U.S. equity commission wallets are down almost 50% since their peak in 2009. This presents challenges for brokers in terms of lower revenue and profitability, causing many to rethink their business models. Behind this gloomy headline number, however, there is a silver lining: Increased usage of CSA's and unbundling trends now mean that a majority of buy-side trading flow is not earmarked for research and advisory services and can be routed with full discretion.

This represents a potential $4.4 billion of commissions up for grabs. To have a shot at this "money in motion", brokers will have to shine at sourcing liquidity for their clients by focusing on natural liquidity when available, intelligent trading tools when it isn't. Relationships and service are also vital—brokers should focus on understanding client needs and tailoring the service offering around them.

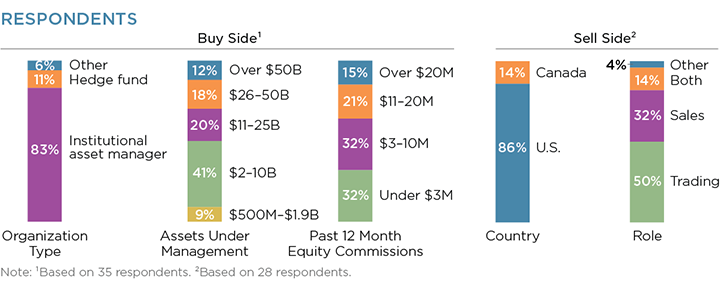

MethodologyIn April 2019, Greenwich Associates interviewed 35 buy-side trading executives and 28 sell-side sales and trading executives in the U.S. and Canada. Respondents were asked a series of questions to better understand the nature of the buy-side/sell-side relationship, the services most valued by the buy side and opportunities for brokers to increase market share.

In addition, this research leverages data from our 2018 Market Structure and Trading Technology Study, comprising interviews with 256 buy-side traders in Europe and North America, working on equity, fixed-income and foreign-exchange trading desks.