Fixed-income trading profits have been on a tough road over the past decade, with low volume, low volatility, low rates, and a high cost of capital eating into what was once a cash cow. But as several of those factors are showing signs of reversing, broker-dealers focused on U.S. corporate and municipal bond markets are simultaneously taking a particular interest in putting the influx of newly available data to work.

Relationships and balance sheet still matter, of course, but the ability to manage both in a more quantitatively driven way can mean the difference between profit growth and a year-on-year decline. This idea has driven both large and middle-market dealers to focus their technology efforts on data, analytics and workflow automation, while looking to increase the data management literacy of everyone on the desk.

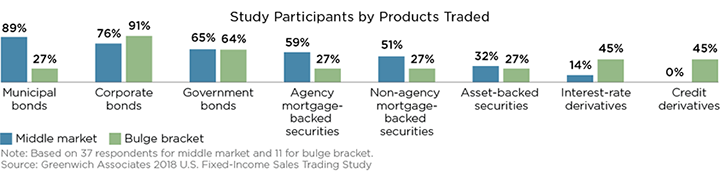

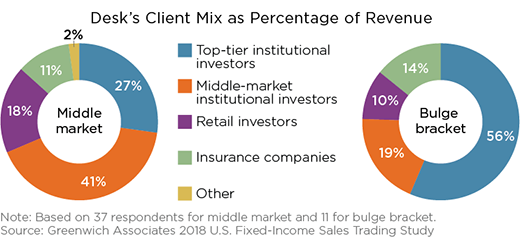

Based on feedback from nearly 50 U.S. fixed-income broker-dealers, this research examines the current state of the fixed-income business, top concerns of both large and middle-market dealers, technology priorities, and the most likely path forward.

MethodologyIn the summer of 2018, Greenwich Associates interviewed 48 fixed-income traders and sales professionals at broker-dealers in the U.S. in an effort to understand the changes facing the fixed-income market and the impact of technology on their business. Participants included both global and regionally focused banks, with individuals comprising a mix of traditional voice sales and those focused on e-commerce initiatives.