Table of Contents

After seeing declines in the volume of structured products distributed to retail and high-net-worth individuals last year, volumes in 2018 increased to just over $48 billion (annualized). This growth was driven by an uptick in structured products based on equity underlyings, which grew more than enough to offset declines in products with FICC underlyings. Distributors are continuing to reach out proactively to issuers for product, as 29% of all volume is based on reverse inquiries (versus 20% just two years ago).

Other key highlights from the research findings:

- Distributors are seeing a move toward fee-based accounts. Over the past year, 24% of structured products were sold into fee-based accounts, up from 19% a year ago.

- Distributors are recognizing the costs of issuers’ sales teams. Just a year ago, two-thirds of distributors preferred to be covered by both structured products generalists, as well as a team of specialists within each asset class. This figure has dropped to 51% this year.

- Distributors want their issuers to “focus on the basics.” Innovation ranks fifth as a key selection criterion as to how they select their issuers, behind the competitiveness of an issuer’s pricing, the expertise of their sales team, their creditworthiness, or the sales team’s ability to understand distributors’ needs and objectives.

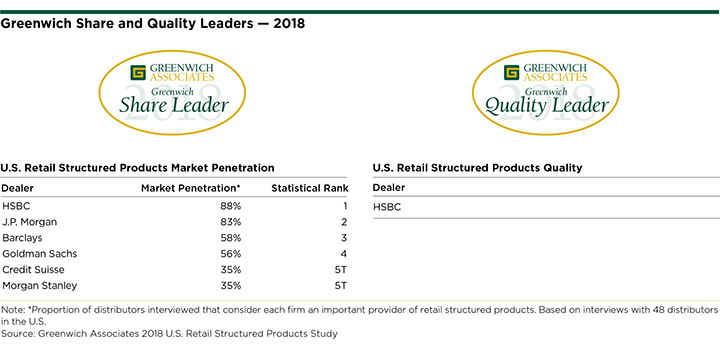

Greenwich Share and Quality Leaders

The competitive landscape in U.S. retail structured products continues to be dominated by two issuers—HSBC and J.P. Morgan—which have a significant lead over the competition.

HSBC tops the list of 2018 Greenwich Share Leaders℠ in U.S. Retail Structured Products, followed by J.P. Morgan, Barclays and Goldman Sachs, the latter of which increased its footprint meaningfully year-over-year. Credit Suisse and Morgan Stanley round out the top five.

HSBC has once again maintained the extremely high level of service it provides to clients and, as a result, the bank earns the title of 2018 Greenwich Quality Leader℠ in U.S. Retail Structured Products.

Consultant David Stryker advises on the retail structured products and fixed-income markets.

MethodologyBetween April and June 2018, Greenwich Associates conducted telephone interviews with 48 distributors of retail structured products in the United States to better understand product demand, distributor preferences and the competitive landscape. Respondents were asked to name the firms they use for retail structured products and to rate those providers in a series of product and service quality categories. Quality Leaders have distinguished themselves from their competitors by receiving service quality ratings that exceed those of competitors by a statistically significant margin.