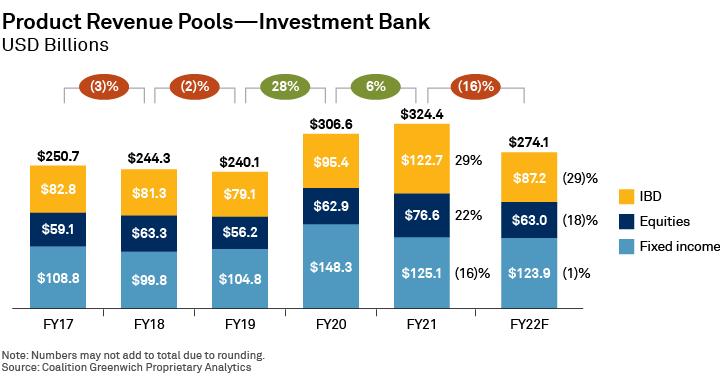

Industry-wide revenue pools increased 6% year over year in fiscal year 2021, albeit via different leading and lagging business lines from the year before. Growth in equity capital markets (ECM) products, led by the special purpose acquisition company (SPAC) boom, heightened merger and acquisition (M&A) activity, and the improved performance in equities and spread financing products contributed to the surge in revenues in FY21, compared to the volatility-driven, macro-products-led growth of FY20. Macro product revenues, including fixed income, currencies and commodities (FICC), normalized in FY21, from a high base of FY20, and were mostly flat versus the pre-pandemic FY19 levels.

However, with volatility surging again in FY22, owing to the Russia-Ukraine war and rising rates, the revenue mix is likely to change further, as evident in the rebound in macro products and decline in M&A announcements in 1Q22. But more on that later.

ECM, M&A and Equities: The Star Performers of FY21

Investment banking revenue growth in FY21 came largely from ECM and M&As. Investment banking division (IBD) revenues touched a decade high, due, in part, to the volume of M&A deal completions and equity underwriting activity.

Equities revenues, too, increased 22%, excluding the $10 billion drag caused by the Archegos Capital Management collapse. Including the Archegos hit, they were still up 5%. Strikingly, the meme stocks boom, which began in 1Q21, had such a positive impact on both cash equities and structured derivatives volumes at the institutional level that, for the first time in a decade, the U.S. retail structured product market exceeded the European market in size. Cash equities gained about 10%, whereas exotic derivatives boomed by almost 90%. But flow derivatives, which mainly benefit from volatility, were down.

Meanwhile, a challenging trading environment in rates, normalization in credit, and muted activity in currencies and emerging markets (EM) pulled down fixed-income revenues in FY21. However, high liquidity in the system was directed into less-liquid credit, such as warehousing finance and securitization instruments, including as collateralized loan obligations (CLOs). Lower funding charges also contributed to the boom in these spread financing products.

1QFY22—A Portent of Things to Come?

The tide may be turning, though, as the return of volatility means that FY22 is looking like a repeat of FY20. Trading-side spread products that grew in FY21, such as agency residential mortgage-backed securities (RMBS) and high-yield credit, are down 30–50% in 1Q22. Warehousing finance remains robust, however, indicating there is still ample opportunity for connecting investors and issuers.

Also, while volatility has hit the exotic end of rates, resulting in losses at some banks, vanilla or lightly structured options have done relatively well in 1Q22. More crucially, the surge in foreign-exchange (FX) trading volumes, along with improved margins and spreads, means that most G10 and EM FX dealers are up 20–50% in 1Q22. Plus, revenues from energy-related commodities products are up about 30% in the first quarter of the current year.

In ECM, with IPO volumes dropping off, most dealer revenues are down more than 80% in 1QFY22, reverting to pre-COVID levels. And, while M&A revenues increased 15–30% in 1Q22 due to deal completions announced in 2H21, deal announcements so far this year are down 30–50%. Hence, the second and third quarters in FY22 may see a pause in M&A revenues, although this will depend on the war, investor confidence levels and a possible boost in investments in defense, energy security, and environmental, social and governance (ESG) themes.

As for debt capital markets (DCM) products, despite the rising rates, revenues are likely to remain relatively robust, since money is still quite cheap historically (at least at the writing of the research) and refinancing needs are plentiful.

The Productivity Challenge

Going forward, investment banks will be challenged to sustain the productivity gains made over the past three years, when head counts were relatively flat on the back of investments in technology platforms. The exodus of talent to the buy side over the past 12–18 months has resulted in a hiring spree. While on the IBD side, it seems unlikely that revenues will keep pace with the increase in head count over FY21.

Looking Ahead

The revenue mix has clearly shifted in 1Q22. Macro products have done better as spreads have cooled off, replacing some of the earlier revenue streams. Within equities, prime services have been relatively robust compared to exotic derivatives.

Given rising rates and the war, will investment banks achieve a managed landing? Or will it be a hard landing with a stagflationary environment. Coalition Greenwich estimates that IB revenues in 2022 will be 10–15% lower than in FY21. While spreads and IBD are facing a hard-landing scenario, equities seem to have switched to a managed landing mode, with index values still high and not much asset allocation away from them.

Hence, macro-weighted banks, such as the British and European ones, are likely to fare better than those that are focused on spread, M&As and equities. For banks that have a balanced portfolio across products, revenues may be down 5–10%.

Kevin McPartland is the Head of Research for Market Structure and Technology and Michael Turner is the Head of Competitor Analytics at Coalition Greenwich.

MethodologyCoalition Greenwich analyzes public, private and proprietary data to calculate individual banks and business line performance, which is benchmarked against the Coalition Greenwich standard product taxonomy. Adjustments are made to publically reported revenue by each bank based on Coalition Greenwich research and analysis.