Table of Contents

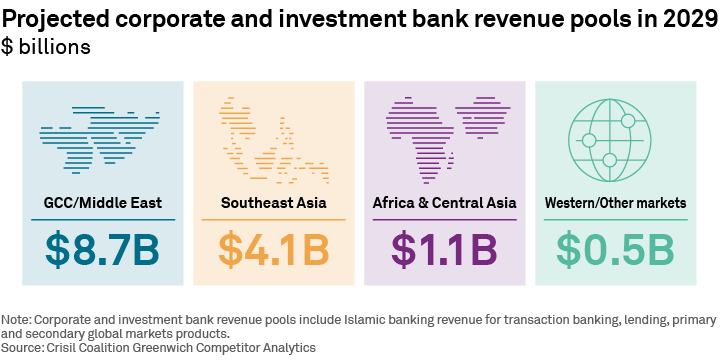

The global Islamic finance industry has exhibited substantial growth, with assets reaching $5.4 trillion as of 2024 and forecasted to expand to $9.75 trillion by 2029, representing a CAGR of 10%. The industry’s geographic landscape is characterised by a significant concentration in Middle Eastern markets, with the Gulf Cooperation Council (GCC) region accounting for roughly 50% of global assets. Southeast Asia, led by Malaysia and Indonesia, constitutes the second-largest market, representing approximately 20% of total assets.

Islamic banking remains the dominant segment, comprising around 70% of total assets, while sukuk and Islamic funds are increasingly contributing to the sector’s growth. Notably, the integration of sustainability principles has emerged as a key trend, aligning Islamic finance with the global sustainable finance movement. Although Africa and Western markets currently hold smaller market shares, they are expanding rapidly and are expected to become significant players in the Islamic finance space, driven by growing demand for Shariah-compliant financial products and services.

GCC: The Middle East powerhouse

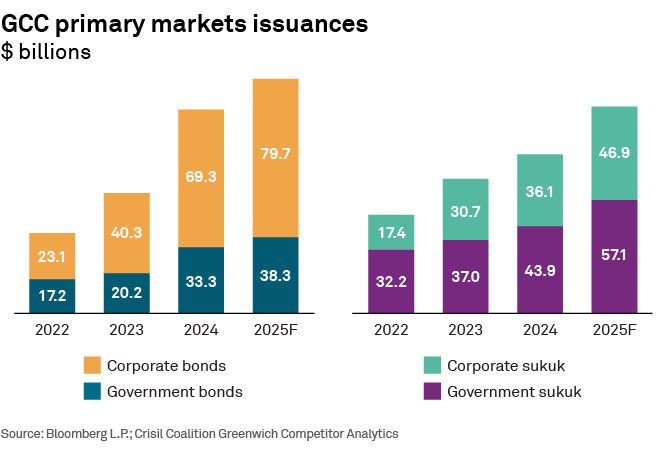

Assets in the GCC are expected to exceed $5 trillion by 2029 (~$2.5–$2.7 trillion in 2024), driven by high oil revenues channelled into Shariah-compliant investments, government initiatives and strategic visions that prioritise Islamic finance (e.g., Saudi Vision 2030) and economic growth in the region. Corporate and investment banks are poised to capitalise on this growth through GCC primary markets issuances.

- Sukuk and capital markets: The GCC region presents a significant opportunity for banks to capitalise on the growing demand for sukuk issuances, with an estimated annual fee ranging from $800 million to $1 billion over the next five years. Recently, Saudi Arabia’s Public Investment Fund issued its second sukuk in 2024 to support projects under its Vision 2030 initiative. Banks are increasingly leveraging their expertise to arrange sukuk issuances for sovereign and corporate clients, including “green sukuk” for environmentally friendly infrastructure and renewable energy projects, which are increasingly attractive to sustainability-focused investors.

- Islamic wealth and asset management: The burgeoning demand for Shariah-compliant investments among high-net-worth individuals and sovereign wealth funds in the GCC creates a compelling opportunity for banks to offer bespoke Islamic wealth management solutions, such as private banking services, funds and structured investments that adhere to Islamic principles. A surge in activity in managing Islamic funds and trusts, creating sukuk investment portfolios, and providing advisory services to family offices on Islamic asset allocation strategies is tapping into this rapidly expanding market.

- Project finance and advisory: Structuring Islamic financing for mega-projects, such as infrastructure, new/modernisation of cities and clean energy initiatives is on the rise across GCC. Banks are building expertise in Islamic project finance and capturing mandates as governments diversify funding sources beyond conventional bonds and more into Shariah-compliant ones.

The GCC’s Islamic finance market is poised for robust growth, with a projected annual expansion of 15–17% over the next four to five years, unlocking new streams for banks.

Southeast Asia: Established innovation hub

Southeast Asia, led by Malaysia and Indonesia, is the second-largest Islamic finance market, with assets projected to reach $3 trillion by 2029 (20%–22% of global Islamic assets). Key opportunities within the region include:

- Sukuk market: Malaysia’s innovative approach to sukuk, including retail and sustainability-compliant green sukuk, has established it as a leader in the global sukuk issuance market. This market is poised to yield over $1.2 billion in revenue over the next five years, fuelled by increasing demand for Shariah-compliant funding for infrastructure and climate-related initiatives.

- Islamic wealth products: There has been a significant increase in the Islamic asset management industry in the region with Malaysia driving the growth through dozens of Islamic unit trusts, Islamic funds and ETFs. By offering customised funds to HNIs and UHNIs who prefer Shariah-compliant investments, investment banks are capitalising on the growing demand for wealth management solutions, with the overall pools growing by approximately 18%.

- Fintech and digital banking: New digital Islamic banks in Malaysia and Indonesia are pioneering Shariah-compliant services, including digital wallets, P2P lending and micro-investment apps. This trend is expected to contribute significantly to the growth of Islamic capital market products, with the sector projected to account for over 25% of the $350 billion global Islamic fintech market. Banks leverage their expertise to advise on and facilitate partnerships between fintech companies and traditional Islamic financial institutions.

- Cross-border deals and green finance: The increasing flow of investments between Southeast Asia and the Middle East presents opportunities for banks to facilitate cross-border Islamic deals. Global banks are bridging the gap between GCC investors and Indonesian project sukuk, as well as facilitating Malaysian banks’ sukuk issuances in Gulf markets. The growing trend of green finance in the region, driven by green sukuk issuances for solar parks and climate projects, presents a significant opportunity for banks with climate finance expertise to capture a substantial share of the $700 million fee market over the next five years.

The natural alignment of Islamic finance and sustainability principles, combined with the region’s focus on sustainable development, positions Southeast Asia for significant growth in Islamic finance and green investments.

Africa: The final frontier

Africa’s Islamic finance industry presents a high-growth opportunity for investment banks, driven by a focus on long-term development and foundational growth, with opportunities to expand and scale across various Islamic financial products.

- Infrastructure funding: The significant $100 billion annual infrastructure funding gap in Africa has created a substantial opportunity for sukuk to emerge as a key financing solution. Countries such as Nigeria, Senegal, Ivory Coast, and South Africa are using sovereign sukuk to fund infrastructure projects, creating revenue streams for banks through underwriting, secondary market transactions and currency hedging.

The African Islamic finance market is projected to generate significant revenue for investment banks, with estimated revenues ranging from $500 million to $600 million over the next five years. Furthermore, the growing demand for green sukuk and sustainability-related initiatives is expected to contribute an additional $80 million to $100 million in revenue, driven by an increasing focus on sustainable development and environmental considerations.

- Banking and takaful expansion: As the African Islamic finance sector matures, banks are looking to capitalise on opportunities to provide capital-raising services, M&A advisory and investment management for Islamic banks and takaful (Islamic insurance) providers. Although current revenue from African banking deals is limited, early engagement has paved the way for larger future opportunities for investment banks as these institutions expand. With a baseline annual growth rate of 15% to 20%, the projected industry revenue pools stand at a staggering $220 million to $250 million over the next five years.

These established markets offer a unique opportunity for banks to drive significant revenue growth, thanks to their large market size and immediate potential for returns. In Africa and Central Asia, the emphasis is on “market development”—securing early mandates and helping shape the frameworks, which will translate into an outsized influence as these frontiers expand and grow.

In recent years, the investor base for Islamic finance assets has undergone a significant expansion, extending far beyond its traditional roots in the Gulf and Southeast Asia. Today, international investors, including major institutional accounts, are driving growth in demand for Islamic finance assets. The issuance of dollar-denominated sukuk has played a key role in this trend, effectively opening-up Islamic finance to a global audience. As a result, this field has evolved from a regional niche to a mainstream global asset class, attracting significant capital from investors worldwide and competing successfully for a share of the global investment market.

Crisil Coalition Greenwich Competitor Analytics team members Bhavya Ahuja and Aamir Hazaria are co-authors of this report.