Equity market structure remains one of the most important topics in finance. The U.S. capital markets are the largest in the world, and the industry must continue to focus on areas where improvements can be made to reflect the evolution of technology and the changing dynamics of the economy.

Last year, as part of our annual Market Structure and Trading Technology Study, we sought to capture the views of the buy side on a wide range of equity market structure issues. As longer-term investors, institutional asset managers often have points of view that are very different from brokers, exchanges and market makers. One year on, we decided to repeat the study. Many of the topics are still front and center for equity investors, such as the Tick Size Pilot Program, while other topics, including access fees and the Order Protection Rule, have moved into focus.

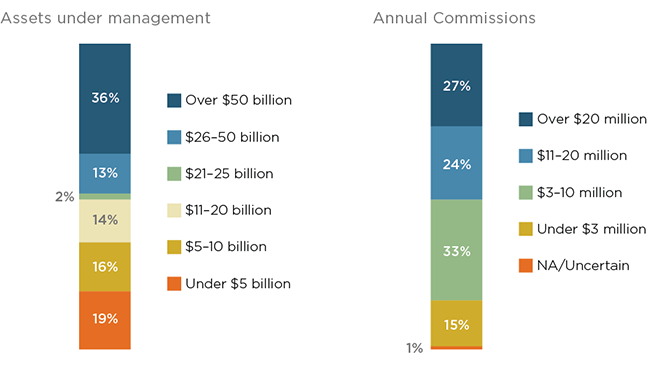

MethodologyFrom June through September 2017, Greenwich Associates interviewed 52 buy-side equity traders in the U.S. to learn more about trading desk budget allocations, trader staffing levels, OMS/EMS/TCA platform usage, and the impact of market structure changes on the sector.