Trading is now a highly complex and data-driven activity. U.S. equity markets comprise dozens of execution venues, each with different liquidity characteristics, order types, fee structures, and latency differentials. Trading algorithms are an essential tool for navigating these seas of liquidity, but execution performance can vary significantly from one algo to the next. In this Greenwich Report, we identify the Key Performance Indicators driving algo performance.

- The buy side is focused on slippage across different types of algo strategies: price impact is the most meaningful KPI for better algo performance.

- Institutional traders are willing to engage the sell side in more algo experimentation and customization, and dive into the details of venue selection and algo customization.

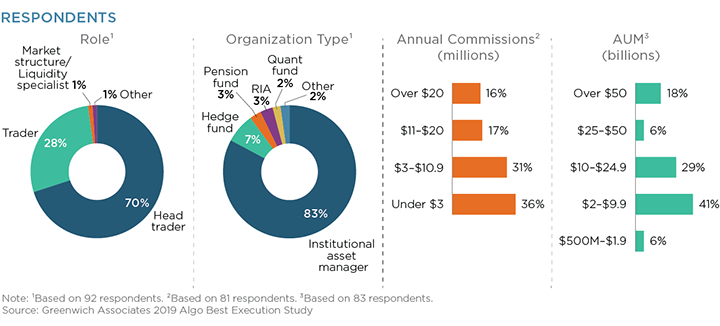

Between August and September 2019, Greenwich Associates interviewed 92 buy-side trading executives in North America representing over $6 trillion in combined assets under management and annual equity commissions of over $800 million. Respondents were asked a series of questions related to their execution style, trading analytics and venue preferences.