Table of Contents

Japan’s large equity brokers are building on recent impressive gains among domestic institutions by capturing considerable market share with foreign investors active in Japanese equities.

For the second year in a row, Japan’s domestic brokers grew their share of the country’s equity research/advisory business at the expense of their foreign competitors. Timing played an important role in this shift in the competitive landscape as several domestic brokers made significant investment in equities at the same time that a number of foreign brokers cut back. After an extended period of weak market performance and anemic flows in institutional trading volume and commission revenues, global banks had started to scale back their Japanese equity operations by 2012–2013. Meanwhile, several large Japanese banks were placing big bets by making sizable investments in their own equity research and trading platforms. At the same time the new Prime Minister Shino Abe launched the economic stimulus program that has come to be known as “Abenomics,”which then sparked a resurgence in the Japanese stock market.

The results of these events became evident a year ago, when the leading Japanese brokers all increased market share to varying degrees while foreign firms lost ground. Over that period, most of the domestic brokers’ gains came from market share won from domestic Japanese clients. “In 2014, we entered phase two,” says Greenwich Associates consultant John Feng. “While the top Japanese firms continue to do well with domestic clients, most of the gains over the past 12 months have come from foreign and offshore institutions that generate the majority of the market’s trading commissions and have traditionally been the stronghold of non-Japanese brokers.”

Nomura Securities, Daiwa Securities and Mitsubishi UFJ Morgan Stanley Securities all picked up commissionweighted research/advisory vote share to varying degrees over the past year. However, the biggest gainers over the past two years were Mizuho Securities and SMBC Nikko Securities, both of which were making significant investments in their equity franchises just before the extraordinary run in the Japanese market in 2013.

“Of course, economic growth and market performance do not follow a linear path, and it remains to be seen how things will play out for the Japanese market and the major brokers in 2015,” says Greenwich Associates consultant Tomio Sumiyoshi.

Greenwich Leaders

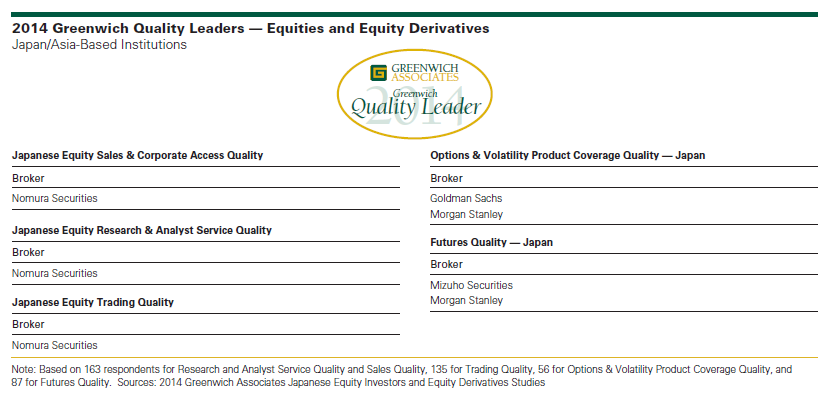

The results of the 2014 Greenwich Associates Japanese Equity Investors Study with Asia/Pacific-based institutions reflect the considerable gains made by domestic Japanese firms. Nomura remains far and away the leader in Japanese equity brokerage, not only in terms of share but also in quality. Extending its strong showing over many years, Nomura is the 2014 Greenwich Leader in Japanese Equity Research & Analyst Service Quality, Sales and Corporate Access Quality, and Trading Quality.

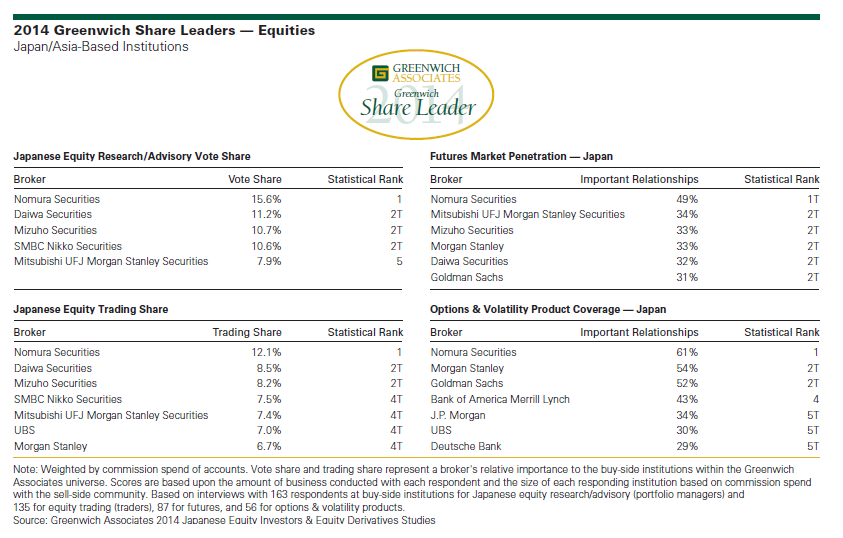

With a 15.6% commission-weighted share of the vote by which institutions allocate commissions to providers, Nomura Securities is the clear leader in research/ advisory services. In a three-way tie for the second spot, Daiwa Securities, traditionally a Top 2 player, is joined by up-and-comers Mizuho Securities and SMBC Nikko Securities—all with vote shares of 10.6–11.2%. Rounding out the Top 5 Greenwich Share Leaders in Japanese Equity Research/Advisory Services is Mitsubishi UFJ Morgan Stanley Securities at 7.9%.

Brokers’ positioning in research and advisory services is a key determinant of overall performance because institutions allocate 60% of their Japanese equity commission payments to compensate the sell side for such services. The power of research as a driver of trading volumes is demonstrated by the fact that all five of the top providers of research and advisory services also appear among the leaders in Japanese equity trading. “However, it is important to note that domestic Japanese firms have not won as much ground in trading as they have in research,” says Greenwich Associates consultant Taeko Sumiyoshi.

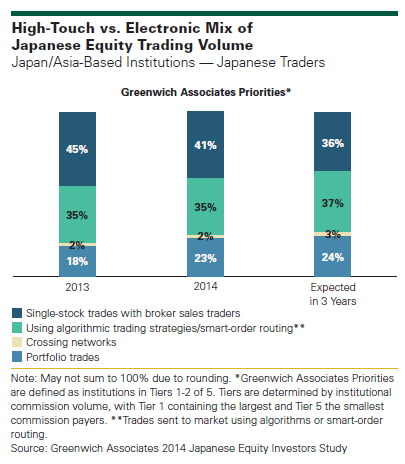

Foreign brokers have been able to better defend their market share in trading for one main reason: In one of the world’s most electronic marketplaces, foreign firms still have the upper hand in e-trading competition. As the accompanying chart shows, only 41% of institutional trading volume in Japanese equities is executed via traditional “high-touch” single-stock trades with broker sales traders. The majority of trading volume is executed electronically via algorithmic trading strategies, smart-order routing, crossing networks, or portfolio trades. “In the competition for trading volume, global brokers like UBS garner a considerable advantage from their well-established e-trading platforms,” says John Feng.

Despite this e-trading differential, the top three brokers in trading are all leading domestic firms. Nomura Securities is the 2014 Greenwich Share Leader in Japanese Equity Trading among Asia/Pacific-based institutions with a 12.1% trading share, followed by Daiwa Securities and Mizuho Securities, which are tied with shares of 8.2–8.5%. Deadlocked, the next four firms include two Japanese brokers, SMBC Nikko Securities and Mitsubishi UFJ Morgan Stanley Securities, and two foreign firms, UBS and Morgan Stanley. These brokers are tightly grouped with trading shares of 6.7–7.5%.

Options and Volatility Products

Most trading volume in Japanese equity options is generated by foreign and offshore accounts, including hedge funds. With domestic Japanese institutions accounting for no more than 20% of this business, foreign brokers are in a strong position to leverage their extensive infrastructures and existing global relationships to capture options trading volumes. In fact, only one homegrown Japanese firm appears in the top tier of brokers in this business.

Approximately six out of 10 institutions active in Japanese options and volatility products use Nomura Securities as an important broker. Next up are Morgan Stanley and Goldman Sachs, which are tied with market penetration scores of 52–54%, followed by Bank of America Merrill Lynch at 43% and the trio of J.P. Morgan, UBS and Deutsche Bank, which are statistically tied at 29–34%. These firms are the 2014 Greenwich Share Leaders in Japanese Equity Options and Volatility Product Coverage. The 2014 Greenwich Quality Leaders in Japanese Equity Options and Volatility Product Coverage are Goldman Sachs and Morgan Stanley.

Futures

Institutional investors tend to concentrate their futures trading business with a relatively small number of brokers. As a result, trading relationships are precious and brokers that win them capture a significant share of any given institution’s trading volumes. With a market penetration score of 49%, Nomura Securities is once again the clear leader in this market, followed by a tight group of five brokers—Mitsubishi UFJ Morgan Stanley Securities, Mizuho Securities, Morgan Stanley, Daiwa Securities, and Goldman Sachs—which are tied with market penetration scores of 31–34%. These firms are the 2014 Greenwich Share Leaders in Japanese Equity Futures. The 2014 Greenwich Quality Leaders in Japanese Equity Futures are Mizuho Securities and Morgan Stanley.

Consultants John Feng, Tomio Sumiyoshi and Taeko Sumiyoshi advise on the Japanese institutional equity market.

MethodologyGreenwich Associates conducted interviews with 163 equity portfolio managers, 135 equity traders and 118 equity derivatives users across domestic Japanese institutions, foreign subsidiaries in Japan and offshore institutions in Asia/Pacific about market trends and broker relationships in the Japanese market. Interviews were conducted from July to September 2014.

The findings reported in this document reflect solely the views reported to Greenwich Associates by the research participants. They do not represent opinions or endorsements by Greenwich Associates or its staff. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results.

© 2015 Greenwich Associates, LLC. All rights reserved. Javelin Strategy & Research is a subsidiary of Greenwich Associates. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, Greenwich ACCESS™, and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promotional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.