Alternative data is becoming a coveted tool for institutional investors seeking alpha. But as many on the buy side can attest, turning a seemingly endless array of data into something useful can be a complex and costly endeavor.

For those fortunate few who have found the needle in the haystack, utilizing alternative data comes with two major challenges:

- Finding and gaining access to the data you need (or don’t yet know you need);

- Securing the tools needed to analyze these often huge data sets and then take action on those findings.

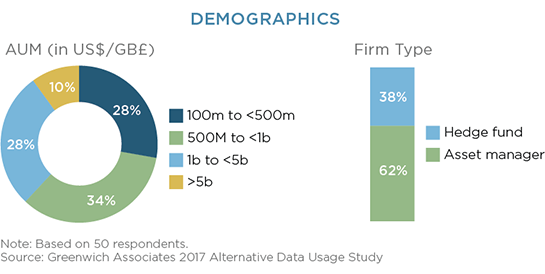

In June of 2017, Greenwich Associates interviewed 50 asset managers and hedge funds in the U.S. and Europe.

More than half the firms reported having a long-short investment strategy, while 22% each said they were long only or market neutral. Two-thirds of the respondents invest in equities, almost half in interest rates, roughly 40% invest in each of credit and commodities, and 13% invest in FX.

Study participants were asked about their current and expected use of alternative data and its contribution to the investment process.