Table of Contents

The U.S. corporate banking market is on the cusp of a revolution, with relationship strength and wallet allocation increasingly driven by effective process digitization.

For much of the past decade, relationships between banks and their corporate customers have been fraught.

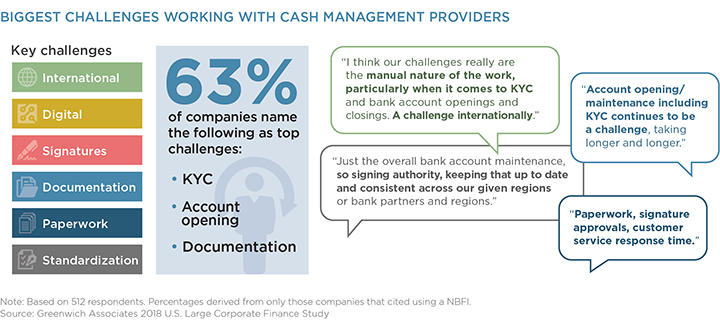

In the wake of the global credit crisis, companies lost trust in banks they felt didn’t do enough to support them. Banks worked for years to rebuild relationship equity and regain trust. But even as they did so, they faced a fierce headwind in the form of intrusive new know-your-customer (KYC) requirements and other new regulations that created headaches for companies. As compliance and documentation burdens made basic processes like onboarding more time-consuming and frustrating for corporate treasury teams, banks experienced further deterioration in client satisfaction.

Transformative Technology

To address these challenges, leading banks have turned to technology—streamlining and digitizing countless workflows and processes. Now these large investments addressing pain points in the middle and back office are starting to pay off and will soon have dramatic implications for the U.S. banking industry and its clients.

Large U.S. companies tend to concentrate the bulk of their banking business with their core banks, which tend toward the biggest U.S./global players. These banks offer the range of products and geographic locations necessary to meet the needs of multinational corporations.

However, the service these global banks provide has never been as seamless as desired by corporate treasurers, and KYC rules and other compliance demands have made doing business with banks feel like “hard work.” Companies often complain about the need to enter the same data on multiple occasions, while also bemoaning a perceived lack of transparency and outdated,paper-based systems. “Opening accounts, doing just simple things seems to be extraordinarily painful,” says one U.S. corporate treasury professional about working with a global bank. “Our experience has just been far more difficult than expected.”

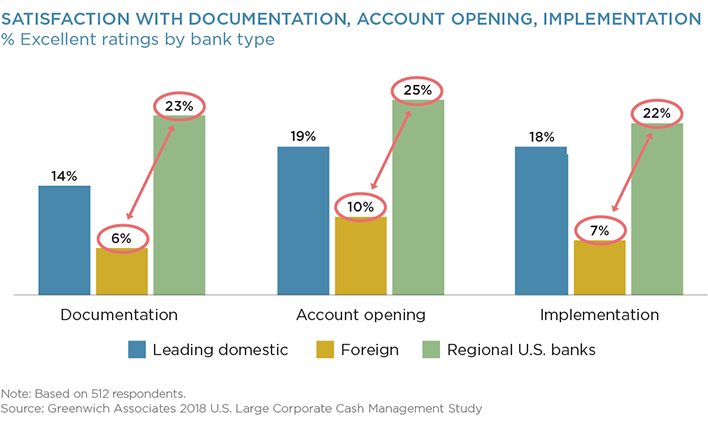

The ability to provide a better overall customer experience has always been a selling point, especially for doing business in foreign markets where “local champions” can really differentiate themselves with superior service and advice. This advantage has helped banks outside the global bulge bracket maintain relationships and market share against bigger rivals with substantially more resources. It has also provided an opportunity for nonbanks to capture market share in certain product niches by utilizing sophisticated technology platforms to provide unique values combined with real-time service and positive customer experience.

Large Banks Demonstrating Digital Prowess

But the tech platforms now being rolled out by the world’s biggest banks have the potential to erode and even eliminate the service advantage of their smaller and newer rivals. The leading banks are harnessing technology to make it easier for companies to do business with them by digitizing customer information and storing it in a central repository (e.g., digital document vault) that is easily accessed by all bank units and functions. Leading banks are—or soon will be—using new capabilities and features, such as e-signatures, to streamline documentation and speed functions like onboarding and account opening.

“The differentiated customer experience of 2020 will be driven more by fluid user experience than a responsive service professional. The evolution in preferences/expectations favors those with the ability to invest and effectively deploy technology,” according to Greenwich Associates Managing Director Chris McDonnell.

The impact of new digital technology won’t be limited to service and ease-of-doing-business. On the contrary, with the rise of data and analytics, sophisticated technology platforms will also give big banks an advantage when it comes to providing companies with advice. Those banks investing heavily in curating their data as an competitors. Done well, digitization, streamlining of processes, and rich, predictive analytics will make corporate treasurers’ lives easier by reducing the amount of effort required to engage with a bank and get consistently excellent advice in return.

“The banking industry is in the early stage of an analytics arms race to create and deliver differentiating insights. While there are some leaders making strong progress and pulling away from other major providers, banks (including the leaders) are still at a modest level of maturity in leveraging robust, comprehensive data, predictive analytics and forms of AI to create prescriptive, contextual recommendations efficiently at scale, tailored for specific client needs,” says Greenwich Associates Managing Director Don Raftery.

Of course, even if the world’s biggest banks were to perfect the client experience entirely, it wouldn’t mean the demise of smaller competitors. “Eventually, companies’ desire for efficiency will bump up against their need for financing,” says Greenwich Associates Managing Director John Colon.

Shifting Landscape for Corporate Banking

Companies often rely on regional and smaller banks for credit as well as local advice. That need won’t disappear and, given the economics of corporate lending, large U.S. companies will continue including these banks in their list of providers in cash management and other fee-based services as a means of maintaining solid relationships with their lenders. “It’s their willingness to provide capital through good times and bad,” says one U.S. corporate treasury professional when asked why his company uses a “regional champion” bank in Asia.

“They have a lot of capital and they have a pretty cheap cost of capital. They tend to be good growing partners.” Nevertheless, new technology rollouts over the next two years will reshape the U.S. corporate banking landscape by turning the tables and making it easier for companies to bank with the industry’s leading providers. “Digitization is substantially influencing where corporate banking business is flowing and where it will flow,” says Greenwich Associates Managing Director Don Raftery. “This will be transformative to the industry.”

Greenwich Share and Quality Leaders

In this dynamic environment, J.P. Morgan tops the list of 2018 Greenwich Share Leaders℠ in U.S. Large Corporate Banking, just nosing ahead of Bank of America Merrill Lynch. They are followed by Wells Fargo and Citi, with HSBC and newcomer MUFG Bank statistically tied for the fifth and final spot. The 2018 Greenwich Quality Leaders℠ in this category are Bank of America Merrill Lynch and J.P. Morgan. Bank of America Merrill Lynch is No. 1 among the 2018 Greenwich Share Leaders in U.S. Large Corporate Cash Management, with J.P. Morgan and Wells Fargo taking the second and third spots, respectively. Citi and HSBC round out the top five.

The accompanying table presents the complete list of 2018 Greenwich Share and Quality Leaders in U.S. Large Corporate Banking and U.S. Large Corporate Cash Management.

Consultants John Colon and Don Raftery specialize in corporate banking, cash management and trade finance services in North America. Consultant Chris McDonnell also specializes in digital banking.

MethodologyFrom April through September 2018, Greenwich Associates conducted interviews at U.S.-based companies with $2 billion or more in annual revenue with 422 chief financial officers, treasurers and assistant treasurers and 512 cash management specialists and other financial professionals in cash management. Participants were asked about market trends and their relationships with their banks.