Institutional asset managers face an increasing array of challenges when managing an equity trading desk. More time is being spent on analysis, administration, compliance, and covering portfolio managers than on trading. At the same time, low budgets are making it harder to remain relevant and receive high-quality service from brokers. The sell side is facing its own challenges, as fixed costs are rising while the commission pool is shrinking.

Within this dynamic, outsourced trading desks have created a strong niche and compelling value proposition. They work with their buy-side clients to understand their workflow, trading objectives, research commitments, and other pertinent information to best represent their clients in the market. Once a specialty business, outsourced trading is now emerging as a mainstream offering.

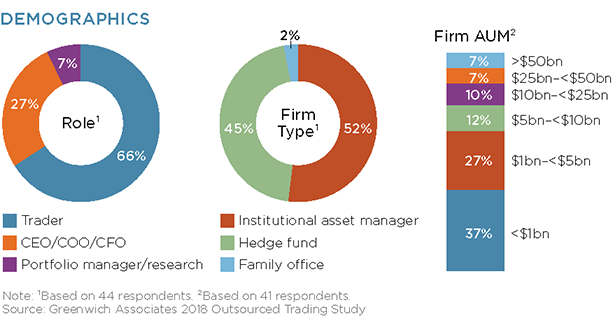

MethodologyBetween August and September 2018, Greenwich Associates interviewed 44 U.S.-based institutional investment professionals. Respondents were asked a series of quantitative and qualitative questions about their trading process and experience, and their understanding of outsourced trading.