We are now over two years into the great MiFID II Trading Transformation.1 The dust has settled, and we are able to take a measured look at how traders are adapting to this new market structure landscape.

Aside from the unbundling of trading and research, MiFID II brought in sweeping changes concerning how investment firms and brokers were able to execute orders. Broker crossing networks (BCNs), which aggregated internal proprietary flow with client orders, were abolished due to concerns around lack of transparency and that institutional investors were potentially being disadvantaged. The systematic internaliser (SI) regime was enhanced to provide a clear framework for investment firms to interact with market-maker and proprietary flow.

European regulators were also concerned that too much trading was being executed away from lit markets, harming price discovery. To counter this, the Reference Price Waiver (whereby dark pools would execute trades at prices derived from the lit market) was restricted via volume caps. However the Large-in-Scale (LIS) waiver, which permits dark trading for orders above a certain size threshold, remained in place.

In this Greenwich Report, we assess European traders’ opinions on these changes and discuss where the regulators may take this in the future.2 Of course, these results were gathered prior to the recent turmoil and disruption of the markets as a result of the COVID-19 crisis and should be considered as such.

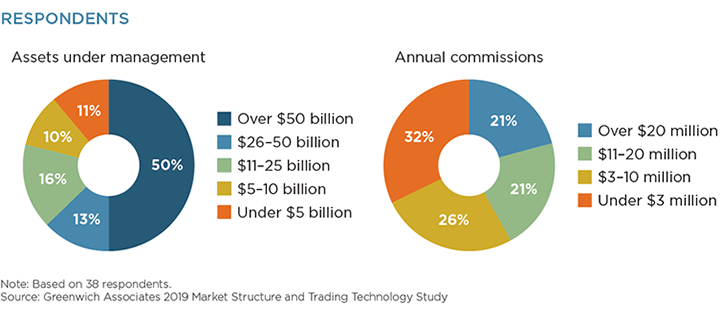

MethodologyBetween July and September 2019, Greenwich Associates interviewed 38 European equity traders. Respondents were asked a series of questions regarding equity market structure.