The markets in 2022 have been tough for banks, and Q3 was no exception. Central banks, led by the U.S. Federal Reserve, continue to hike interest rates to quell the infationary environment of the last 18 months. While this is necessary medicine for the economy, the treatment in the short term feels worse than the disease. Off the back of rate hikes, volatility in the U.S. Treasury market (as measured by the ICE BofA MOVE Index) spiked over 160, its highest level since March 2020.

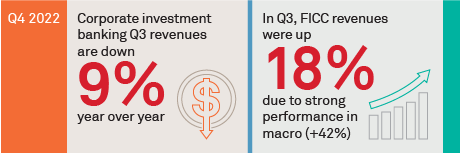

The diverse business models that make up the world’s largest investment banks have left them well positioned to weather the storm, as declines in equity businesses are offset by increased revenue in fxed-income trading, especially for macro products, with 3Q revenues down 9% overall YoY.

MethodologyThe Coalition Index tracks the performance of the 12 largest investment banks globally. Banks included in the U.S. CIB are bolded. It comprises:

- BofA, BARC, BNPP, CITI, CS, DB, GS, HSBC, JPM, MS, SG, UBS

- The Coalition Index is refreshed for 1Q, 1H, 3QYTD and FY