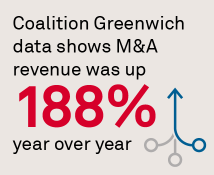

While a lot can happen in the last few months of 2021, especially with a Fed taper looming and equity markets starting to wobble slightly, Coalition Greenwich expects corporate and investment banking revenues for the full year to fall only slightly below 2020, with investment banking activity making up for the decline in trading volumes year over year.

Nothing, of course, is certain: Fickle retail traders could drive equity markets down and deal makers could start to back off if interest rates rise or ultra-high private company valuations start to come back down to earth. But our expectations through year-end are for more of the same—a good thing for banks.

MethodologyThe Coalition Index tracks the performance of the 12 largest Investment Banks globally. It comprises:

- 2016 to 2021: BofA, BARC, BNPP, CITI, CS, DB, GS, HSBC, JPM, MS, SG, UBS

- The Coalition Index is refreshed for 1Q, 1H, 3QYTD and FY

Results:

- Numbers may not add up due to rounding.

- Percentages are based on unrounded numbers.

Sources:

- Public domain information including financial disclosures, investor presentations, media article

- Independent research

- On-going validation by an extensive network of market participant

Methodology:

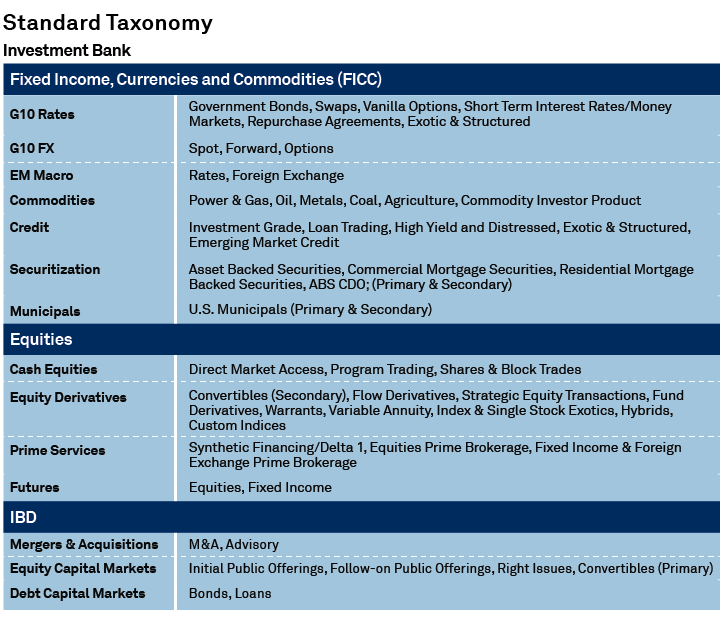

- Performance is benchmarked against Coalition’s Standard Product Taxonomy

- Adjustments are made to publicly reported performance. Examples:

» Exclusions: write-downs, non-core, ring-fenced Proprietary Trading, Principal Investments/ Private Equities and products that are reported in non-Investment Bank divisions (even if they appear in the Standard Product Taxonomy)

» Accounting adjustments: brokerage costs and gains/losses on own debt

» Business structure adjustments: removal of non-Investment Bank businesses (e.g. Retail Foreign Exchange, Corporate Lending)

» Legacy business adjustment: where reported within the Investment Bank, revenues from legacy portfolios and the relevant portion of internal joint ventures, are included in the respective products (e.g. Securitisation, FX)

» Exclusions: one off regulatory fines/legal settlement costs, amortisation of intangible assets and impairment of goodwill

- Headcount is defined as revenue generating front office headcount. Headcount is provided on a full-time-equivalent (FTE) basi

» Inclusions: Equities and FICC include headcounts in Sales, Trading and Research functions; IBD includes headcounts in Advisory, Coverage, ECM and DCM function

» Exclusions: Front Office Administrative Staff, Temporary staff; Contractors and Supporting Functions (e.g. Middle Office and Back Office); Rotating Graduate/Trainee

- Productivity is measured as revenues divided by revenue generating front office headcount