Table of Contents

Since the end of the financial crisis, regulatory changes and geopolitical and social influences, in combination with the natural evolution of the industry, are broadly impacting global financial markets. With so many forces at play, we are beginning to see ripples of change across the industry. The financial services sector, and the institutional financial services space in particular, is embarking on a dual arms race for both people and technology that is significantly altering the market landscape.

Budget Totals

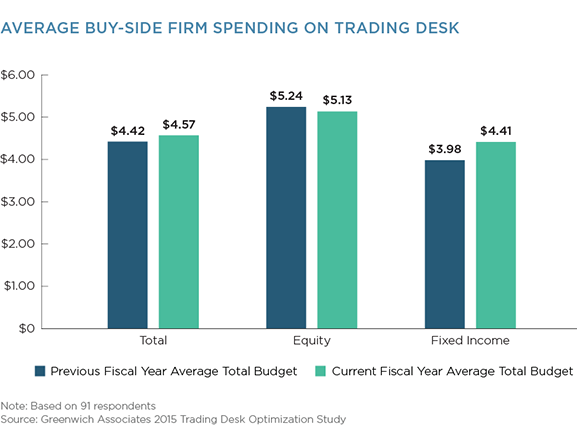

Greenwich Associates 2015 Trading Desk Optimization Study estimates that the buy side spent $15.6 billion to fulfill trader compensation and technology expenditures—an overall increase of 4% since 2014. The average budget per desk grew at a similar rate, to $4.57 million. Declines in reported spend by equity and FX desks were offset by spending increases on the fixed-income side. Market structure changes coupled with an unsettled interest-rate environment have forced fixed-income desks to keep spending, despite increased risks and shrinking returns.

Talent First

Although e-trading in most market segments continues to grow, the idea that talent trumps technology is taking over. Technology is only as good as the people behind it, and buy-side trading desks are putting their money where their mouth is. Trading desks are in a phase of allocating a larger proportion of their budgets to pay trader compensation.

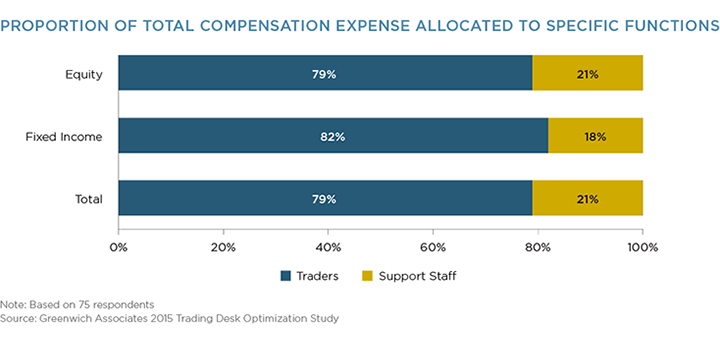

Buy-side trading desks need to be staffed with skilled technicians who have a strong understanding of both the financial markets and the advanced trading technologies used to execute trades—thus the focus on trader compensation. But our study results also show that the bulk of the trading staff budget is earmarked for trader compensation and not support staff. The majority of buy-side institutions place trading support staff under operations, which explains why this segment accounts for only 20% or so of the total compensation expense.

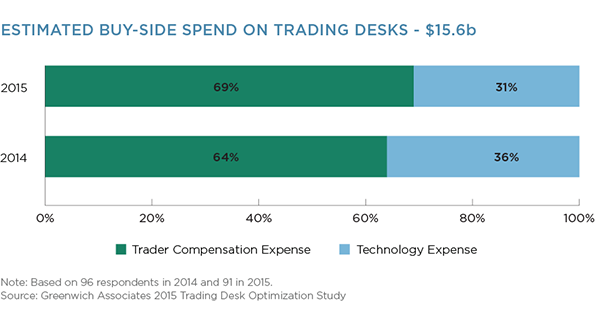

Nearly 70% of buy-side spending tracked by the Greenwich Associates study is allocated to compensation requirements on the desk, while the balance covers technology expenses. Compensation and technology requirements vary greatly by the type of asset classes the desk trades. Equity trading desks adopted change in the early 2000s, while fixed-income and FX trading desks are just now embarking on revolutionary changes that impact both their personnel and technology needs.

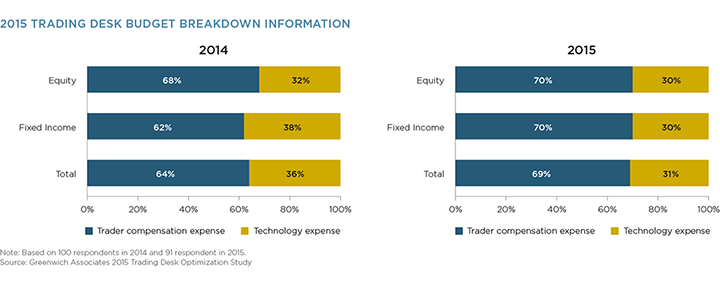

Equity and fixed-income trading desks both reported a 70/30 split in budget allocation for trader compensation versus technology expenditures. While the equity figures are fairly flat year-over-year, fixed-income results have changed considerably. In 2014, 62% of trading-desk budget tracked in the study was allocated to trader compensation. That figure has risen to 70%, as the fixed-income markets have experienced a series of changes over the past three to five years. The markets have since been settling, absorbing the effects of greater use of technology to trade products typically traded over-the-counter, the continual cloud of interest-rate hikes across the globe and shortened supplies of market liquidity.

The boost in budget allocated for trader compensation highlights the importance of trading talent and maintaining sound relationships with the sell side. Even as the fixed-income market becomes more electronic, the need for retaining people with strong relationships and a keen understanding of the market structure is increasingly important and critical to the success of the trading desk.

The focus on trader compensation also highlights the need to have experienced people with the right skills working the trading desk. Our 2015 research shows firms are willing to pay for individuals who can help solidify the client relationships built by the sales team.

Technology After Talent

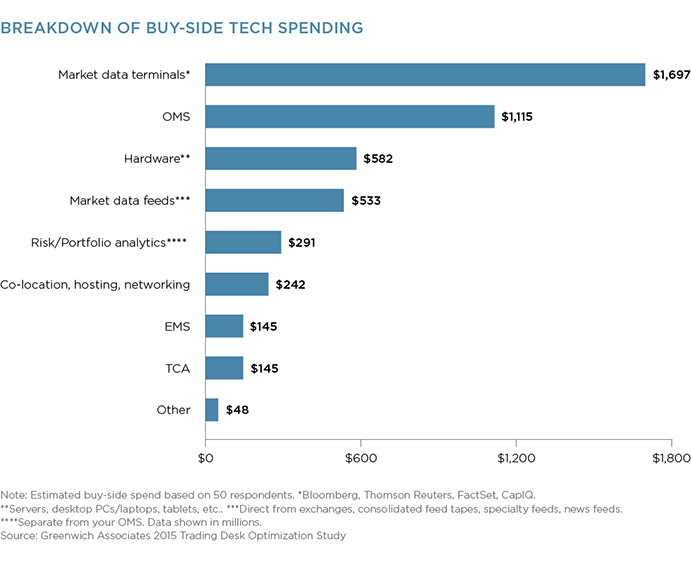

Greenwich Associates estimates that buy-side trading desks paid $4.8 billion to cover trading desk technology obligations in 2015. Nearly 60% of the trading desk budget is comprised of just two key components of the desk. Thirty-five percent of the estimated total, or $1.7 billion, covers the cost of access and licensing fees for market data terminals used on the trading desks—like Bloomberg, Thomson Reuters and FactSet. An additional $1.12 billion, or 23%, pays for the order management systems (OMS).

The fact that over 80% of the estimated total trading desk budget is allocated to the top four components of the trading desk reflects another interesting theme. In addition to market data terminals and OMS, 12% of trading desk budgets are allocated to hardware (e.g., servers, desk-top PCs/lap tops, tablets) and 11% to market data feeds (direct from exchanges, consolidated feed tapes, specialty feeds, news feeds, etc.).

With the increased use of technology across asset classes and readily available trade information, the era of “big data” is already upon the financial markets. Tools used to help manage the accessibility and amount of market data consumed by the trading desk are vital to the success of the desk.

Traditional providers like Bloomberg, Thomson Reuters and FactSet are operating in an increasingly crowded space that is being joined by startups such as Symphony and Money.net, which are offering tools to help improve the trading process. While some see the crowded space as a red flag, it is important to note that the buy side currently receives numerous free services in exchange for trade flow. They are, however, willing to pay for critical tools like terminals and good OMS technology, as long as those tools provide the desk with the opportunity to increase alpha.

Conclusion

We are embarking on a period of ongoing evaluation in the institutional investing space. After several years of rapid adoption of new technology and tools to assist in trading, institutional investors are poised to take the next steps as the markets continue to evolve. Those steps require having the right people in place to execute further change and also measure the success of innovations already implemented on the desk. Technology is only as good as the people and providers behind it, and we are seeing buy-side institutional investors embrace that notion. For the foreseeable future, the markets will remain in motion, adapting to changing conditions accordingly.

Between August and September 2015, Greenwich Associates interviewed 258 buy-side traders across the globe working on equity, fixed-income or foreign exchange trading desks to learn about trading desk budget allocations, trader staffing levels, OMS/EMS/TCA platform usage, and ATS satisfaction levels.