Executive Summary

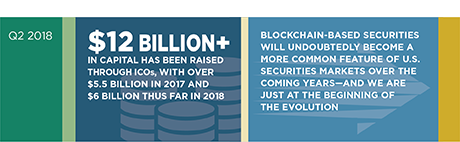

Regulators are stepping in to tame the initial coin offering (ICO) frenzy and ensure investors are protected. With most ICOs being deemed securities and not utility tokens, ICOs will have to comply with U.S. securities regulations. This Greenwich Associates research discusses

what that might look like and what it means for equity issuance in the broader market.