The biggest conundrum facing both the buy and sell side in light of MiFID II is how to put a value on research.

Currently, most buy-side firms use the traditional broker vote, which arms portfolio managers, analysts and, sometimes, traders with votes or dollars to dole out to their research counterparties as they see fit. This somewhat informal process has been targeted by the regulatory bodies behind MiFID II.

Under the new directives, managers will be required to clearly outline and review their research budgets, highlighting which services their clients are paying for with research commissions and to whom their money is going.

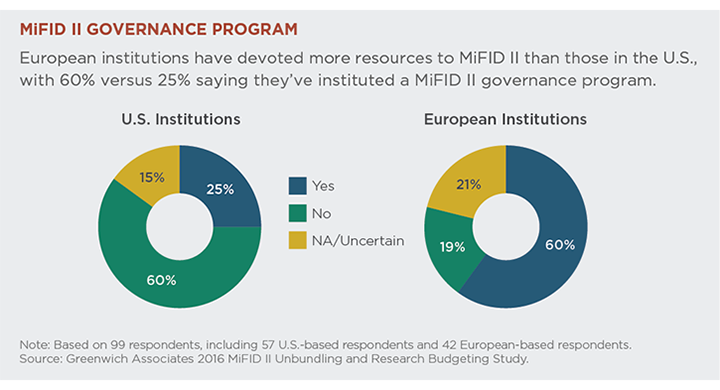

From October through November 2016, Greenwich Associates interviewed 99 buy-side U.S. and European equity broker liaisons, heads of commission management and head traders.

Respondents answered a series of qualitative and quantitative questions about the structure of their research budgeting, evaluation and payment process and expected influences from the changing regulatory landscape resulting from the MiFID II directives coming out of Europe.