global headwinds. Record equity trading volumes and bond market participation have been fueled by rising domestic investor engagement and improved market infrastructure. The private credit market has expanded rapidly, with alternative lenders filling gaps left by banks.

India has also emerged as a significant player in derivatives, with notable growth in contract volume. As the market continues to deepen, banks are poised to capitalize on opportunities in trading and execution revenue, market-making, brokerage services, and electronic trading, driven by a paradigm shift fueled by retail investor participation, institutional support and policy reforms. This presents a compelling growth story for banks to leverage, with India’s capital markets offering a unique opportunity for expansion and revenue growth.

India’s equity market: A global powerhouse

India’s equity market is one of the world’s largest and fastest growing, boasting a market capitalization of approximately $3.5 trillion as of 2024. Over the past two years, Indian equities delivered an impressive 13.3% USD return in 2024, surpassed only by a few APAC markets, and an 18% gain in 2023, making it one of the top-performing markets globally. The market’s breadth and depth have significantly improved, with a diverse universe of over 5,000 listed companies, balanced industry representation and high liquidity.

Furthermore, India’s equity market has achieved parity with several developed markets in terms of free-float market capitalization, trading turnover and derivatives volume, underpinned by robust domestic liquidity. Key highlights of India’s equity market include:

- Block equity deals are gaining traction, with U.S. banks actively participating and expanding their presence.

- The increase in India’s weightage in MSCI indices has benefited banks, with EU banks leveraging their existing prime brokerage businesses to capitalize on growing investor interest.

- Activity in the corporate equity derivatives (CED) space, particularly margin loans, has increased, attracting new entrants, while EU banks continue to lead and expand their footprint in these deals.

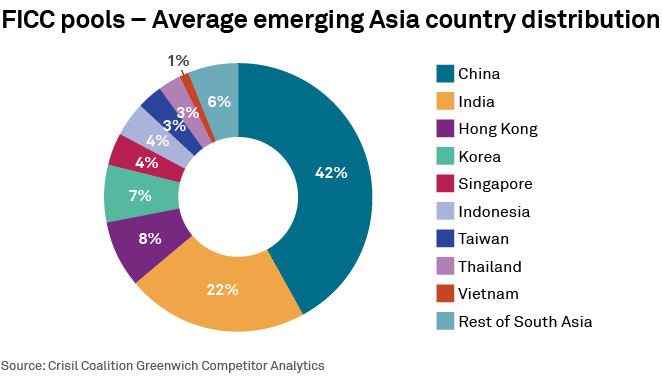

Fixed-income markets: The next frontier for growth

India’s bond markets are experiencing a record year with INR issuances crossing unprecedented levels, creating deeper liquidity and stronger opportunities in credit trading. A significant surge in the issuance of SSA bonds in local currency has enhanced liquidity in the derivatives market, swaps and cross-currency hedging products, further deepening the Indian financial markets.

Foreign currency borrowing is becoming more diverse, with Indian issuers increasingly tapping euro and yen markets alongside the dollar to optimize funding costs and broaden investor access. Total return swap (TRS) activity has also gained momentum driven by index inclusion, providing investors with an efficient way to gain exposure to the Indian bond market. As the Indian economy grows, the bond market is likely to play a crucial role in providing funding for companies and infrastructure projects.

Keys highlights for fixed-income market include:

- Banks are expanding their presence in GIFT City, leveraging the benefits of lower withholding taxes to relocate a significant portion of their lending operations. It has emerged as a significant hub for external commercial borrowings (ECBs), with a notable increase in foreign currency ECBs in yen/euro/dollar/INR trades, with 2024–2025 being a record year. Additionally, other structured lending activities have also grown, such as lending via subscription to corporate non-convertible debentures (NCDs).

- Structured financing and TRS activities are gaining traction in India, driven by a surge in client flows from foreign institutions and a favorable regulatory environment, with increased participation in local currency bond trading and growing demand for private financing and structured loans.

- India’s foreign-exchange and hedging markets are poised for significant growth, and banks are increasing their hedging and corporate finance activities.

- The Indian flow credit market is experiencing increased opportunities in high-yield trading and distressed activities, particularly in the Special Situations Group (SSG), presenting a growing area of focus for investors.

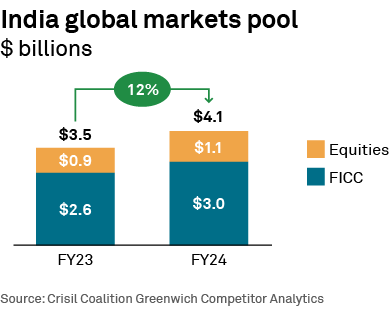

India’s capital markets have undergone a remarkable transformation, driving a substantial expansion of the revenue pool for financial services. The investment banking fee pool has grown significantly, reaching $1.2-1.5 billion in 2024, fueled by soaring trading commissions and exchange revenues from record-breaking volumes. The National Stock Exchange (NSE) has emerged as a powerhouse, dominating India’s equity cash trading with a 93.6% market share and derivatives trading with a 98.5% market share, cementing its position as one of the world’s largest exchanges by trading volume.

India’s markets have achieved a unique balance of retail, domestic institutional and foreign investors, contributing to market stability and rendering it an attractive destination for global investors. The country’s financial landscape is no longer viewed as an “emerging play” by banks, but as a core strategic market, offering expanding revenue pools and significant growth opportunities. By establishing an early presence in this maturing market, banks can reap substantial rewards and solidify their position in the country’s rapidly evolving financial ecosystem. As India’s capital markets continue to grow and mature, they are poised to play an increasingly important role in the global financial landscape.

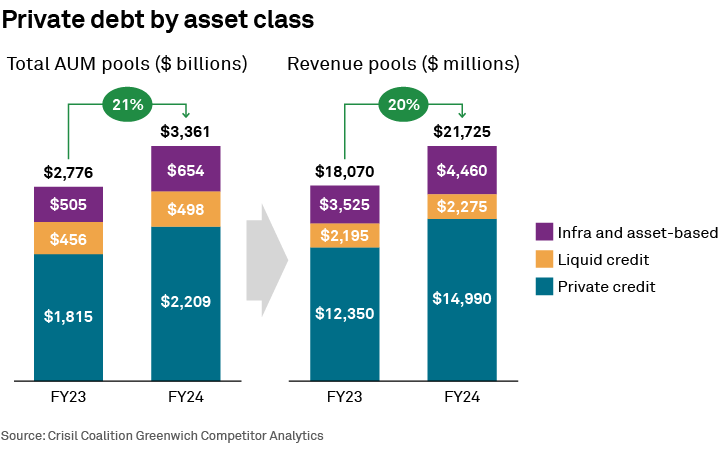

Rapid growth of India’s private credit market

Concurrently with the public markets, activity in India’s private credit sector has accelerated over the past 24 months, driven by a confluence of factors. Corporates are increasingly likely to explore alternative capital-raising avenues beyond traditional banking channels and bond issuances, as are global investors seeking to capitalize on the yield opportunities presented by India’s high-growth economy.

Notably, the private credit market has recorded a substantial increase in deal volumes, with a total of $8.5 billion in private credit transactions in FY23–24. This uptrend is poised to continue, as India’s private credit market enters a new phase of expansion and growth, underpinned by rising investor sentiment and an expanding universe of active credit funds.

Investment in India-focused private debt funds has exploded, with assets under management (AUM) experiencing a 25-fold increase from $0.7 billion in 2010 to $17.8 billion in 2023, outpacing the growth of venture capital and public equity funds in the country. This exponential growth has catapulted India to the forefront of private credit expansion in the APAC region. The recent $3.5 billion private credit transaction involving the Shapoorji Pallonji Group serves as a testament to the robust demand for high-yielding assets among investors.

As the private credit market continues to expand, banks are strategically positioned to capitalize on the resultant opportunities, including private credit fundraising, deal origination and execution, and structured finance solutions. The growth of private credit in India is also driving demand for ancillary products, such as deal-contingent swaps and options. These offer a significant revenue opportunity, especially for international players with an onshore presence, as these products typically have a deliverable leg and are crucial for private credit funds seeking to manage their internal rate of return.

India’s private credit market has emerged as the fastest growing segment within the alternative investment space, driven by strong institutional and global investor demand. The number of SEBI-registered credit-oriented alternative investment funds (AIFs) has grown significantly, from 547 in 2019 to 1,626 by July 2025, with AUM expanding substantially. As of March 2025, credit-oriented AIFs, including debt, real estate debt, venture debt, and distressed funds, accounted for approximately one-third of the combined AUM of Category I and II funds. The total capital commitments to AIFs reached $162 billion, with 76% concentrated in Category II funds, which encompass various private credit strategies. Notably, commitments to Category II funds have surged from $34 billion in 2020 to $124 billion in 2025, representing a nearly fourfold increase over a five-year period. This trend underscores strong investor interest in India’s private credit market, driven by attractive yields, portfolio diversification benefits and the financing gap left by banks in mid-market and special situation lending.

Key drivers for the private credit market include:

- Deal size explosion: Indian private credit is witnessing a significant surge in deal sizes, with multiple mega-loans exceeding $125–300+ million to single borrowers, including complex structured facilities to infrastructure and manufacturing giants, underscoring the market’s growing maturity and sophistication.

- Investor confidence soars: The upscaling of deal sizes, coupled with a proliferation of active credit funds, demonstrates a seismic shift in investor confidence, as lenders increasingly turn to private credit channels to tap into the growth potential of India’s largest corporates.

- Market momentum accelerates: The private credit market in India is experiencing a remarkable growth spurt. An impressive 96 deals were completed in the first half of 2024, representing a significant escalation in market activity and cementing the country’s position as a hub for private credit transactions.

- Sectoral diversification unfolds: While real estate remains the dominant sector for private credit deployment, accounting for a substantial 25–30% of deal value, other sectors such as infrastructure and utilities, healthcare/pharma, technology, and manufacturing are rapidly gaining traction, underscoring the market’s expanding reach and diversification.

- Customized solutions gain traction: Private credit funds are offering a range of innovative, tailored solutions, including unitranche loans, mezzanine capital, convertible debt, and structured bonds, providing borrowers with unprecedented flexibility and speed, and making them an attractive alternative to traditional banking channels.

- Mid-market companies drive growth: Mid-market companies are the backbone of the private credit market, with borrowers seeking swift execution, flexible terms and customized solutions that traditional banks often cannot match, driving the growth of this critical segment and underscoring the importance of private credit in India’s economic landscape.

Roadmap for future growth

As India’s capital markets undergo a transformative evolution, banks need to deploy bespoke strategies to harness the country’s distinctive ecosystem and navigate its complex regulatory terrain. The Indian capital markets present a multi-dimensional opportunity for banks, characterized by a thriving equity market, an underserved bond and private credit market ripe for disruption, and a high-growth economy fueling burgeoning financing demands.

Banks that demonstrate a steadfast commitment to India, backed by a long-term vision, strategic capital allocation and talent investment, will be empowered to capitalize on the country’s secular growth narrative. By tailoring innovative products, forging strategic partnerships and mitigating risks, banks will be poised to capture a significant share of the substantial revenue streams emerging in India’s financial markets. The strategic decisions made today will be instrumental in determining which banks will ultimately succeed in harnessing the vast potential of India’s financial landscape, and those that fail to adapt will risk being left behind in the wake of this seismic shift.

- Anchor a dominant onshore footprint: Global banks can establish a robust and scalable onshore presence in India, leveraging strategic ownership structures, such as wholly owned subsidiaries, expanded branch licenses or targeted joint ventures. This will unlock direct access to India’s vibrant deal ecosystem, enabling banks to underwrite high-profile IPOs and bond issuances, participate in loan syndications and capitalize on secondary market trading opportunities.

- Craft tailored product solutions: Banks can innovate and adapt their product offerings to resonate with India’s unique market dynamics, developing a suite of rupee-denominated products and structured solutions that cater to local investor preferences and regulatory requirements. This can include pioneering structured credit and private debt funds, infrastructure financing and securitization, derivatives and risk management, and ESG and green finance products that address the country’s growing sustainability needs.

- Forge strategic alliances: Global banks can pursue collaborative partnerships with local players, fostering symbiotic relationships that drive mutual growth and value creation. This can involve strategic tie-ups with domestic banks or fintech lenders, collaborative initiatives with public sector institutions, and partnerships in asset management, technology and operations that leverage each other’s strengths and expertise. By doing so, banks can accelerate their growth trajectory, enhance their brand reputation and identify emerging opportunities in India’s rapidly evolving financial landscape.

India’s capital markets have undergone a seismic shift, driven by explosive growth in equity and derivative trading and the rapid emergence of private credit. With its unparalleled growth momentum and deepening market infrastructure, India outpaces global peers, presenting a compelling opportunity for banks to capitalize on its favorable macro trends and evolving market landscape.

By leveraging India’s high-growth economy, digital adoption and supportive demographics, banks can position themselves for success, participating in secondary markets, underwriting and financing the country’s massive investment needs, and innovating products for a new generation of investors. With a strategic approach and strong local integration, banks can unlock substantial rewards from India’s dynamic financial market growth story, driving growth, innovation and profitability.

Crisil Coalition Greenwich Competitor Analytics team members Aamir Hazaria, Bhavya Ahuja and Crisil’s Principal Economist Dipti Deshpande are coauthors of this report.