After nearly a decade of disruption and uncertainty, buy-side trading desks are finally finding a new equilibrium. Continued change is inevitable, of course, even with the next catalyst unclear. But with long-held beliefs finally changing about how trading should work, what type of people are best suited for the job and the role that technology should play, asset management and hedge-fund head traders are finally ready to move forward with a new belief system.

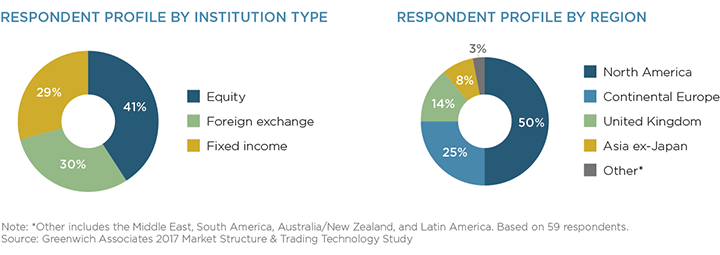

MethodologyFrom June through November 2017, Greenwich Associates interviewed 270 buy-side traders across the globe working on equity, fixed-income or foreign-exchange trading desks to learn more about trading desk budget allocations, trader staffing levels, OMS/EMS/TCA platform usage, and the impact of market structure changes on the sector.