Anyone operating in the U.S. equity market knows it is challenging times. The continued pressure on commissions remains the main story for the buy side, sell side and technology providers operating in the space. Recent bouts of volatility and the approval of IEX’s exchange application are likely to force a refocus on the use of algo-driven routing logic to help navigate an increasingly complex market structure.

With the total U.S. equity commission pool down over 30% from its peak during the financial crisis, our latest research reveals the current commission pool levels and examines how the balance of high-touch trading, algorithmic trading/SOR and crossing networks volume is poised for change.

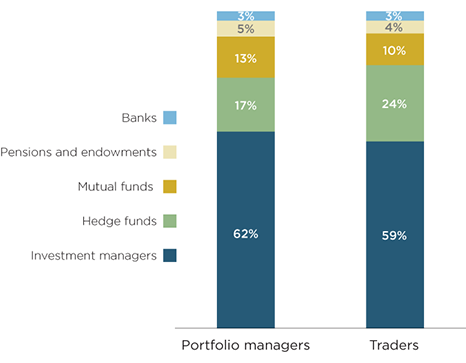

MethodologyGreenwich Associates conducted in-person and telephone interviews regarding U.S. equity investing with 223 U.S. equity portfolio managers and 321 U.S. equity traders between November 2015 and February 2016. Respondents answered a series of qualitative and quantitative questions about the brokers they use and their businesses in the U.S. cash equity space.