U.S. companies are being solicited by a growing group of domestic and foreign banks hungry for profitable corporate banking relationships. That gives companies significant purchasing power when negotiating terms on credit and for fees for cash management and other essential banking services. Companies should be pressing their banks for value-added advice and ideas about how to address the big challenges facing their businesses.

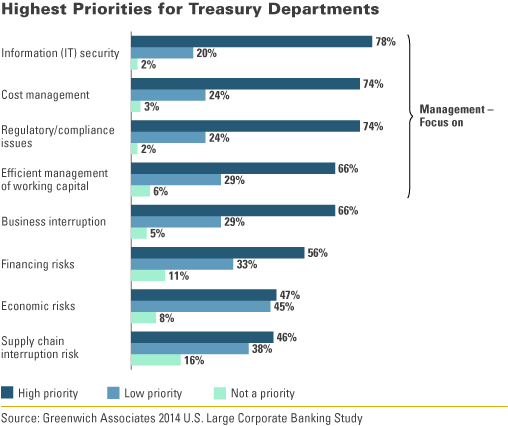

The chart below shows the issues ranked as top priority by treasurers of the large companies (annual revenues of at least $2 billion) participating in Greenwich Associates’ 2014 U.S. Corporate Banking Study.

The Bottom Line

- Treasurers today are worried about broad, complicated issues like IT security, managing costs, regulations and compliance, and how to more efficiently manage their working capital.

- In today’s hyper-competitive market, banks are looking for any edge over their rivals. To that end, many banks are working to provide advisory assistance to companies on a range of critical issues—including many on the list of treasurers’ top priorities.

- But when it comes to actually delivering on advisory services, some banks lack the capabilities to provide good ideas and advice altogether. Others have not developed the coverage models required to marshal needed expertise and resources.

There are banks willing and able to provide real help in addressing the big challenges facing your businesses. If your current providers aren’t stepping up with value-added advice and ideas, press them to do so, or take advantage of the buyer’s market in corporate banking to find someone who will.