Table of Contents

Although liquidity disruptions caused by the COVID-19 crisis were thankfully short-lived for most large U.S. companies, corporate executives and treasury officials have not forgotten which banks stepped up to help in Spring 2020, and which didn’t.

About 80% of the companies participating in the Greenwich Associates 2020 Large Corporate Banking Study rate their banks’ performance during the crisis as “excellent” or “above average.” Those results stand in stark contrast to assessments by midsize companies and small businesses, many of whom felt abandoned by banks in the early stages of the pandemic. However, the fact that large companies were satisfied by the performance of most of their banks during the crisis means that the 20% of banks seen as coming up short could be at risk of losing business in the months to come.

Dissatisfaction Will Mean Less Business for Some Banks

Back in 2019, 49% of large companies said they expected to reduce the amount of business they do with at least one bank on their current list of providers. “There is always some level of churn as part of the normal business cycle,” says Greenwich Associates consultant Don Raftery. But that share jumped 10 percentage points in 2020—an increase Raftery says is almost certainly associated with companies’ dissatisfaction with the support or capabilities they experienced, or didn’t, during the crisis.

When it comes to naming the banks that delivered during the crisis, large U.S. companies put Bank of America, Citi and J.P. Morgan at the top of the list. Those three banks are the winners of the special 2020 Greenwich Excellence Award for “Helpfulness During COVID,” a designation won by banks that received the most citations from large companies for their high-quality service and support during the pandemic.

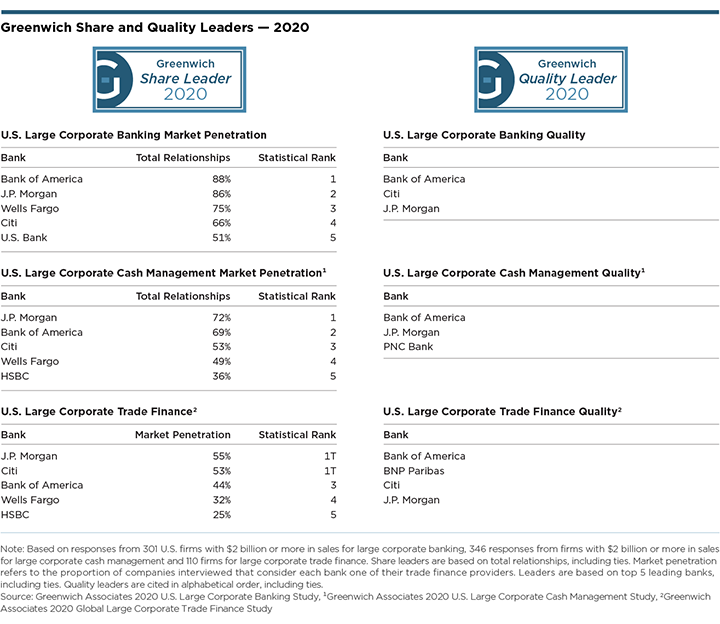

2020 Greenwich Share and Quality Leaders

The 2020 Greenwich Share Leaders in U.S. Large Corporate Banking are Bank of America, J.P. Morgan, Wells Fargo, Citi, and U.S. Bank. These five banks amassed the largest market shares in corporate banking among the biggest U.S. companies last year. Among those Leaders, Bank of America, Citi and J.P. Morgan won the designation of 2020 Greenwich Quality Leaders by receiving quality ratings that topped ratings for other competitors by a statistically significant margin from the 301 large U.S. companies participating in our annual research.

In Large Corporate Cash Management, the 2020 Greenwich Share Leaders are J.P. Morgan, Bank of America, Citi, Wells Fargo, and HSBC. In terms of client experience, Bank of America, J.P Morgan and PNC Bank take the title of 2020 Greenwich Quality Leaders.

The 2020 Greenwich Share Leaders in Large Corporate Trade Finance are J.P. Morgan, Citi, Bank of America, Wells Fargo, and HSBC. The 2020 Greenwich Quality Leaders for Trade Finance are Bank of America, BNP Paribas, Citi, and J.P. Morgan.

Support in Crisis

What were companies looking for from their banks in terms of support during the crisis? First and foremost, credit. In late Q1 2020, companies feared they were in for a liquidity crisis like the one experienced in 2008. To prepare, they sought out new sources of liquidity. In most cases, that supplemental liquidity proved to be a prudent but ultimately unnecessary backstop, as funding for large companies quickly returned to something close to normal. By summer, much of the new liquidity had found its way back onto bank balance sheets, and companies were looking for advice on what to do with increased cash positions. “However, none of that was apparent in February and March, and companies will have long memories about the responses they got from banks when they asked for additional credit to help them weather the crisis,” says Greenwich Associates consultant Chris McDonnell.

Credit was not the only thing companies needed. The switch to work from home created unprecedented operational challenges for companies and their treasury departments. Companies participating in the annual study say bank performance varied widely during the crisis in key functions like cash management. According to study participants, some banks went above and beyond to facilitate the switch to work from home. “The fact that banks like Bank of America, Citi, J.P. Morgan, PNC, and Wells Fargo managed to improve client ratings for ‘ease of doing business’ in cash management during such a disruptive period is a notable accomplishment,” says Chris McDonnell.

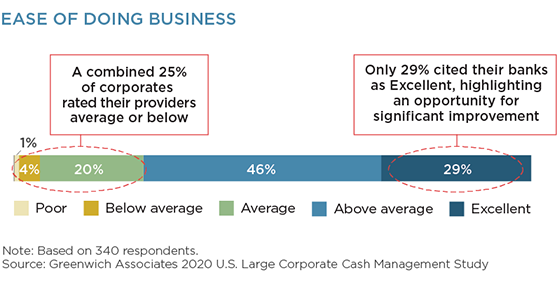

However, companies say other banks actually created additional headaches, with strict documentation and other requirements that were difficult to meet in a remote work environment. Frustrations with these providers’ performance during the crisis likely stem from broader criticisms of cash management being onerous in general. Fewer than 1 in 3 large companies say their cash management provider is “easy to work with.” The remaining two-thirds of study respondents complain about poor customer service and operational breakdowns. KYC compliance is one key pain point that contributes to low scores for overall client satisfaction across the industry—both during the pandemic and in a more normal business environment. Digitalization of these processes will help as more banks get further along in the journey.

Digital Capabilities: Approaching Escape Velocity

Most of the banks that came through for large companies during the crisis have one thing in common: They had a solid digital platform in place coming into 2020 that allowed them to maintain product and service quality during the pandemic. Digital technology is becoming the lynchpin of a wholesale banking franchise—especially in areas like cash management—and banks with the best digital platforms are building a powerful competitive advantage.

Bank of America and J.P. Morgan win the 2020 Greenwich Excellence Award for Best Overall Digital Platform in Large Corporate Cash Management. At a broader level, four global wholesale banks have differentiated themselves by deploying strong digital/technical capabilities and analytics that outpace rivals: Bank of America, Citi, HSBC, and J.P. Morgan. (For more details about this list and additional analysis about the impact of digital technology in wholesale banking, click here for our report, The Future of Banking: Digital Transformation.)

The bad news for banks not making these lists is that the full impact of past digital investments—many of which are now being targeted as back-office efficiency enhancements—has not yet materialized. As customers start to feel the impact of new digital initiatives, the competitive landscape of the entire industry will begin to shift. “There’s an element of escape velocity,” says Don Raftery. “Right now, some banks are using traditional ‘white-glove’ service to remain competitive. However, we are approaching (or, in certain cases, past) the point where the efficiency and cost advantages of the digital platforms become overwhelming. At that point, it’s hard to see how digital laggards can keep up.”

What Does ESG Mean in Corporate Treasury and Finance?

As growing numbers of companies and investors adopt environmental, social and governance standards into their operations, corporate treasury professionals are still trying to figure out exactly what ESG means in specific functions like cash management and in corporate finance more broadly. As part of that process, 21% of the large U.S. companies participating in the study say they have started considering banks’ performance on ESG factors and provision of sustainable finance options like “green bonds” when allocating their banking wallet. “Although that share falls slightly short of the more than one-quarter seen in Europe, the fact that a significant number of the biggest U.S. companies say ESG now plays a role in awarding bank business shows just how fast these issues are permeating business and finance in North America,” says Don Raftery.

Indeed, as corporate treasury officials consider the implications of ESG on their own policies and operations, they should not forget that the new emphasis on these issues goes both ways. As Don Raftery concludes, “Companies should be prepared for their banks’ credit decisions to start taking into account ESG factors like carbon risk in terms of regulations, taxes, potential fines, and even long-term revenue prospects.”

Consultants Don Raftery and Chris McDonnell specialize in corporate banking, cash management and trade finance services in North America. Consultant Chris McDonnell also specializes in digital banking.

MethodologyFrom June through December 2020, Greenwich Associates conducted interviews at U.S.-based companies with $2 billion or more in annual revenue with 301 chief financial officers, treasurers and assistant treasurers, 346 cash managers and other financial professionals in cash management, and 110 corporate trade finance professionals. Participants were asked about market trends and their relationships with their banks. Trade finance interview topics included product demand, quality of coverage and capabilities in specific product areas.