Table of Contents

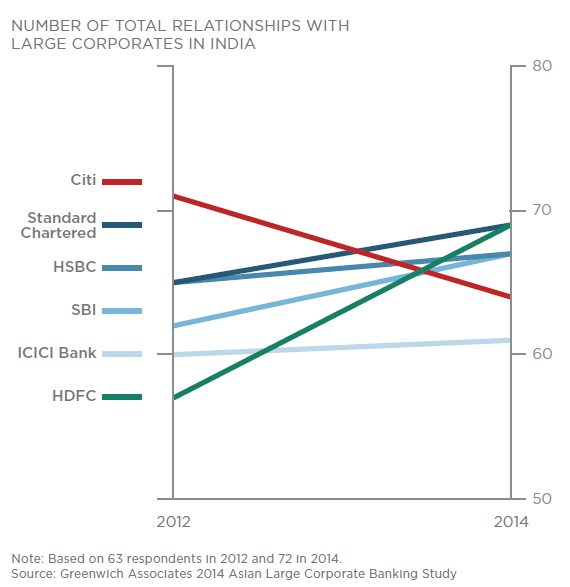

Growing numbers of the largest Indian companies are turning to local banks like HDFC, State Bank of India and ICICI Bank, which now rival the market’s top foreign banks in terms of market penetration in this prized segment.

Standard Chartered, HSBC and Citi traditionally have been the dominant providers of wholesale banking services (such as credit, treasury management, trade finance, and investment banking) to large Indian companies. These so-called “glocals” (global banks that have established on-the-ground presence in each market) are still seen by large companies as the market’s top quality providers.

However, rising capital and compliance requirements have caused foreign/global banks to rethink the way they allocate resources in Asia and elsewhere. At the same time, domestic banks have been closing the quality gap and winning not only spots on Indian companies’ bank lists, but also deeper “core bank” and “lead bank” positions.

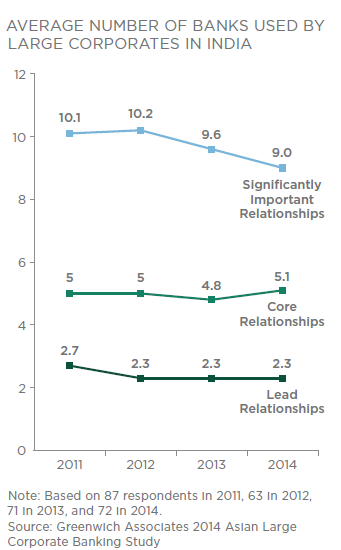

Indian banks are making this progress at a time when large companies are cutting down on the number of banks with which they do business overall. During the global financial crisis, Indian companies—like companies the world over—sought out new bank relationships as a means of addressing counterparty risk and ensuring uninterrupted access to critical credit and banking services.

Since 2012, Indian companies have been unwinding some of these relationships and bringing their bank lists back to “normal” levels. The average number of significantly important providers used by the largest Indian companies declined to 9.0 in 2014 from a peak of 10.2 in 2012. “Companies are consolidating banking relationships at the expense of the tail of secondary providers,” says Greenwich Associates consultant Gaurav Arora. “The importance of winning a position in the ‘core’ or inner circle is greater than ever before.”

Banks Need to Sharpen Propositions in an Increasingly Crowded Market

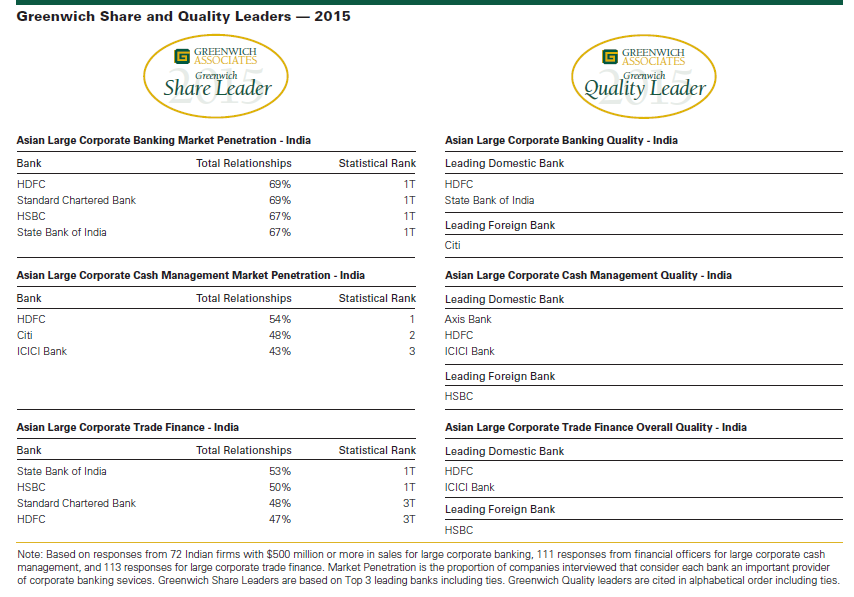

Amid these changes, HDFC has climbed to the top of the market in terms of penetration among the largest Indian companies (those with annual revenues of at least $500 million), narrowly edging out Standard Chartered after two years of strong gains. HDFC has achieved this momentum largely on the basis of its industry-leading domestic cash management network. State Bank of India has secured the third spot in the market on the strength of its lending and international trade finance businesses. ICICI also places in the market’s top tier, after HSBC and Citi, leveraging a diverse franchise with strengths in cash management, trade finance and foreign exchange.

“The corporate banking market in India is getting more crowded but is also deep and growing,” says Greenwich Associates consultant Paul Tan. “Amidst this increasing competition for “share of mind,” banks in India will need to sharpen their propositions to market in terms of the roles they will play and excel in.”

Greenwich Share and Quality Leaders

Every year, Greenwich Associates asks participants in its Asian Large Corporate Banking, Large Corporate Cash Management, and Large Corporate Trade Finance Studies to name the banks they use in each of these areas. Subjects covered included product demand, quality of coverage, and capabilities in specific product areas. To determine the Greenwich Share and Quality Leaders, the Firm conducted 72 interviews in large corporate banking and 111 in large corporate cash management in 2014, and 113 interviews in large corporate trade finance in 2015 with financial officers at companies in India. Greenwich Quality Leaders are banks that receive client ratings topping those of competitors by a statistically significant margin.

Consultants Gaurav Arora (Gaurav.Arora@Greenwich.com) and Paul Tan (Paul.Tan@Greenwich.com) specialize in Asian corporate banking and finance.

MethodologyFrom August to November 2014, Greenwich Associates conducted 72 interviews in large corporate banking and 111 interviews in large corporate cash management at companies in India. From April to June 2015, the Firm conducted 113 interviews in large corporate trade finance at companies in India. Subjects in all studies included product demand, quality of coverage and capabilities in specific product areas.

The data reported in this document reflect solely the views reported to Greenwich Associates by the research participants. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results. Unless otherwise indicated, any opinions or market observations made are strictly our own.

© 2015 Greenwich Associates, LLC. Javelin Strategy & Research is a division of Greenwich Associates. All rights reserved. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates,® Competitive Challenges,® Greenwich Quality Index,® Greenwich ACCESS,™ Greenwich AIM™ and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.