Under a backdrop of increasing fee pressure, slowing AUM growth and reduced margins, the investment management industry is now facing research unbundling trends, which require many asset managers to implement a formal evaluation, budgeting and payment process for the research that they consume.

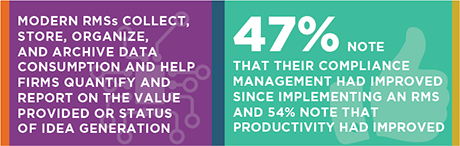

Many asset managers are now recognizing that a modern research management process can help streamline idea generation and data procurement, standardize workflows, track consumption, enhance compliance and improve team collaboration. And asset managers are not the only group that benefit from a robust Research Management System (RMS). Asset owners such as pensions or endowments/foundations are also increasing their usage of RMS, as these tools increasingly help asset allocators streamline their manager due diligence process and vendor tracking and evaluation.

In this Greenwich Associates report we look at the increasingly complex investment management process and analyze how firms are using RMS to enhance both operational efficiency and competitive advantage.

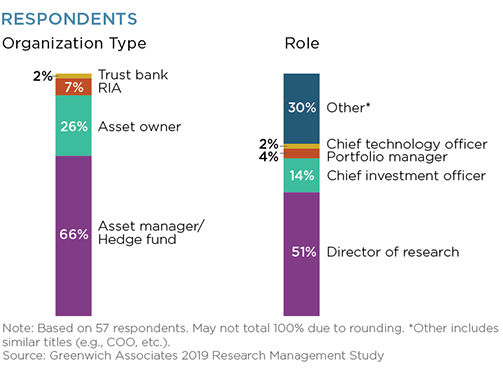

MethodologyBetween August and October 2019, we interviewed 57 executives at asset owners and asset managers to better understand their research management needs and procedures, the pain points they face and the types of technology they use in this process. Respondents represented a variety of organizations, which are broadly categorized into 15 asset owners and 42 asset managers.