The MiFID II directives will surely bring significant changes to the financial industry. With increased scrutiny and a brighter spotlight shining on established investment processes, every affected party will have to adapt—a daunting prospect. There’s fear that, given new budgeting and payment restrictions on investment research, asset managers will drastically reduce their spending. This economized investment research market will then lead to broker and research provider cuts.

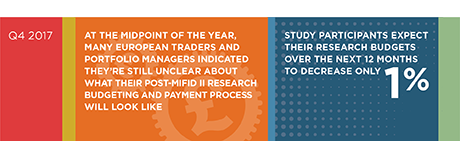

While some are projecting a reduction as large as 40%, participants in the Greenwich Associates European Equity Investors Study predict that MiFID II’s impact on budgets for investment research will be modest—at least initially. When asked how their expected research budget will change in the next 12 months, study participants anticipate only a 1% decrease on average.

This modest decline includes both commission-based soft payments and hard payments taken from asset managers’ own P&L. Respondents upped the ante when isolating the client-funded commission-based payments, citing an average 5% decrease.

MethodologyFrom March through June 2017, Greenwich Associates interviewed 164 buy-side equity traders and 198 portfolio managers across continental Europe and the United Kingdom. Respondents answered a series of qualitative and quantitative questions about their plans and structure for equity research budgeting, evaluation and payment processes, and the expected impact over the next 6–12 months from the changing regulatory landscape as a result of the MiFID II directives in Europe.