In 2022, inflation, rising interest rates and other macroeconomic headwinds replaced pandemic disruptions as the key challenges facing institutional investors in Japanese equity markets.

Many...

Transaction Banking Revenues reached a decade high in FY22, driven by robust growth in Cash Management, while Trade Finance grew moderately. The second half performed better than first half,...

Despite economic headwinds around the world, large companies in the Middle East and North Africa remain extremely positive in their outlook, with attention and resources focused on expanding and...

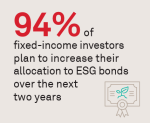

Environmental, Social and Governance (ESG) is one of the more ubiquitous topics in asset management, yet inconsistencies around taxonomies, data and regulation impact the investment process....

Reduced commission rates, constrained budgets and smaller team sizes have left both asset managers and brokers facing greater pressure to automate their trading workflows and accomplish more with...

Japanese institutions are embarking on an ambitious plan to remake their investment portfolios by significantly expanding allocations to alternative asset classes. That transformation is...

Securities Services Index Revenues grew moderately in FY22 with higher Net Interest Income partially offset by decline in Fees owing to lower market asset valuations. Following three consecutive...

Data observations from Greenwich Commercial Loan Analytics (GCLA) clients show that:

U.S. banks tightened credit standards on C&I and CRE loans in Q4 2022

Rapid increases in total loan...

Institutional investors and asset managers in 2023 are facing a host of challenges and changes in a market that is evolving rapidly. In this report, Coalition Greenwich examines the top trends...

So many institutions are using alternative data (alt data) today—data not traditionally used for investing—that the label is increasingly a misnomer. In fact, 44% of institutional asset managers...