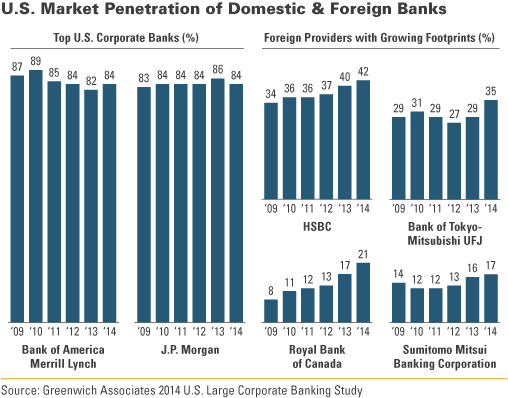

As U.S. companies choose the set of banks that will serve as their core providers, they should take advantage of today’s fiercely competitive environment by holding talks with the growing group of aggressive foreign providers fighting to expand their presence here.

In addition to the traditional corporate banking leaders, companies are being courted by up-and-coming U.S. providers that now offer top-notch capabilities in domestic banking, cash management and other critical functions, as well as international banks that are increasingly willing to lend in the U.S.

Why Companies Should Be Open to Solicitations from Foreign Banks

- New Basel III capital reserve requirements are changing banks’ business strategies, and those changes could affect banking relationships. Now that capital is more expensive for banks, they are moving in near lock-step to direct their resources toward a smaller number of more profitable customers.

- Banks are focusing on their biggest corporate clients and pulling back on their resource commitments to all other companies. The result: Companies that find themselves outside the list of “preferred prospects” for U.S. banks and begin to experience reductions in service coverage intensity or quality might over time find foreign banks more welcoming of their business.

- International expansion is a central part of the long-term growth strategies for an increasing number of companies. Seventy percent of U.S. companies with revenues above $2 billion now use international cash management services. So even companies that don't have much need for international banking capabilities now should think about bringing on board at least one provider with a strong international network.