The role e-trading plays is best understood by looking closely at a specific case: the convertible bond market.

The convertible bond market is to the credit markets what the credit markets are to the securities markets generally: a sophisticated instrument with idiosyncratic liquidity challenges. In other words, the convertible bond market is the bond markets' bond market.

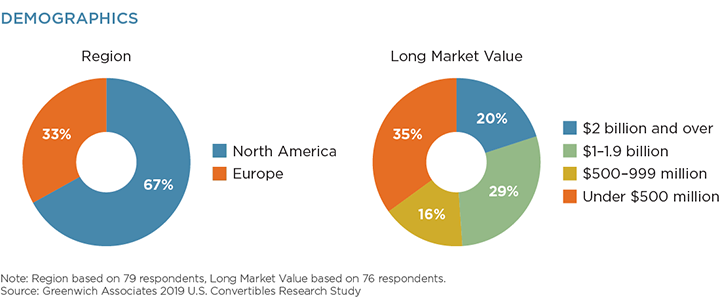

MethodologyBetween April and August 2019, Greenwich Associates interviewed 79 investors at funds domiciled in North America and Europe that trade U.S. convertible bonds. Respondents were asked a series of questions about their activity in the U.S. convertibles market, including proportion of volume executed by broker, primary convertibles investment strategy, proportion of convertibles volume executed via multidealer platform, as well as key factors that are most important to the trader when deciding which broker to engage.

In addition, senior analysts from Greenwich Associates worked with data provided by Tradeweb, a multidealer platform operating an RFQ market for convertible bonds, in order to understand the nature of activity present in the electronic market.