Table of Contents

Although global trade volumes have rebounded from the depths of the crisis last year, Asian companies are still battling dislocations caused by COVID-19—and they are looking to their trade finance providers for help.

Supply chain disruptions, surging shipping costs and elevated commodities prices are just a few of the pandemic-related challenges still roiling the businesses of large Asian corporates. That’s in addition to concerns about the strength of the global economy in the face of virus variants and political risks arising from continued tensions between the United States and China, and other factors.

“The cases of COVID-19 in Indonesia and India are high, which affects our business and increases the difficulties in communicating with the customers,” says the representative of a large Asian corporate. “The trade war has negatively impacted the whole supply chain of raw materials and key components,” adds a treasury executive at another large Asian company. “We are also concerned about the costs due to inflation.”

In this difficult environment, large Asian corporates are asking their trade finance providers for support and advice. Companies participating in the Coalition Greenwich 2021 Asian Large Corporate Trade Finance Study say they are particularly interested in receiving useful advice on geopolitical and country risk, as well as ideas about how to best hedge FX risks and other exposures. In terms of immediate challenges posed by the pandemic, companies are looking for their trade finance providers for proactive market updates, advice on operational issues like supply chain, work-from-home and digitization, and specific advice on financing, working capital and liquidity management.

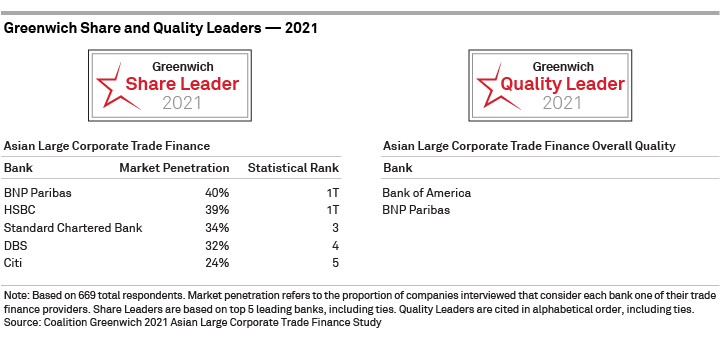

All of the 2021 Greenwich Share Leaders for Asian Large Corporate Trade Finance won accolades from corporate clients for delivering on these and other counts during the crisis. The 2021 Greenwich Share Leaders are BNP Paribas, HSBC, Standard Chartered Bank, DBS, and Citi. “All five of these providers were named a top bank for ‘delivering distinctive advice in times of need’ by the large companies participating in this year’s study,” says Gaurav Arora, Head of Asia at Coalition Greenwich.

The 2021 Greenwich Quality Leaders in Asian Large Coporate Trade Finance are Bank of America and BNP Paribas.

Digital Acceleration

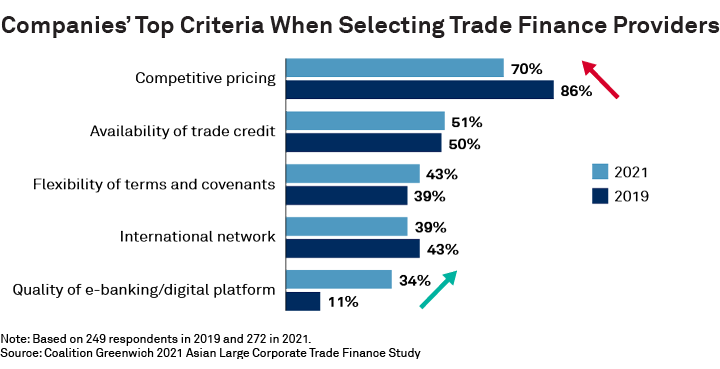

Trade finance has been one of the last areas of financial services to go digital. Asian large corporates continue to use paper-based, manual processes for many trade-related functions. The COVID-19 crisis could mark a moment of transformation. From 2019 to 2021, the share of large Asian companies citing “quality of e-banking/digital platform” as a key consideration in their selection of a trade finance provider tripled to 34%. “Given the pressure on bank margins in Asian trade finance, providers are eager to facilitate the shift to digital channels,” says Coalition Greenwich consultant Winston Jin. “By forcing companies to adopt digital tools just to keep their businesses running during lockdowns and work-from-home, the pandemic accelerated the digitization of trade finance, not just in Asia, but around the world.”

Applying ESG Standards in Treasury and Trade

Although a large majority of the companies participating in this year’s study have adopted formal environmental, social and governance targets for their companies, many large Asian companies have not yet determined the precise role ESG criteria will play in trade finance. Going forward, companies will be asking their trade finance providers for advice about how to apply and implement ESG in the trade function.

Today, a quarter of large companies want their trade finance providers to help achieve sustainable financing objectives, including the use of green bonds. Companies also see the move away from paper and toward digital as an avenue in which their banks can help support ESG standards. “In general, companies are looking for their trade finance banks to take a proactive role, and to reach out with ideas about how to create and meet ESG goals in the areas of treasury and trade,” says Gaurav Arora.

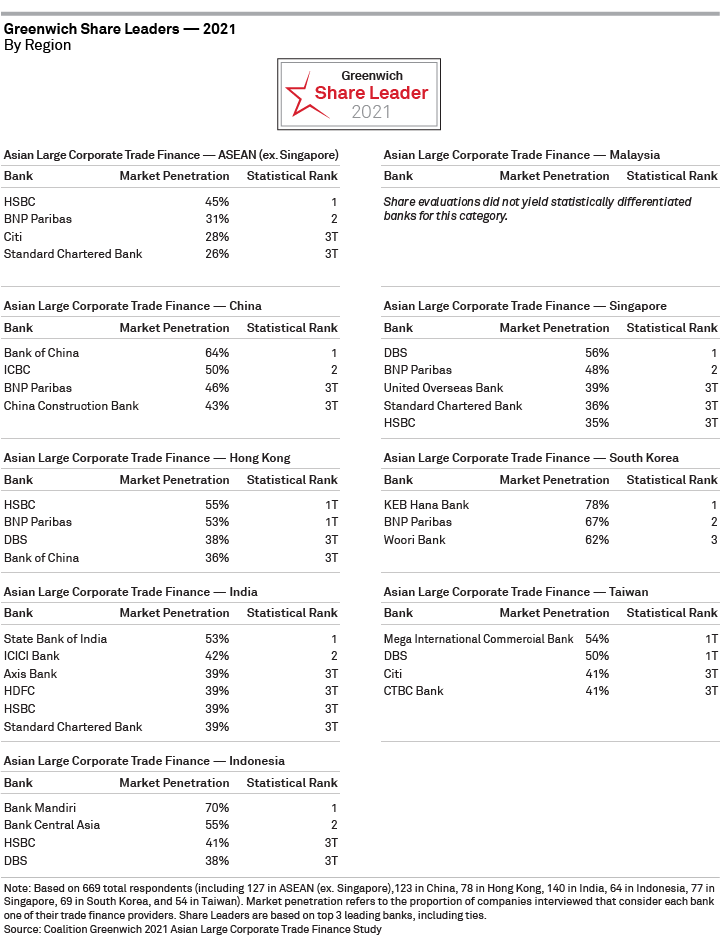

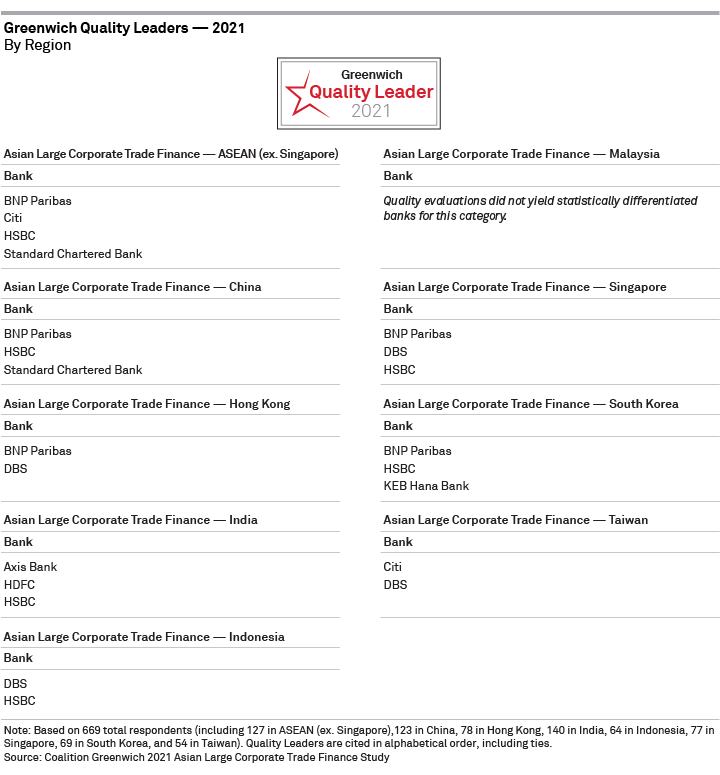

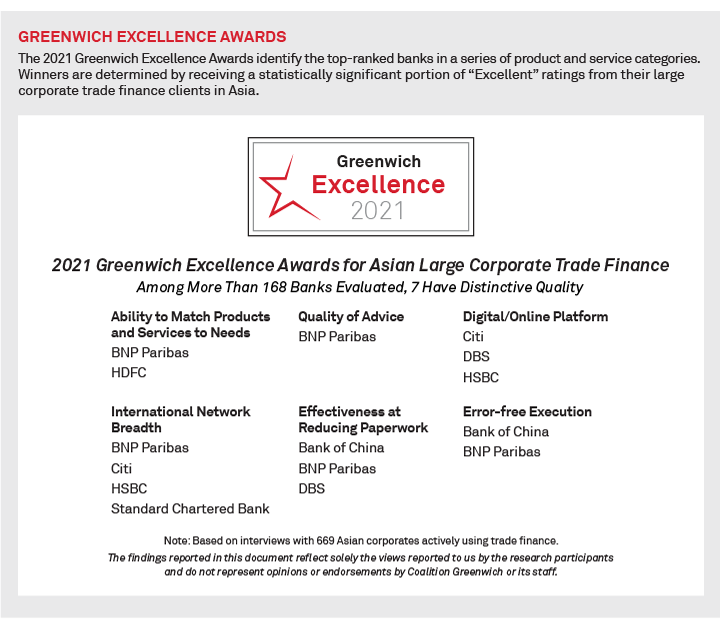

Greenwich Share and Quality Leaders, Excellence Awards

The following tables present the complete list of 2021 Greenwich Share and Quality Leaders across Asia and in individual Asian countries, and the winners of the 2021 Excellence Awards in several important categories.

Coalition Greenwich Head of Asia, Gaurav Arora, and consultant Winston Jin specialize in Asian corporate/transaction banking and treasury services.

MethodologyBetween April and June 2021, Coalition Greenwich conducted 669 interviews with corporates with annual revenues of $500 million or more, across China, Hong Kong, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. Trade finance interview topics included product demand, quality of coverage and capabilities in specific product areas.