Table of Contents

2016 Greenwich Leaders: European Corporate Banking and Cash Management

BNP Paribas strengthened its already market-leading position in European corporate banking last year in part by picking up new clients in cash management—a business that usually experiences a low level of change of provider—is experiencing a bout of nearly unprecedented volatility due to the retrenchment and exit of some major providers.

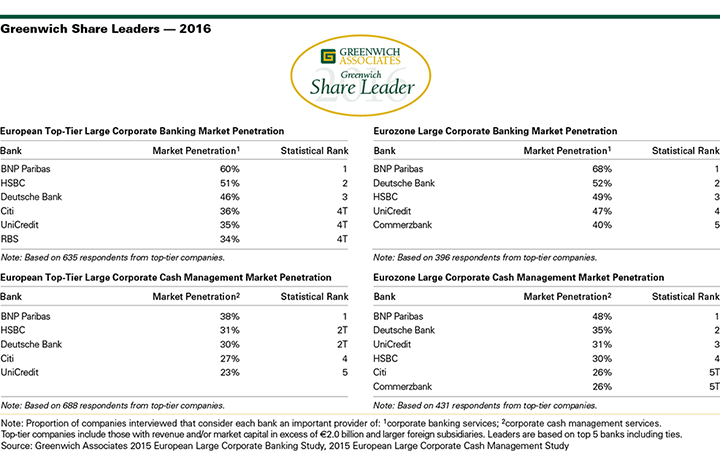

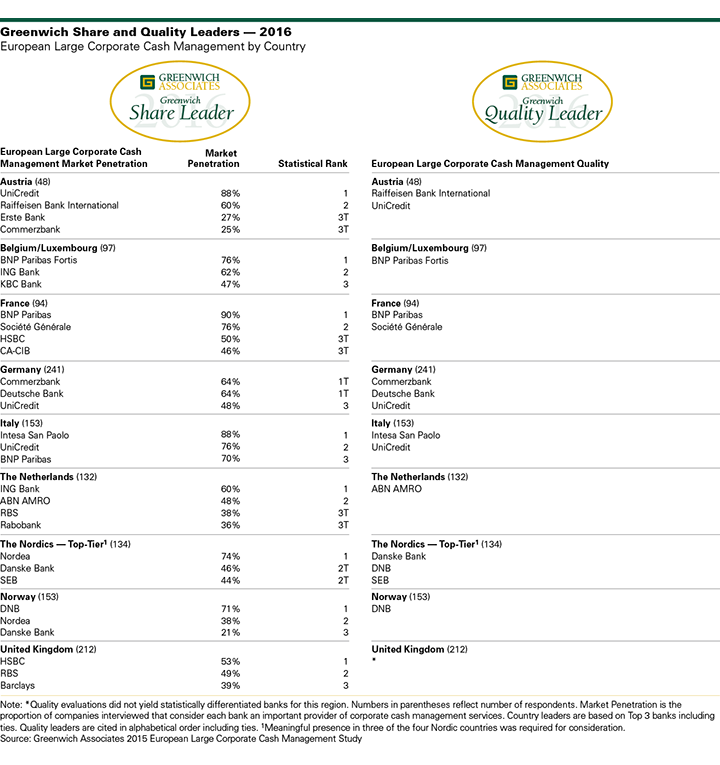

Sixty percent of large European companies with at least EUR 2bn in turnover use BNP Paribas for corporate banking and 38% use the bank for cash management, according to the results of the Greenwich Associates 2015 European Large Corporate Banking and Large Corporate Cash Management Studies. Those results place BNP Paribas comfortably ahead of competitors in both businesses.

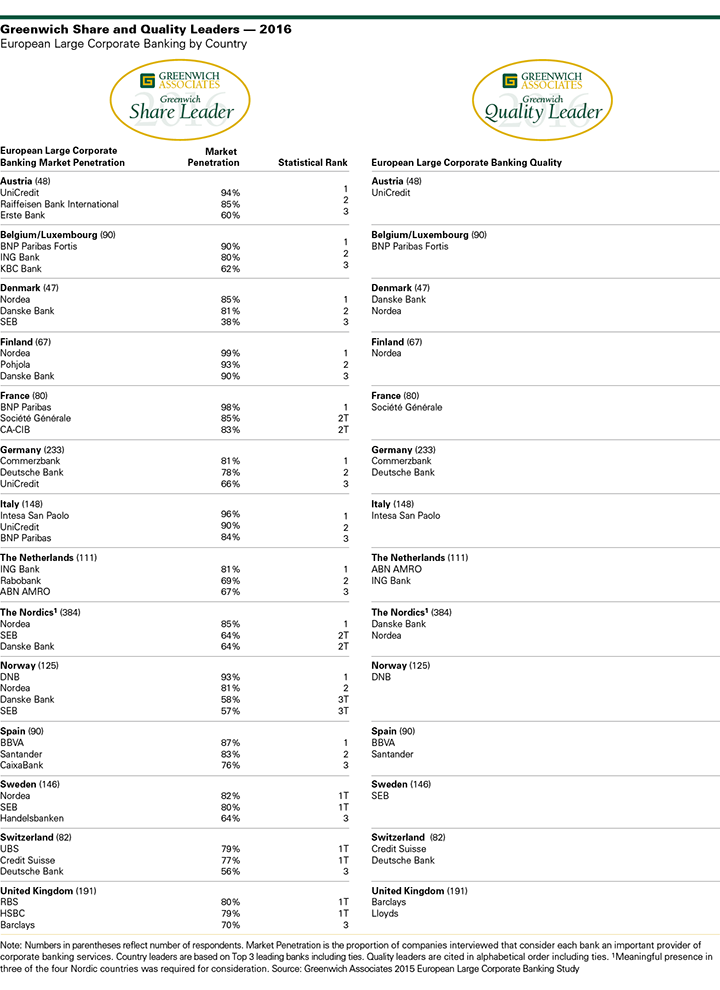

In corporate banking, HSBC ranks second behind BNP Paribas with a market penetration score of 51%, followed by Deutsche Bank at 46% and the trio of Citi, UniCredit and RBS. These banks are the 2016 Greenwich Share Leaders in European Top-Tier Large Corporate Banking.

In large corporate cash management, HSBC and Deutsche Bank tie for second place behind BNP Paribas, with market penetration scores of 30%-31%, followed by Citi at 27% and UniCredit at 23%. These banks are the 2016 Greenwich Share Leaders in European Top-Tier Large Corporate Cash Management.

The 2016 Greenwich Quality Leaders in European Top-Tier Large Corporate Banking are BNP Paribas, Citi, Deutsche Bank and UniCredit. Driven by strong performance in their three western European home markets, two of which are among the five largest economies in Europe, UniCredit also claims the title of 2016 Greenwich Quality Leader in in Top-Tier Large Corporate Cash Management.

Cash/Liquidity Management Become Top Priorities

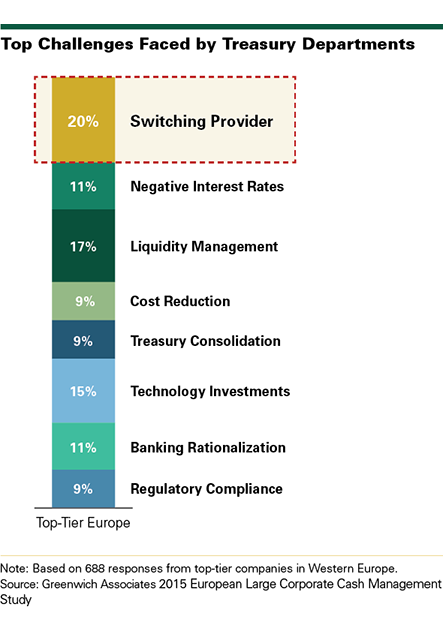

It’s no accident that the leader in European corporate banking is showing strength in cash management. Cash and liquidity management rank by far as the top concerns of corporate treasury departments participating in the Greenwich Associates 2015 study. Two factors have elevated cash and liquidity management to top priority:

1. With the European Central Bank and central banks of a number of non-Euro countries pushing interest rates to negative levels, the question of how to allocate cash reserves has become a critical issue for European companies. Given that many companies are relatively cash rich following an extended period of low interest rates and favorable credit conditions while investment opportunities are looked at with increasing caution, cash and liquidity management will remain a leading priority in the year ahead. In Denmark, 60% of treasury professionals cite negative interest rates as a top concern for 2016.

2. The exit of RBS from transaction services outside of the United Kingdom and pull-backs by other leading banks are causing disruption in the usually staid corporate cash management business. Because switching costs associated with changing a corporate cash management platform are so onerous, turnover rates among providers traditionally are extremely low. But amid the volatility caused by shifts in bank business strategies, an impressive 20% of European corporate treasury departments name “switching cash management providers” as the top challenge they face in 2016.

“Banks that can help large companies successfully navigate unprecedented challenges like negative interest rates and the need to unexpectedly switch cash management providers are differentiating themselves from competitors and winning new clients,” says Greenwich Associates consultant Dr. Tobias Miarka. “But in some ways this represents a new challenge for banks, since it’s difficult to make money while providing this level of service in a low-margin business like cash and liquidity management.”

Shifting Competitive Landscape

For BNP Paribas and other banks that are picking up cash management business from retrenching rivals, the challenge for the next two years will be integrating these new clients and retaining their business.

For many other banks, meeting large European companies’ growing international need for corporate banking and cash management service will represent a primary challenge going forward. “Regional banks in Europe are trying to expand their international capabilities in step with the growing international businesses of their large corporate clients,” says Greenwich Associates consultant Robert Statius-Muller. “But given the level of investment required, they are struggling to keep pace with global banks like Citi and HSBC that make international reach a centerpiece of their business offerings.”

Consultants Dr. Tobias Miarka, Robert Statius-Muller and Melanie Casalis specialize in corporate and investment banking in Europe.

The findings reported in this document reflect solely the views reported to Greenwich Associates by the research participants. They do not represent opinions or endorsements by Greenwich Associates or its staff. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results.

© 2016 Greenwich Associates, LLC. All rights reserved. Javelin Strategy &Research is a subsidiary of Greenwich Associates. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise,to external parties or publicly without the permission of Greenwich Associates,LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, Greenwich ACCESS™, and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promotional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.

MethodologyGreenwich Associates conducted 2,585 interviews with financial officers (e.g., CFOs, finance directors and treasurers) at corporations and financial institutions with sales in excess of €500 million, including 1,122 with sales of at least €2 billion.

Interviews were conducted throughout Austria, Belgium, Denmark, Finland, France, Germany, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom. Interviews took place from August through November 2015.

Subjects covered included bank credit capabilities, domestic and cross-border advisory capabilities and equity underwriting capabilities. Cash management and debt capital markets capabilities were examined in separate interviews with corporate treasurers.