When the U.K. Stamp Act was imposed in 1694, and from time to time since then, there have been sporadic discussions around imposing financial transaction taxes in various markets around the world. Not surprisingly, especially in an election year, the question of enacting a financial transaction tax (FTT) in the United States has again come to the fore.

In a purely theoretical sense, the lure of an FTT seems seductive—by adding a small charge to financial transactions, the government can pay for a bevy of potential programs. Some may point to the costs of healthcare reform, others to the recent massive government stimulus for COVID relief. In the proponents' view, the FTT should not cause any harm, and the tax revenue could be used to implement a world of good.

However, in reviewing the history, research and the results from our own study of market participants, it is clear that imposing an FTT on the U.S. markets is likely to have far-reaching negative consequences. Moreover, the history of these taxes around the world proves that they do not generate the anticipated windfall - and, in fact, tend to do more harm than good.

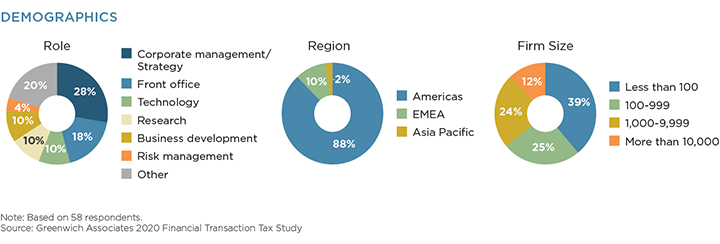

MethodologyIn January and February 2020, Greenwich Associates interviewed 58 market professionals regarding their views on the effect of the imposition of a financial transaction tax. The respondents included, among others, retail brokers, wealth managers, institutional asset managers, regulators, banks, hedge funds, institutional broker-dealers, and consultants, primarily from the U.S., but also EMEA and APAC.