The recent market turmoil will only increase the importance of TCA in both the short and long term. To be able to discern actionable information from the tidal wave of data that is now before practitioners will go a long way toward establishing winners and losers in this unprecedented time.

Over the last 30 years, transaction cost analysis (TCA) in equities has evolved from a niche practice to mainstream adoption. In Europe, 2018 was the year that TCA became a regulatory requirement (under MiFID II); 2020 will be that year for the United States.

As of January 1, 2020, brokers are required to collect more detailed information on how they route investors’ orders.1 Therefore, all institutional investors will now be able to get access to more detailed information about how and why brokers route their orders.2

This will drastically change the market for TCA, and our data indicates this is already having an effect in the market. Many investment firms will view relying on quarterly reports provided by brokers as a minimum requirement. Most will require brokers to provide the Rule 606(b)(3) not-held order-routing information—something we will discuss in detail later in this Greenwich Report. To comply with this rule, brokers may need to implement their own systems to improve their best execution practices. In addition, many smaller brokers will be required to enhance their TCA systems. This represents a golden opportunity for vendors who now have a more captive market to sell into, and those with the strongest product market fit will reap the benefits.

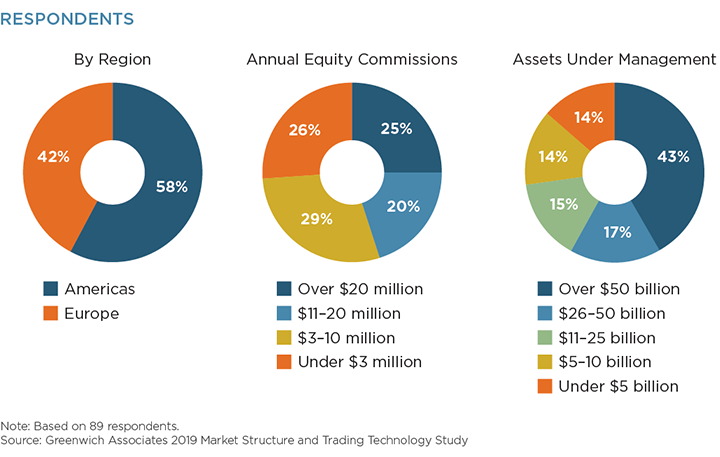

MethodologyBetween July and September 2019, Greenwich Associates interviewed 89 equity traders in the Americas and Europe. Respondents were asked a series of questions concerning their usage of transaction cost analysis (TCA) tools.