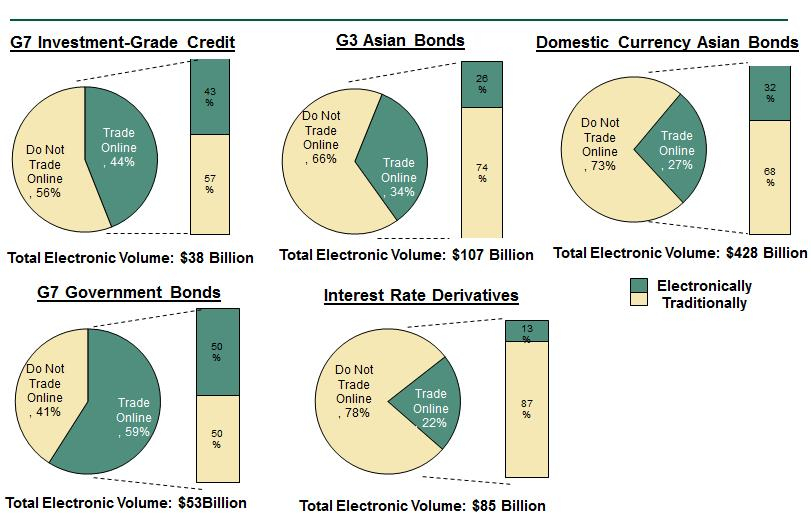

While use of e-trading increased at a modest rate for all products (37% of investors trade at least a part of their portfolio electronically), most fixed-income investors are expecting to largely continue trading through high-touch channels (voice/chat).

Among investors trading electronically a larger proportion of their volume is traded high-touch rather than online.

Bottom Line:

- While investors continue to place high value on secondary trading, the value placed on sales coverage and relationship management increased and represents the most important service offered by dealers.

- Among institutions trading electronically, banks and insurance companies experienced the largest increase of users while online hedge fund trading decreased by approximately 40%.

- G7 denominated fixed-income products represent the highest proportion of overall online volume trading. Specifically, G7 Investment Grade Credit electronic trading volume increased 13% in 2014.

The average number of dealers used by the buy-side remains around 7.5, d own from the reported 9 in 2009, and holding steady. Investors continue to assess their existing coverage and reward those that provide the most consistent service.