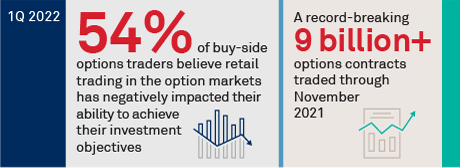

U.S. option market volumes caught fire in 2021. Records were made, broken and then almost immediately broken again. The top six volume months in the history of the Options Clearing Corporation (OCC) reporting occurred in 2021. By the end of November 2021, volumes had already exceeded 2020’s record-breaking 7.52 billion contracts traded, with over 9 billion contracts traded. Moreover, the notional value of options traded in the United States has grown to top that of equities throughout the year.

Retail interest continues to shoot for the moon. As always, the markets are evolving. The challenge for institutions is to determine the best ways to interact with the market, whether that is through improved technology, enhanced counterparties or simply through advocacy.

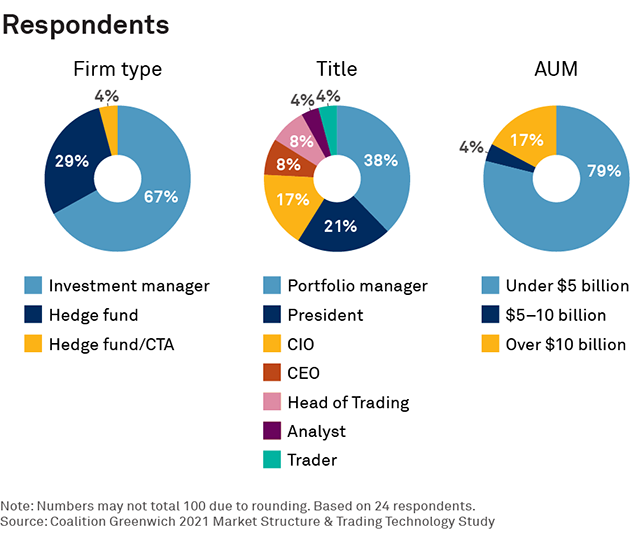

MethodologyBetween June and September 2021, Coalition Greenwich asked a series of qualitative and quantitative questions regarding options market structure and related issues of buy-side options firms based in the U.S..