It has been over a year since MiFID II shook up the European equity trading landscape. Traders have been adjusting to a slew of new regulations, including unbundled execution, double volume caps for dark-pool trading, a new Systematic Internaliser (SI) regime, pre- and post-trade transparency requirements, and more stringent best-execution standards.

The new European regulations were designed to reduce conflicts of interest and deliver better outcomes for end investors. Through unbundling, investment firms can focus purely on execution performance when selecting brokers and not be tied to trading with those firms that provide research. The elimination of broker crossing networks (BCNs) and the new SI regime were designed to provide investors with more clarity about when they are interacting with broker principal liquidity. And the caps on dark pool trading were designed to improve transparency and price discovery.

As a result of these changes, the European equity trading landscape today looks very different than it did two years ago. Traders have adjusted their workflows, brokers have repositioned their offerings, and execution venues have redesigned their product offerings. The results may not be exactly what regulators had imagined, but the market overall has adapted well. It may be too soon to measure whether the anticipated cost benefits have accrued to asset owners, but we can now explore how the trading landscape has evolved, how execution preferences have changed, and get a glimpse at who the winners and losers are in this new trading world order.

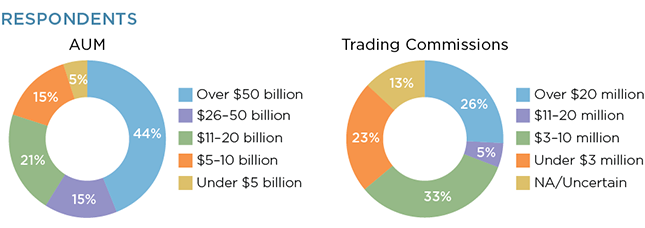

MethodologyBetween May and October 2018, Greenwich Associates interviewed 39 buy-side equity traders in Europe. Topics included trading-desk budget allocations, trader staffing levels, OMS/EMS/TCA platform usage, and the impact of market structure changes on the sector.