According to the results of a recent study by Greenwich Associates, the majority of equity investors utilize transaction cost analysis (TCA), with high-volume equity trading desks being the biggest users, at 90%.

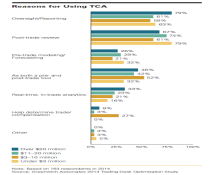

Roughly two-thirds of investors have consistently used TCA for oversight/reporting and post-trade reviews to measure trading effectiveness and idientify outliers. But as the equity environment changes, the buy side's focus on leveraging TCA for alpha generation will only increase.

MethodologyBetween August and September 2014, Greenwich Associates interviewed 199 buy-side traders across the globe working on equity trading desks to learn more about trading desk budget allocations, trader staffing levels, OMS, EMS, and TCA platform usage.